An interesting strategy some people have started doing is to treat their Fidelity account as a checking account, savings account, and the home of their emergency fund. This effectively means they’re using Fidelity as a bank.

Why would you do this? Well, most of these people have been eyeing the higher interest rate on cash that a Fidelity Cash Management Account (CMA) offers compared to a traditional savings account, and how a Fidelity brokerage account can offer many of the key features your bank provides.

In this article, we’ll dive into how you can use a Fidelity brokerage account and Cash Management Account to manage everyday functions such as bill pay, direct deposit, ATM access and debit cards, credit cards, check writing, and the limitations (Fidelity does not support Zelle or physical cash deposits).

What You Need to Replace A Bank

The following features are the main things a bank provides for everyday savings and spending. If a Fidelity brokerage account or Cash Management Account can substantially offer most of these services, it accomplishes the same goal as a checking or savings account.

A checking account should offer:

- Direct deposit

- Bill pay

- Check writing features

- Check deposits

- Routing and account numbers for direct deposit and bill pay

- ACH transfers

- Wire transfers

- Debit card and global ATM withdrawals

- Physical cash deposits

- Zelle support

A savings account is a deposit account found at virtually every bank and credit union that offers a modest interest rate. They are most commonly used to store an emergency fund. As we’ve discussed many times, there are many better alternatives to traditional savings accounts with higher APYs and more liquidity.

Fidelity’s Brokerage Account and Cash Management Account (CMA) Offers Core Banking Services

