In this guide, we will walk you through a step-by-step process on how to buy CDs on Charles Schwab.

All the CDs sold on Charles Schwab are brokered CDs. Brokered CDs are bank CDs you purchase through a brokerage, such as Charles Schwab.

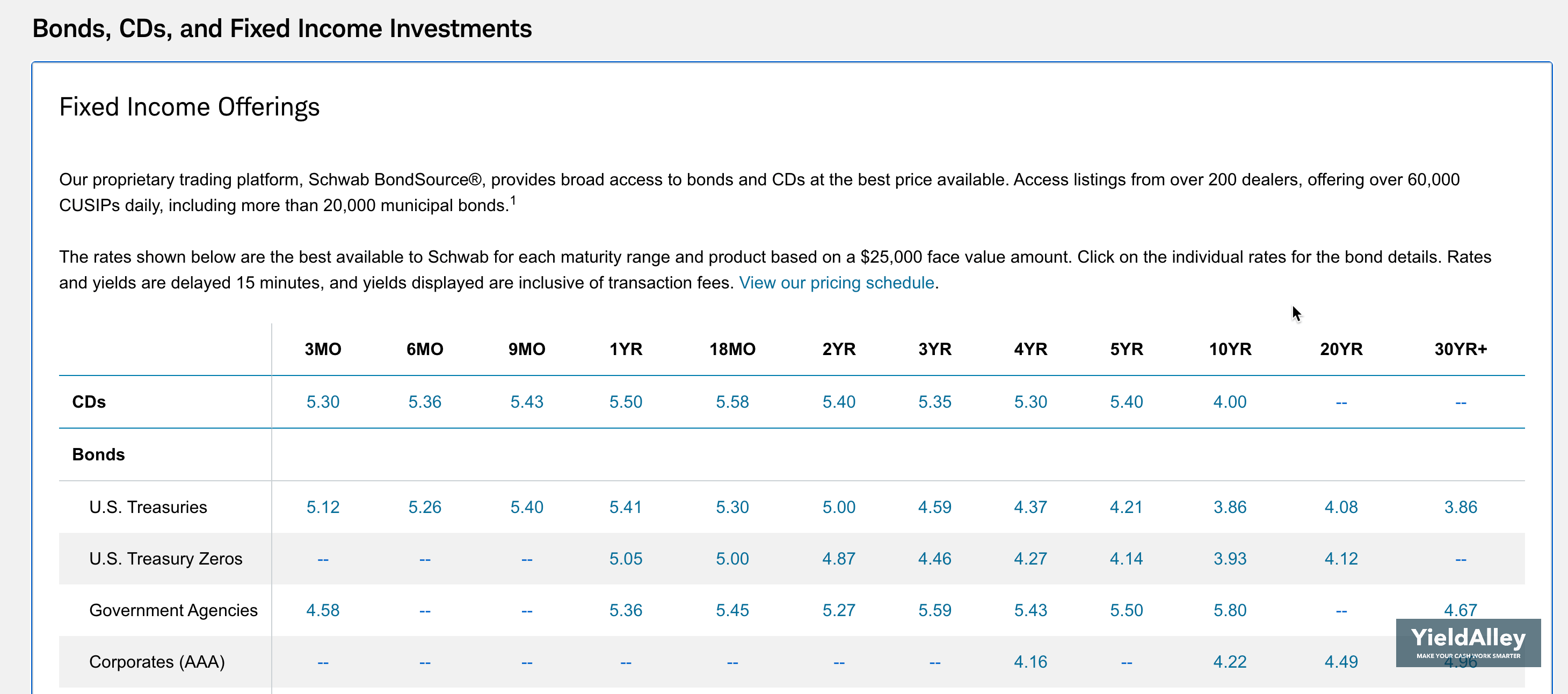

Charles Schwab’s CD rates and terms include 3-month, 6-month, 9-month, 1-year, 18-month, 2-year, 3-year, 4-year, 5-year, 10-year, 20-year and 30-year plus terms. The rates and terms will frequently change, and we advise the reader to visit Charles Schwab’s website for the latest information.

