In this article, we will walk you through a step-by-step process on how to buy CDs on Fidelity.

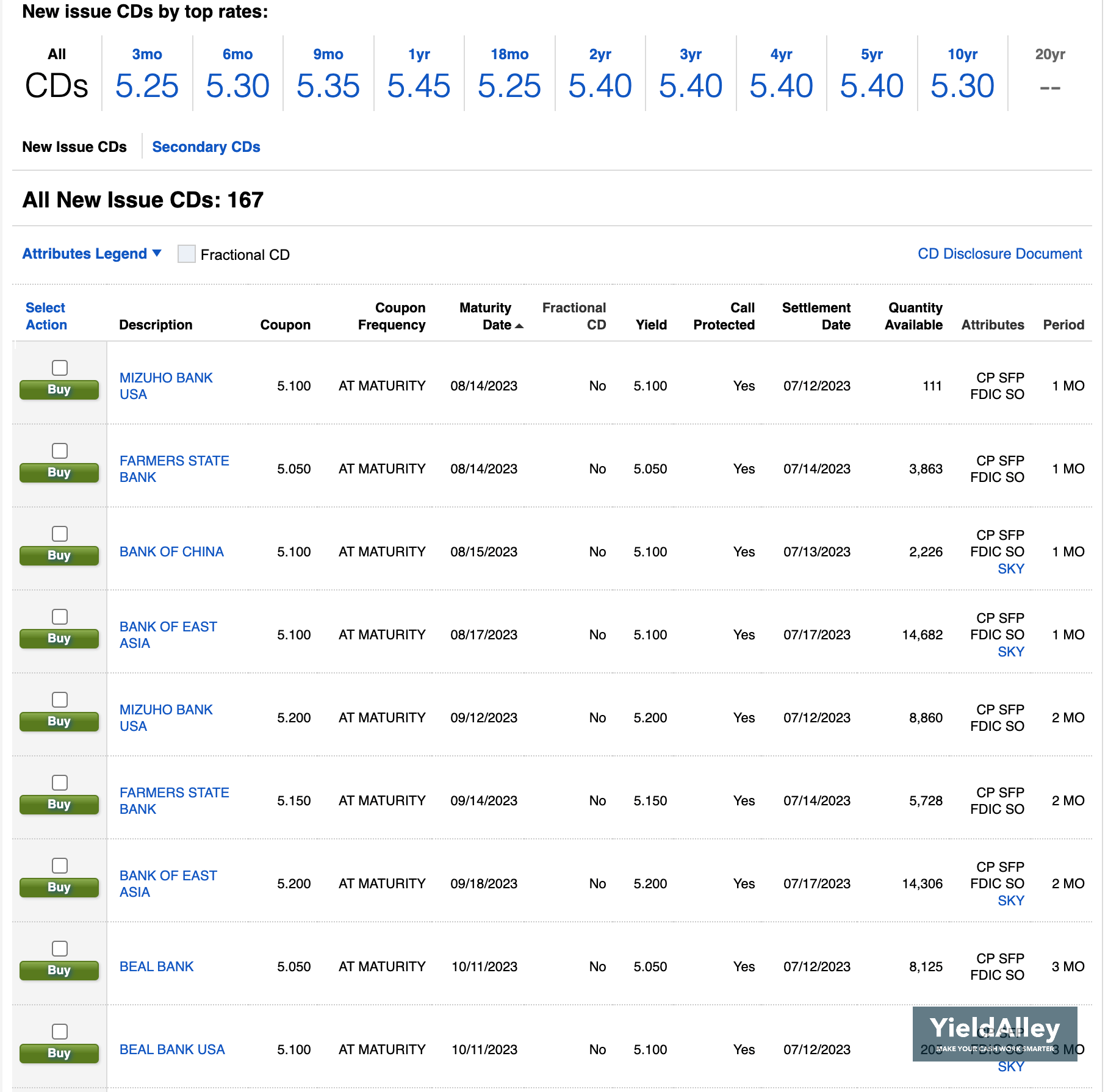

Fidelity sells brokered CDs, which are bank CDs you purchase through a brokerage. Fidelity’s CD rates and terms include 3-month, 6-month, 9-month, 1-year, 18-month, 2-year, 3-year, 5-year, 10-year, and 20-year terms. The rates and terms will frequently change, and we suggest the reader visit Fidelity’s website for the latest information.