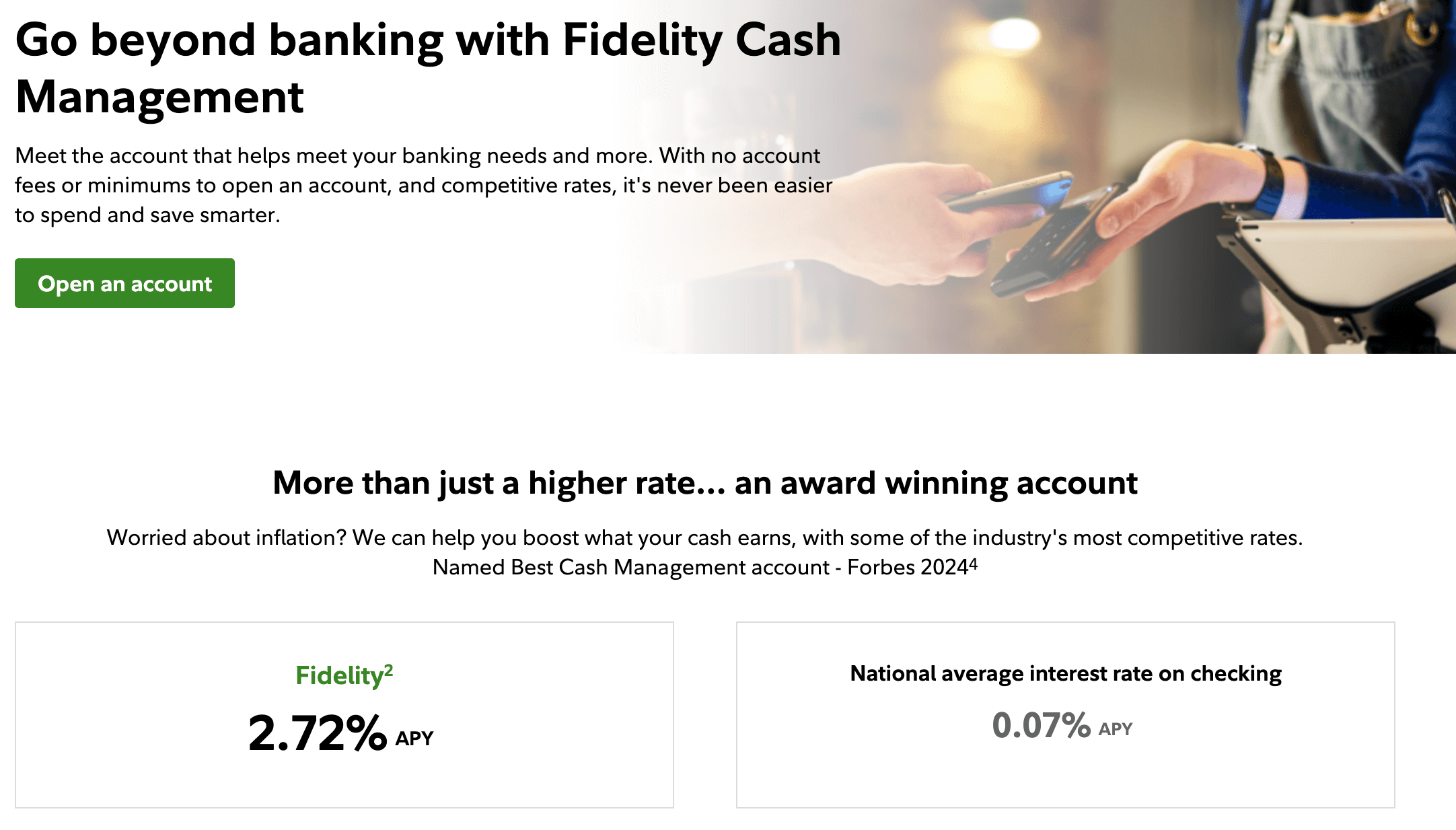

Fidelity offers a Cash Management Account (CMA), which is a different type of account from the regular taxable Fidelity brokerage account most people are familiar with. The Fidelity Cash Management Account was created specifically to satisfy banking needs, and it offers many of the features of a typical checking account.

You can also buy brokered Certificates of Deposits (CDs) and Treasury Bills (T-Bills) with a CMA.

The Fidelity Cash Management Account is not meant to replace your regular brokerage account. It’s intended to manage daily spending and cash management. This way, you have separate accounts for your spending and your investment activity.

Fidelity Cash Management Account as a Checkings Account

Here’s what you get with a Fidelity CMA for free:

- FDIC-insured cash that pays 2.72% APY interest as of March 2024

- No minimum balance

- No monthly fees

- Routing and account numbers provided for direct deposits and outgoing transfers

- Check deposits via the mobile app or at Fidelity branches

- Free checkbook, no minimum check amount

- Free Visa debit card for purchases, ATM withdrawals, and teller cash advances, with no usage minimum

- ATM fees are reimbursed worldwide

- Free Bill Pay with eBill

- Same-day ACH free; $100,000 out, $250,000 in per day. You can request higher transfer amounts by calling customer service.

- Free wire transfers; $100,000 per day online. You can request higher transfer amounts by calling customer service.

You get all the features above with a regular Fidelity brokerage account minus the FDIC-insured cash (instead, your uninvested cash gets swept into SPAXX which currently pays around 5%), checkbook, and debit card and ATM withdrawals.

Fidelity Cash Management Account as a High-Yield Savings Account to Buy SPAXX and other Money Market Funds

In addition to the core banking features typically found in a checking account, Fidelity makes it easier to earn higher APYs on your cash. The CMA is still considered a brokerage account, and thus it’s easy to purchase investments in the account. You can do the following in a CMA:

- Buy money market funds, brokered CDs, and ultra short-term Treasury ETFs as a cash alternative

- Buy stocks, mutual funds, and other ETFs

Fidelity treats its money market funds as cash. If you are invested in a Fidelity money market fund, the balance will automatically be used to cover any expenses, payments, or outgoing transfers.

Here’s an example:

You deposit $10,000 into your Fidelity CMA and decide to buy SPAXX with it to earn 5% APY. Later that month, you have a $2,000 credit card balance that will be automatically paid off with a scheduled bill pay for the entire card balance. Fidelity will automatically deduct $2,000 from your $10,000 SPAXX balance to cover your credit card payment!

Some people have moved all their cash from their bank account to a Fidelity CMA. By doing so, you automatically earn an FDIC-insured 2.72% APY, with the ability to earn more if you buy a money market fund or Treasury-bill ETF.

If you are comfortable using a regular Fidelity brokerage account to park your cash, it’ll automatically be swept to SPAXX and earn close to a 5% APY as of this writing. Fidelity’s money market funds almost always beat out high-yield savings accounts interest rates.