How to Buy a CD on Charles Schwab: A Step-by-Step Guide

1. Log into your Charles Schwab account.

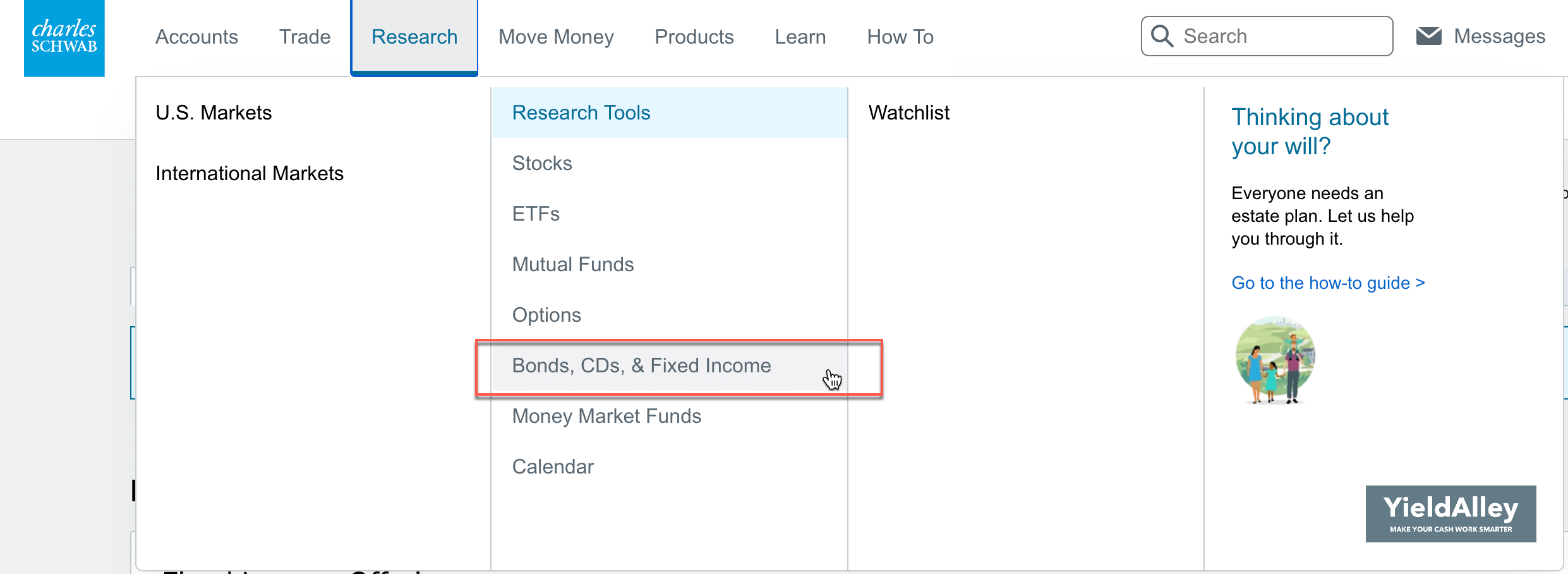

2. Navigate to the “Research” tab and click “Bonds, CDs, & Fixed Income.”

We recommend this overview of CDs instead of the “CDs” overview under the “Trade” tab. The Research view shows more detail and a comparison table of the CD rates alongside U.S. treasuries and other fixed-income products.