How to Buy CDs on Fidelity: A Step-by-Step Guide

1. Log into your Fidelity account.

Note: Fidelity requires you to be logged-in in order to view their CD rates.

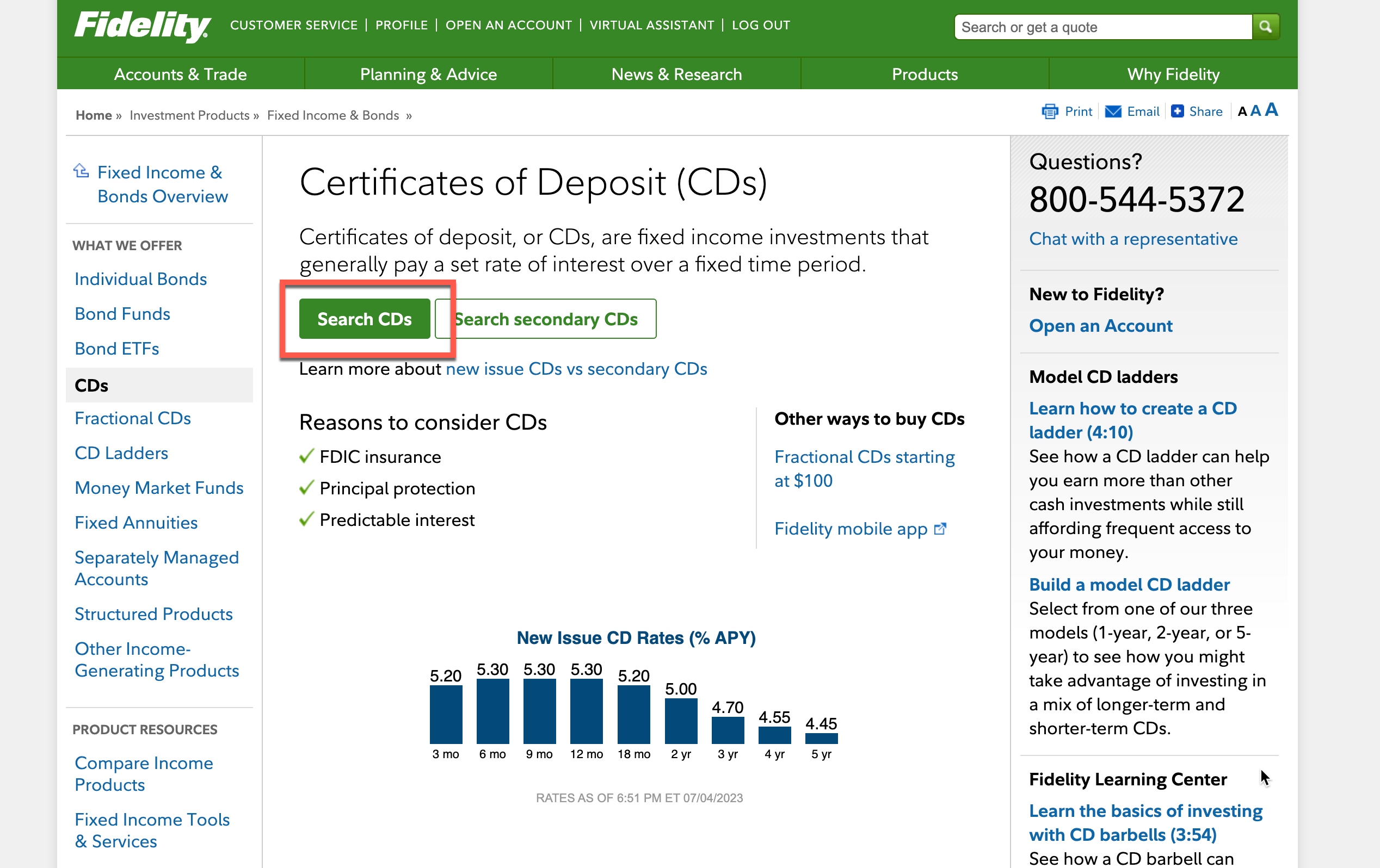

2. In the “Products” tab, select “Fixed Income, Bonds & CDs.” Click “Certificates of deposit (CDs)” in the section below.