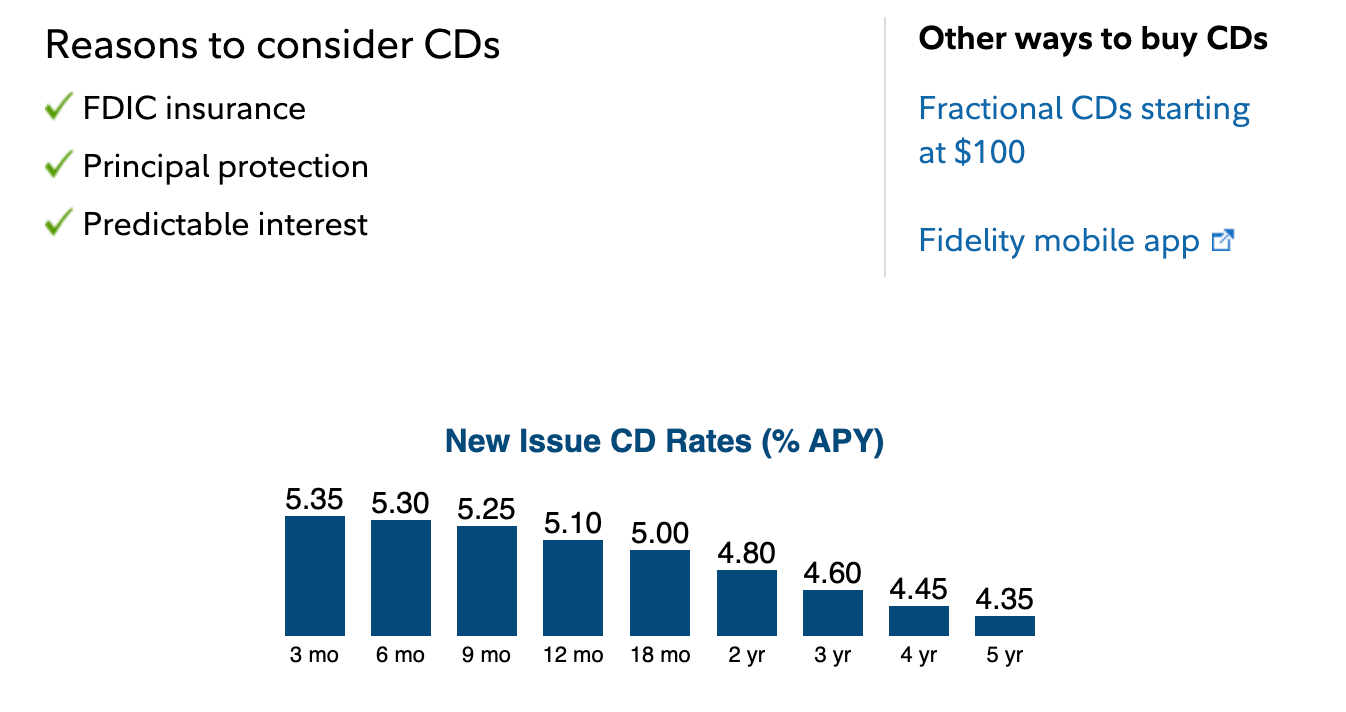

Buying Certificate of Deposits (CDs) and T-Bills in a Fidelity CMA

You can easily buy brokered CDs and Treasury Bills with a Fidelity CMA. Buying investments in a CMA is like buying them in a regular Fidelity brokerage account. Treasury bills and brokered CD rates pay higher than most savings and cash management accounts and can offer higher APYs than some Fidelity money market funds.

When you utilize a CMA to purchase CDs and T-Bills, all funds will be transferred back to your CMA account after the CD and T-Bills mature. They’ll automatically start earning the 2.72% FDIC-insured rate if they remain uninvested.

Fidelity Bill Pay Review

Fidelity has a free Bill Pay service that you can use to make payments and manage your bills. You can use Fidelity Bill Pay to schedule credit card payments or use the routing and account number of your Fidelity CMA to auto-withdraw directly from your account for rent or mortgage.

The setup process for Fidelity Bill Pay is straightforward. Once you have a qualifying non-retirement brokerage account, you can activate this feature through Fidelity.com.

Fidelity Direct Deposit

You can also directly deposit your payroll into a Fidelity account. Any income directly deposited into a Fidelity Cash Management Account automatically earns an APY of 2.72%. Any income directly deposited into a regular Fidelity brokerage account will earn an APY of around 5% by being invested in SPAXX.

To initiate direct deposit, provide your employer or benefits provider with your Fidelity account’s routing number and your specific account number. These details are accessible on the Direct Deposit and Direct Debit Information page once you log in, or at the top of your Portfolio Summary page under the account name. It might take a few pay periods for the direct deposit to become active, and your employer should send a confirmation when the setup is finalized.