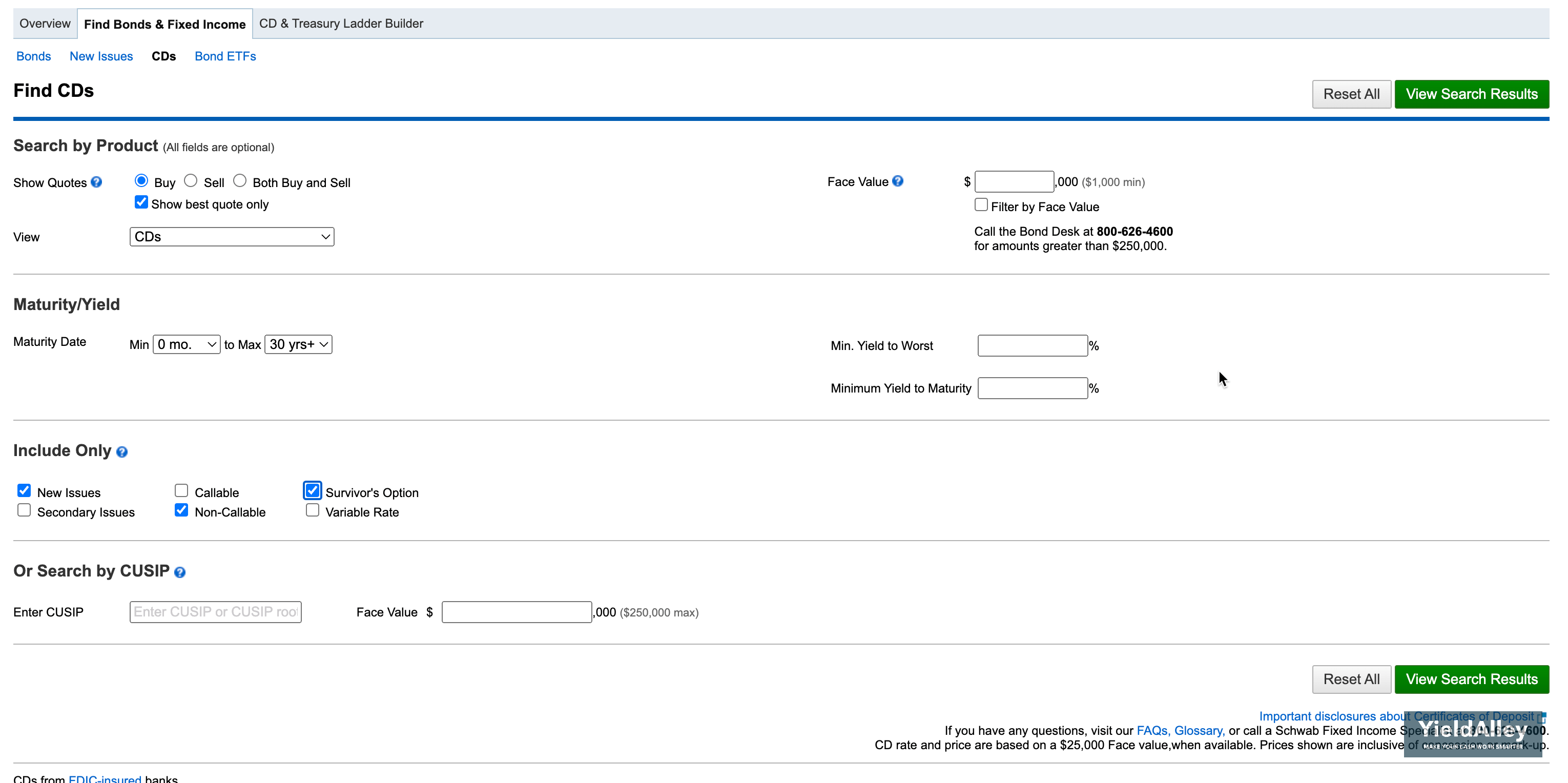

3. Filter and sort for the CDs you want.

If you are interested in filtering for CDs that are either New Issues vs. Secondary Issues or Callable vs. Non-Callable, you can do so by clicking “Modify Search”. In our case, we want to filter for CDs that are New Issues and Non-Callable with a Maturity up to 2 years.