3. Click “Search CDs” if you’d like to view new issue CDs.

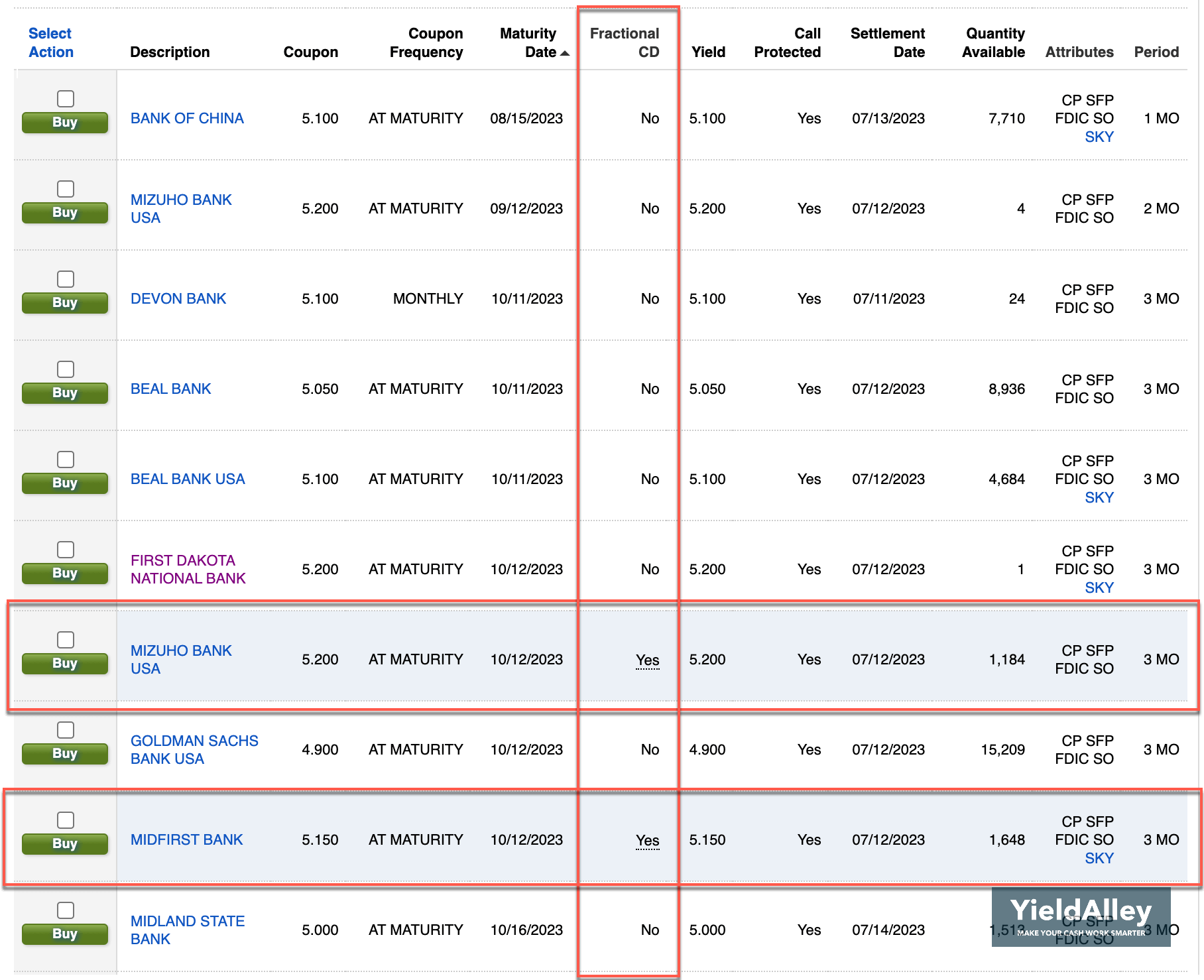

4. Browse Fidelity’s list of CDs. To filter by maturity, click a maturity term in the section above.

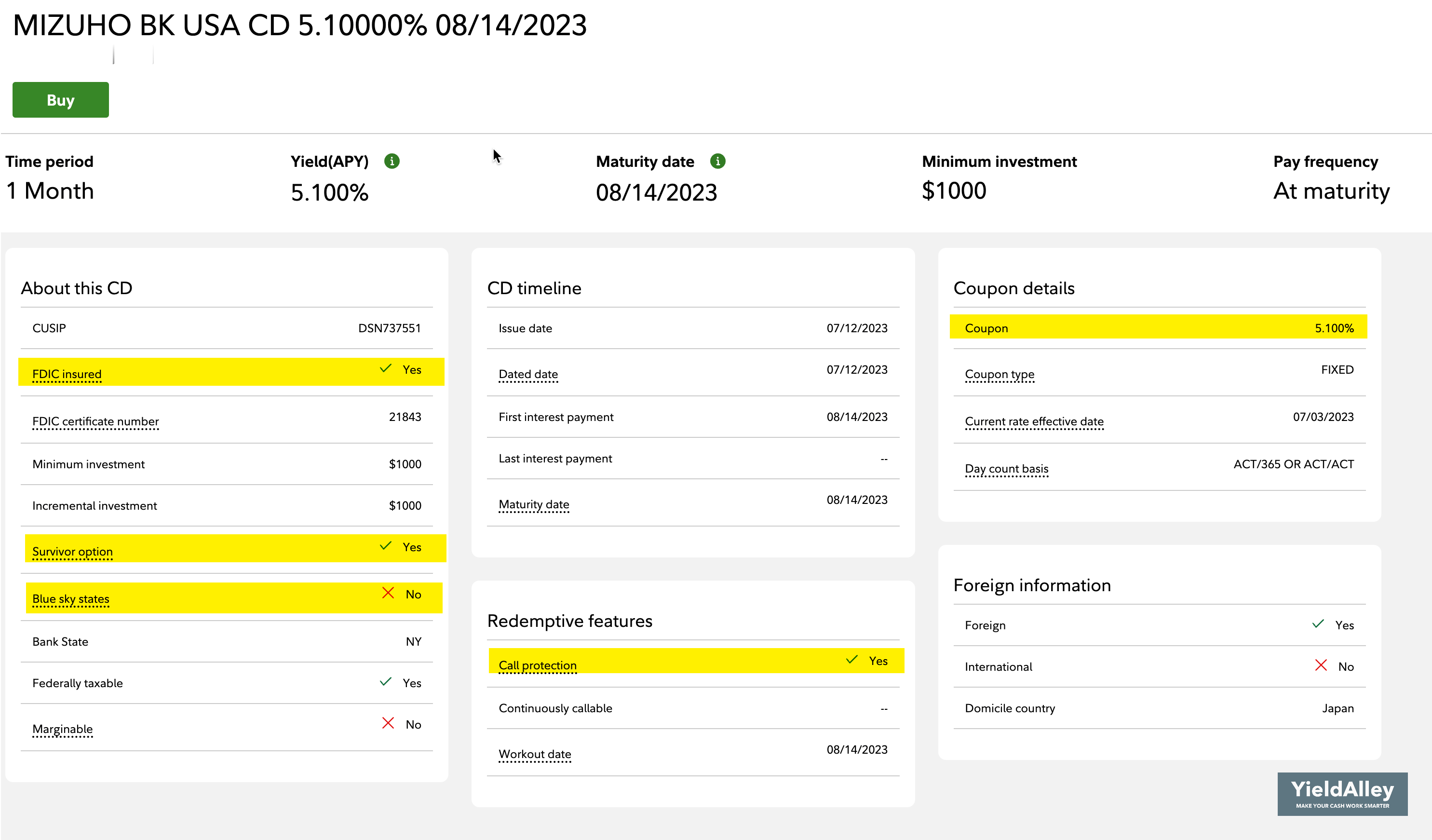

5. Click on a CD to learn more details.

Double-check the maturity date, the coupon rate, whether the CD is call-protected, and ensure FDIC coverage.

Check for any Blue Sky restrictions. Due to individual state securities regulations (Blue Sky laws), certain CDs may not be purchased in selected states or territories, which will be listed in the details.

When ready, click “Buy” to place your order.