Fidelity ATM Access and Debit Card Review

Fidelity will provide you with a debit and ATM card with no annual fee. The core features of the Fidelity Debit Card include:

- No annual fee

- Using the card for any purchases where Visa is accepted

- Withdrawing cash for free at ATMs worldwide wherever you see the Visa, Plus, or Star logos.

- ATM fee reimbursement at any global ATM for Fidelity Cash Management Account owners.

To get a new Fidelity debit card, use your Fidelity mobile app to request one, or visit the Manage debit cards page on Fidelity’s website after you log in. You should receive your card within 7 to 10 days from the time your request is submitted.

Fidelity Credit Cards

Fidelity also offers the Fidelity Visa Signature Card. Key features of the card include:

- No annual fee

- No foreign transaction fee

- Unlimited 2% cash back on card purchases

- Earning is unlimited with no caps or category restrictions

- No expiration on reward points

The card is decent enough and could be your preference if you want everything to stay within the Fidelity ecosystem. Frankly, we think there are much better credit cards that offer much higher cash back and rewards than the Fidelity Visa Signature Card, but we wanted to point it out here in case you want to replace your bank completely.

Fidelity Loan and Mortgage Solutions

Let’s be clear. Although the Fidelity Cash Management Account provides numerous features similar to those of a bank checking or savings account, it’s important to note that Fidelity is a brokerage firm, not a bank. This means that Fidelity does not provide loans and mortgages.

However, Fidelity offers lending solutions through a mortgage referral with their third-party partner Leader Bank. Through this program, clients work with Leader Bank to apply and go through the mortgage process, and Fidelity offers a $1,399 credit towards the closing costs.

We’ve never gone through this process or taken advantage of Fidelity’s offer. If you do, we highly recommend talking to other banks and mortgage providers to compare competitive mortgage rates.

Reddit User Example of Using Fidelity as a Bank

A Reddit user’s experience showcases how they integrated Fidelity’s Cash Management Account and Fidelity brokerage account to manage their banking needs. Utilizing the Fidelity Cash Management Account (CMA) alongside a brokerage account, the user:

- Uses a brokerage account to park their cash which gets automatically swept into SPAXX.

- Directly deposits their paycheck to this brokerage account every week.

- Automatically pays bills through ACH using the brokerage account’s unique account number and routing number. The amount is automatically deducted from the user’s SPAXX balance.

- Earns a 5% APY from SPAXX that’s paid monthly.

The user also has a Fidelity Cash Management Account with no cash in it:

- This CMA account is set up as overdraft protection from the brokerage account.

- The user uses the CMA account to withdraw money from an ATM or write a check. Because the CMA has $0, the brokerage account will automatically deduct funds from SPAXX and deposit them into the CMA to cover the transaction.

- When withdrawing cash from ATMs, all fees are reimbursed as well.

The user has set up this more complicated structure because a regular Fidelity brokerage account sweeps all uninvested cash into SPAXX, Fidelity’s default core position. If you directly deposit your paycheck to the CMA, you have to manually buy SPAXX each time. Otherwise, you’ll earn the FDIC-insured 2.72% that Fidelity pays for uninvested cash in a CMA.

The user also has another Fidelity brokerage account for investing, and yet another brokerage account for buying T-bills and Brokered CDs for even more yield.

Limitations with Using Fidelity as a Bank Account

While the benefits of using Fidelity as a bank are significant, you can’t deposit physical cash directly into your account whether it’s your CMA or regular brokerage account. Additionally, Fidelity does not support Zelle, although this is mitigated by compatibility with other payment services like PayPal and Venmo.

The Fidelity Cash Management Account also doesn’t support instant linking through Plaid, which means integrations with certain financial apps are limited. Also, the lack of sub-accounts means you can’t easily separate funds for different savings goals within the same account, potentially complicating your financial organization.

Other limitations include the absence of cashier’s checks. For international travelers, the 1% transaction fee on debit card purchases abroad is another consideration, although international ATM withdrawals are exempt from this fee.

Should You Use Fidelity As a Bank?

Fidelity offers a wide variety of banking services in both its regular brokerage accounts and Cash Management Account, combining the benefits of both checking and savings accounts with competitive APYs and added perks like FDIC and SIPC insurance, free checkbooks, and a debit card with free ATM withdrawals. If you don’t typically need to deposit cash or use Zelle, Fidelity can effectively replace your bank account. Even if you require those services, you can always have an unused bank account or credit union as backup when needed.

Using Fidelity as a bank is a strategy that allows you to centralize spending and investment management while earning higher APYs on your cash.