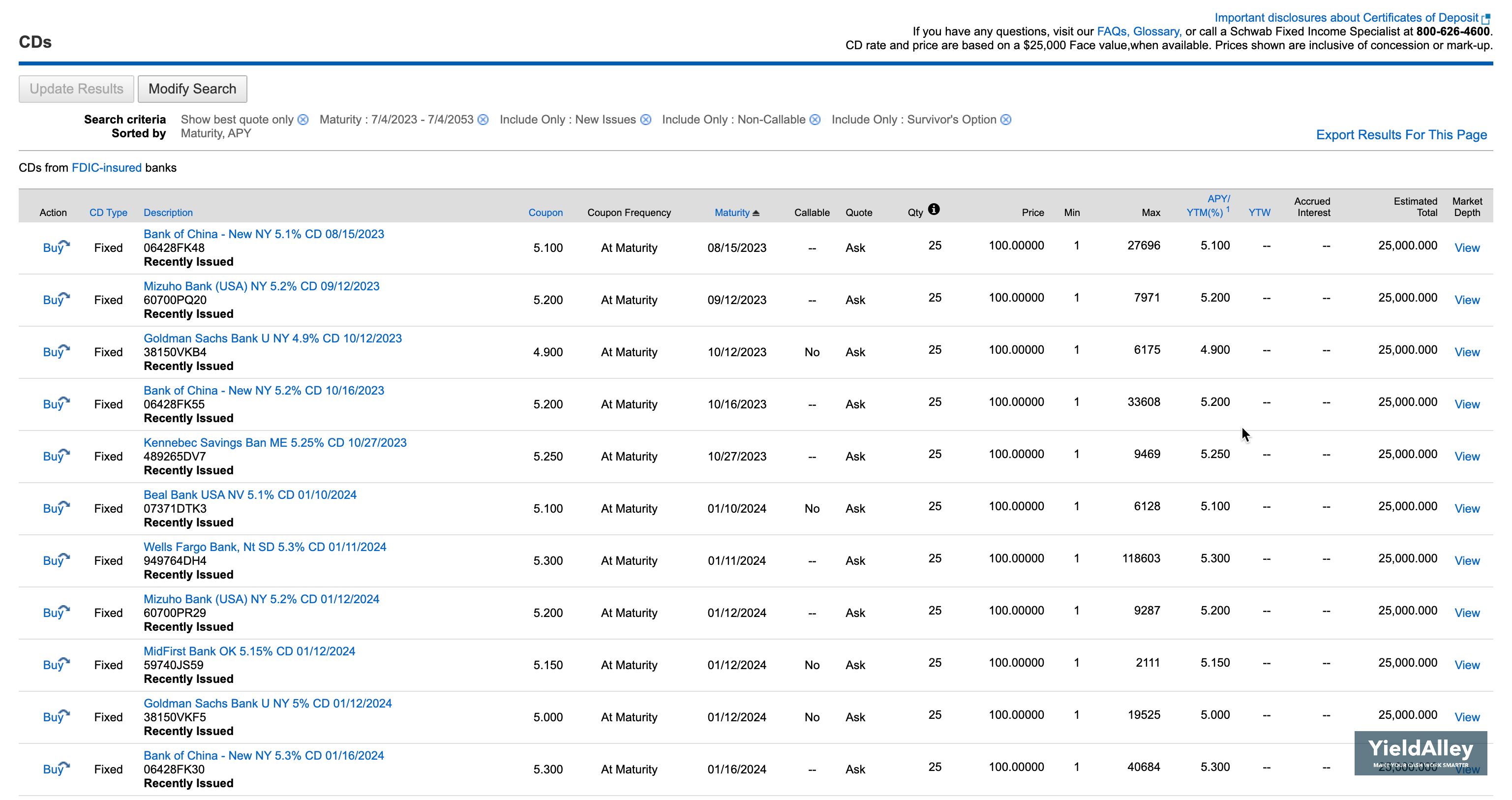

We want to take a look at the best CD rates that Schwab has to offer. We can click the “Coupon” column to sort the CDs with the highest coupon rates to the least.