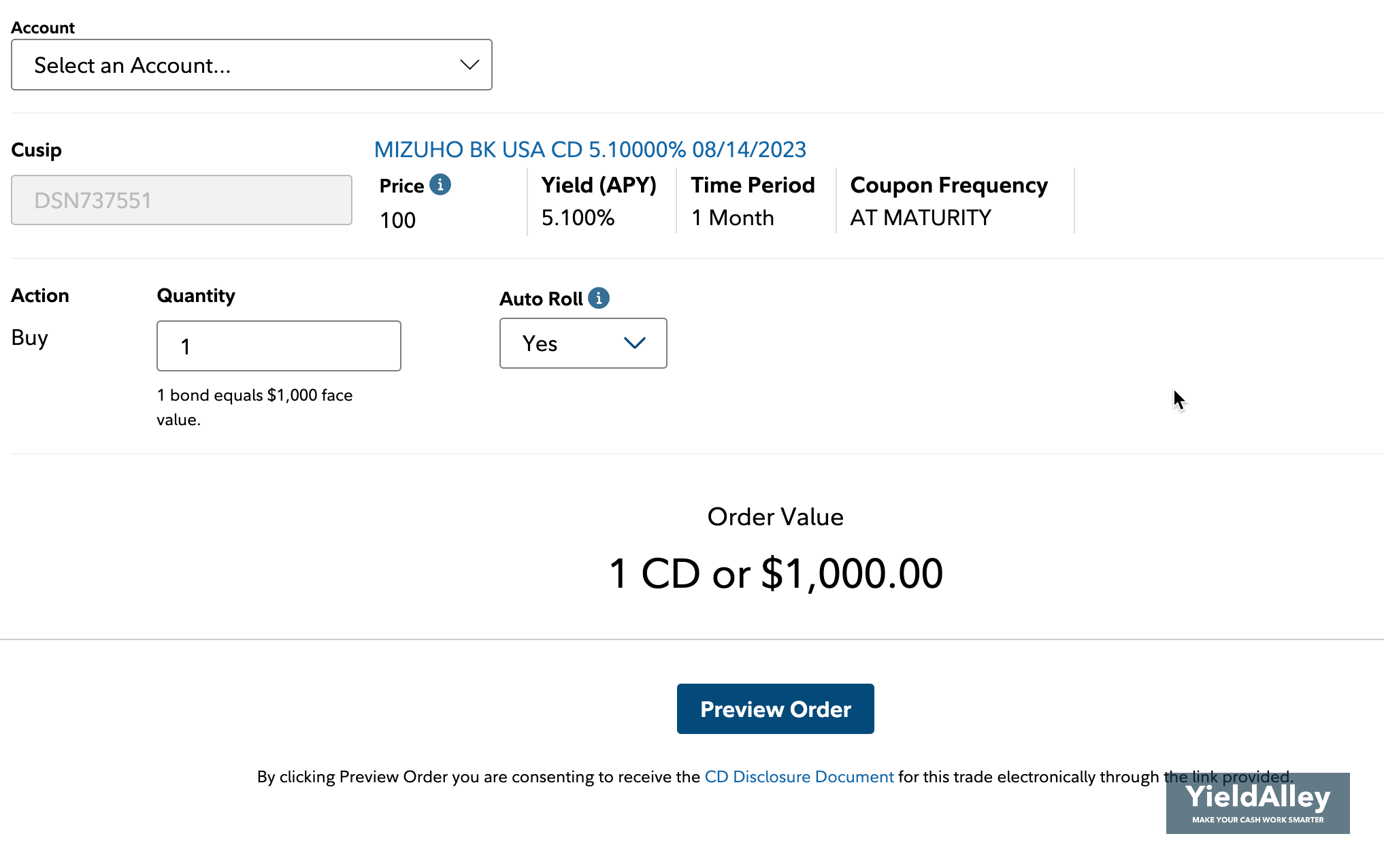

6. Enter and review your details. Then, place your order.

A minimum investment of $1,000 is required when buying brokered CDs on Fidelity. If you would like to purchase a CD for less than that, Fidelity has recently introduced a “Fractional CD” program that you may be interested in.

In Fidelity, we also have the choice to auto-roll our CD. This means you can reinvest in the same maturity or use the dropdown to select a new maturity length for your new investment and each subsequent rollover thereafter. Fidelity will attempt to roll into a CD based on your criteria, and by default, they will look for a CD with a similar maturity, coupon frequency, and the highest yield that fits those parameters. You can learn more in Fidelity’s subscriber agreement.

Congrats, you have learned how to buy CDs on Fidelity now!

Does Fidelity Offer CDs?

Fidelity provides the option to buy Certificates of Deposits (CDs) through their online platform. To purchase brokered CDs on Fidelity, it is necessary to have a Fidelity brokerage account. These CDs ensure a fixed rate of return within a specified duration, provided they are kept until maturity. Fidelity is a well-regarded brokerage firm that enables investors to trade various financial instruments such as stocks, bonds, options, mutual funds, ETFs, and CDs.

Fidelity CD Rates

Fidelity offers brokered CD rates for 3-month, 6-month, 9-month, 1-year, 18-month, 2-year, 3-year, 5-year, 10-year, and 20-year terms.