Pay attention to the coupon rate, coupon frequency, and maturity date for the specific features of each CD.

4. Click on the CD to learn more.

We’re interested in the first Wells Fargo CD listed here. Let’s click on the name to learn more.

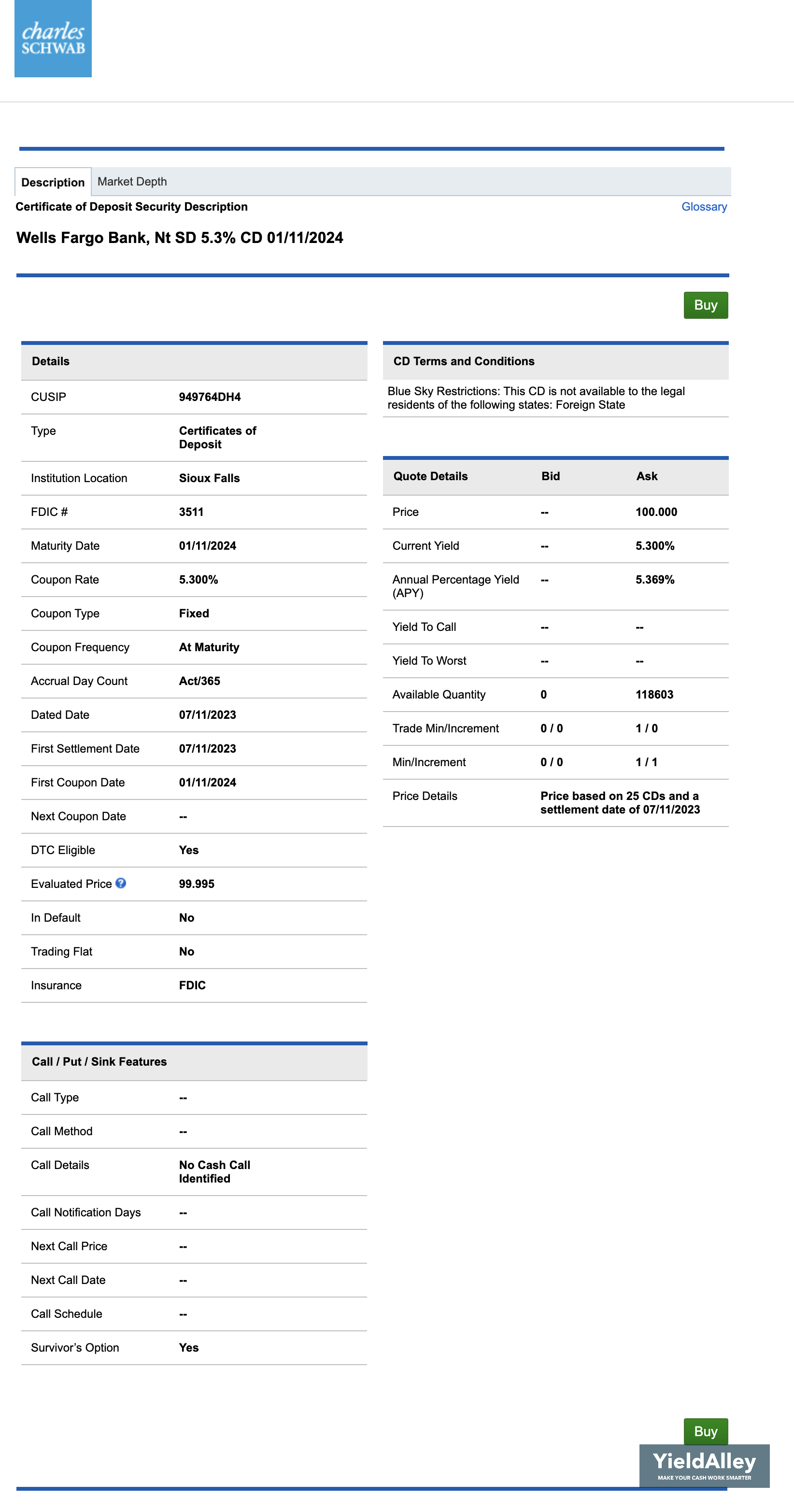

We learn that this is a 6-month CD that pays an annual coupon rate of 5.30%. The interest will be paid At Maturity, and that it is FDIC insured (all CDs sold by Schwab are FDIC insured). This CD also has Blue Sky restrictions that do not allow the sale of this CD to any “Foreign State.” Since we are in the United States, this does not apply to us. The CD is also non-callable, which aligns with the filter we previously applied.

This looks fine. Let’s continue by clicking “Buy.”

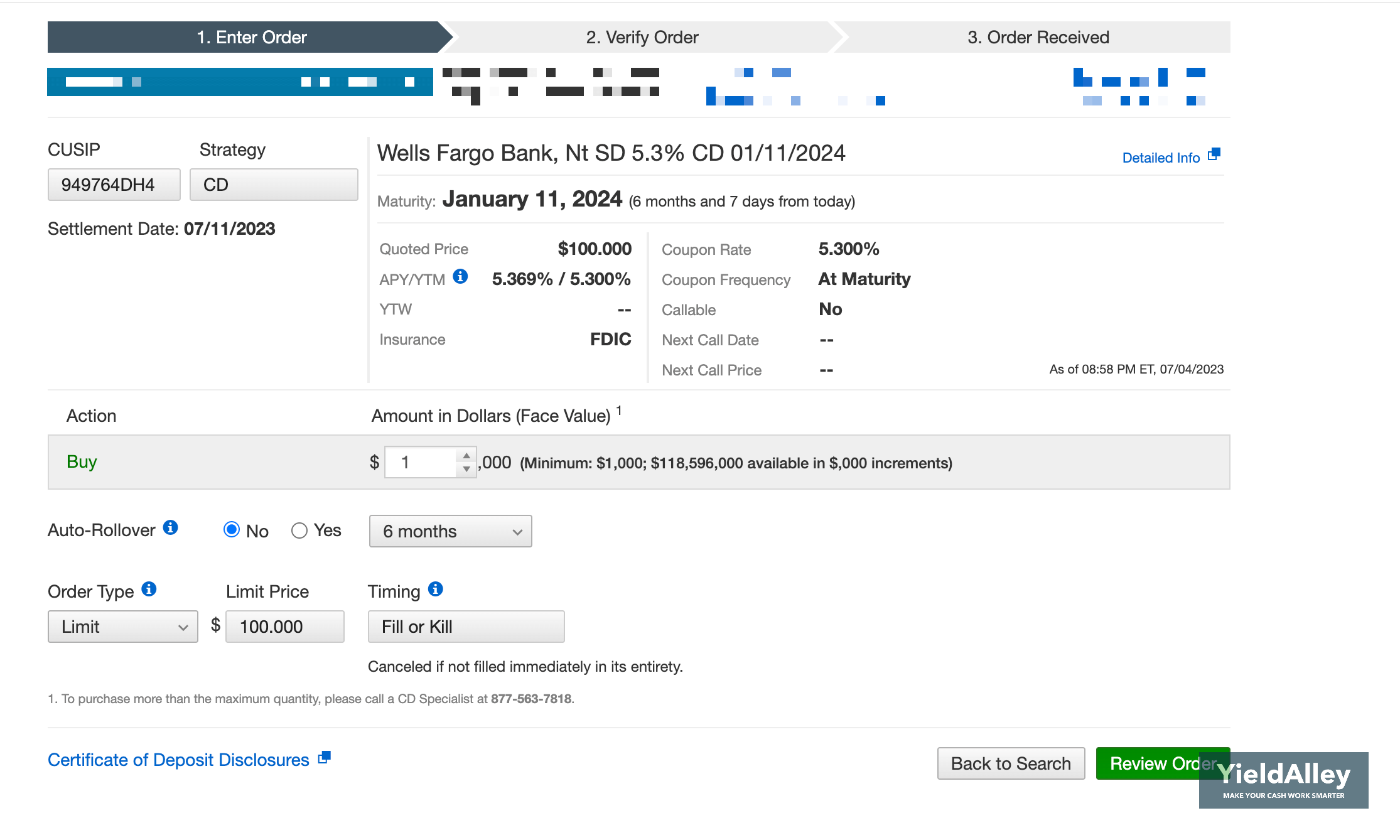

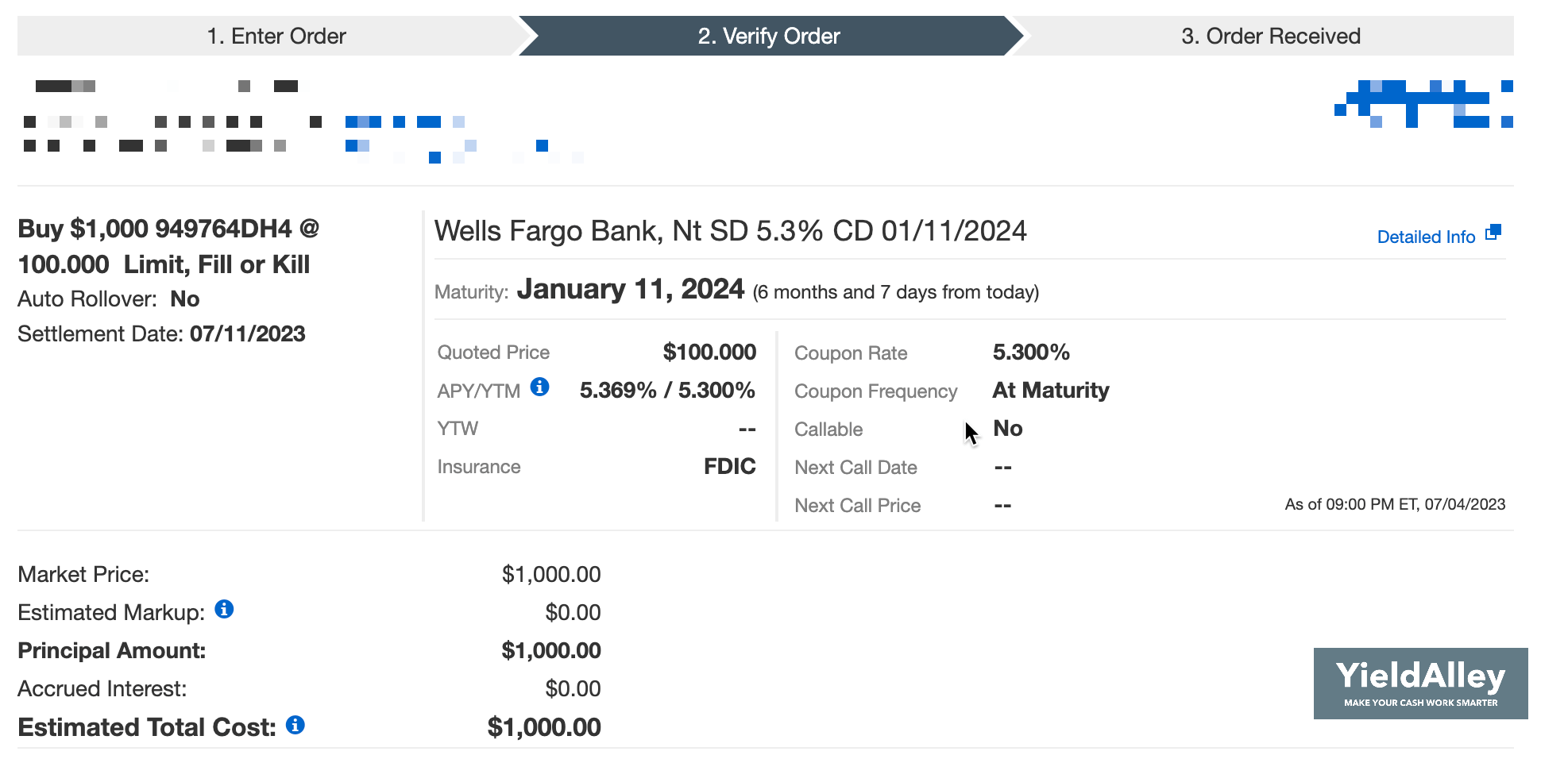

5. Enter your CD order details and review them before placing your order.

We can now enter the amount that we want to purchase. Charles Schwab has a minimum investment of $1,000 for each CD.

We also have the choice to auto-rollover our CD. This means that you can choose to reinvest in the same maturity or use the dropdown to select a new maturity length for your new investment and each subsequent rollover thereafter. For CDs, Schwab will choose a CD with the same face value, the maturity term you selected, no Blue Sky restrictions, the highest APY available at Schwab for that CD, a new issue, fixed coupon, and non-callable CD.

6. Verify your order and click purchase!

Congrats, you have learned how to buy Charles Schwab CDs!

Does Charles Schwab Offer CDs?

Yes, Charles Schwab does offer CDs as part of their investment options. With Charles Schwab, customers can choose from various CD terms ranging from a few months to several years. The CDs that Charles Schwab sells are called brokered CDs, which are CDs that are issued by banks and credit unions, and sold through a brokerage like Charles Schwab.