You can also check the latest Fidelity CD rates here. For other brokerages, you can also check the latest CD rates for TD Ameritrade, E*Trade, Vanguard, Merrill Edge, and Charles Schwab.

Is It Safe to Buy CDs From Fidelity?

Fidelity’s brokered CDs have FDIC insurance up to $250,000 per account owner, per institution. You can expand this coverage beyond the $250,000 limit by buying CDs from different issuing banks.

How to Buy a New Issue Fractional CD at Fidelity

Buying a new issue fractional CD at Fidelity is straightforward. Following the same steps above, you can pay attention to any shaded blue rows. On the purchase screen, you will have the option to enter the minimum investment of $100.

Summary of How to Buy a CD on Fidelity

With Fidelity, you can purchase various certificates of deposit (CDs) from different issuers, each with different maturity dates and interest rates. If you invest in multiple CDs, you can benefit from expanded FDIC insurance coverage. The money you invest and the interest you earn will be directly deposited into your Fidelity account. You can also sell your brokered CDs on the secondary market before they reach maturity.

Building a brokered CD ladder on Fidelity may be attractive if you’d like to have guaranteed returns while planning for periodic access to cash. This ladder can be customized to meet your specific financial needs, and we now you know how to buy CDs on Fidelity before doing proceeding with this step.