Is it Safe to Buy CDs Through Schwab?

Brokered CDs from Charles Schwab are issued by banks and savings associations. These CDs are insured by the FDIC, up to a maximum of $250,000 per depository institution for both principal and interest.

Why is My Schwab CD Losing Money?

Brokered CDs are tradeable securities. This means that the value of the brokered CD can fluctuate in the secondary market. Your Schwab CD may appear to “lose” money when interest rates increase. This is because new CDs will be offering higher rates, making the older ones less desirable.

However, as long as you hold your brokered CD to maturity, you will be guaranteed your CD’s principal and interest on the maturity date.

Charles Schwab CD Rates

Charles Schwab sells CDs with 3-month, 6-month, 9-month, 1-year, 18-month, 2-year, 3-year, 4-year, 5-year, 10-year, 20-year and 30-year plus terms. These rates will change often, so it’s best to check the Charles Schwab website for the latest data.

You can also check the latest Charles Schwab CD rates here. For other brokerages, you can also check the latest CD rates for Fidelity, E*Trade, Vanguard, Merrill Edge, and TD Ameritrade.

Summary of How to Buy a CD on Charles Schwab

Charles Schwab offers CDs as part of their investment options, which can be a good option for investors looking for a guaranteed return backed by the U.S. government.

Within a single Charles Schwab account, you can buy multiple CDs. These CDs will come from various issuers and have different maturities and returns. By doing this, you will have expanded FDIC insurance coverage and be able to earn returns while maintaining liquidity. The money you put into the CDs, both the principal and interest payments, will be deposited directly into your Schwab account. Schwab does provide an option for you to sell the brokered CDs before they mature on the secondary market.

Once you learn how to buy Charles Schwab CDs, you may be interested in building a ladder of brokered CDs on the Schwab platform. This ladder can be customized to meet your specific cash needs.

We also suggest considering Treasury bills, which have tax benefits and other advantages over CDs.