We will walk you through a step-by-step process on how to buy CDs on Merrill Edge.

The CDs that Merrill Edge sells are brokered CDs. Brokered CDs are bank CDs you purchase through a brokerage. Merrill Edge’s CD rates and terms include 3-month, 6-month, 9-month, 1-year, 3-year, 5-year, 5-year+ terms. The rates and terms often will frequently change, and we advise the reader to visit Merrill Edge’s website for the latest information.

How to Buy CDs on Merrill Edge: A Step-by-Step Guide

1. Log into your Merrill Edge account.

The Merrill Edge login and Merrill Lynch login site can be accessed at https://www.merrilledge.com/ or https://olui2.fs.ml.com/login/signin.aspx.

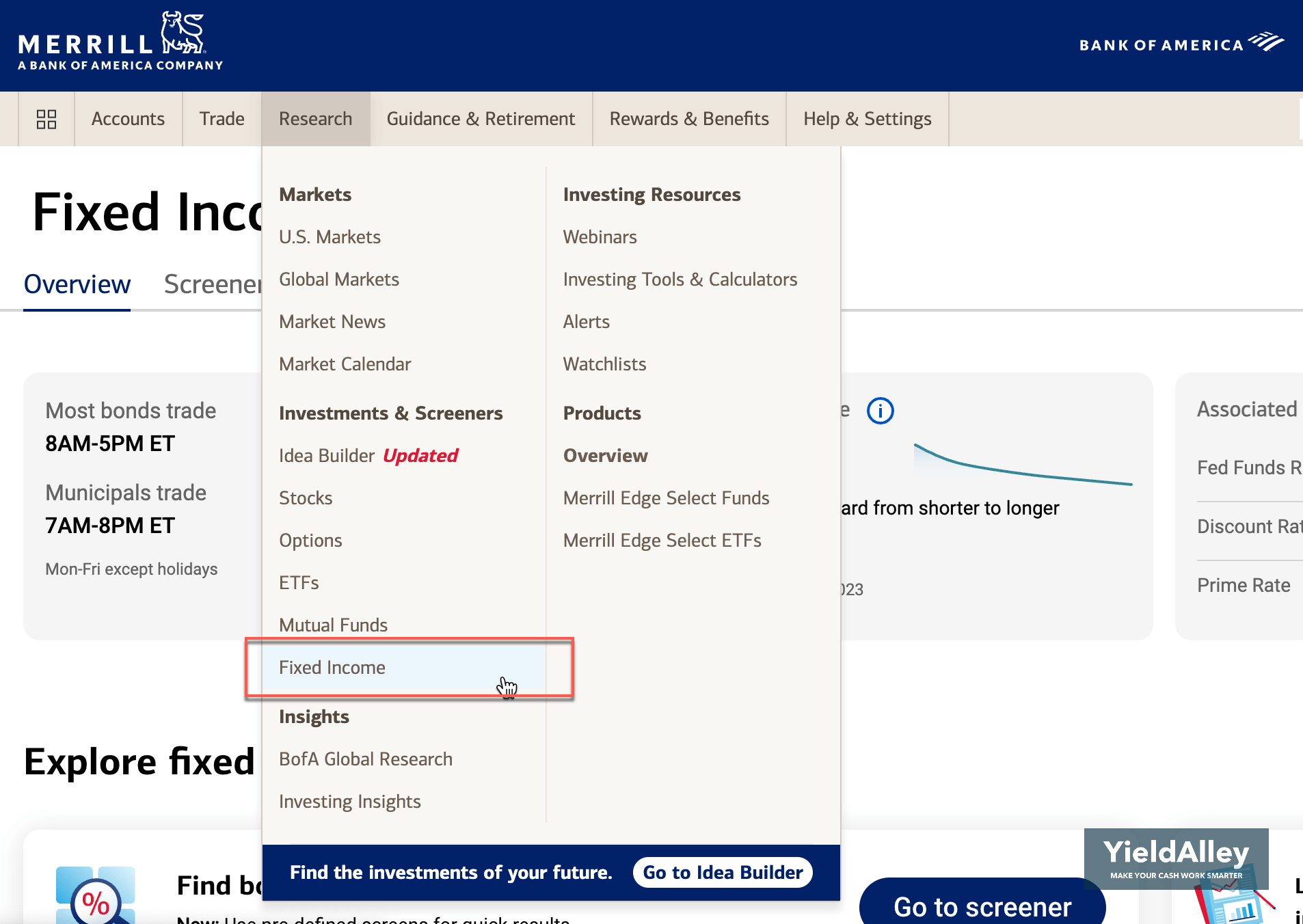

2. Navigate to the “Research” tab and click “Fixed Income“

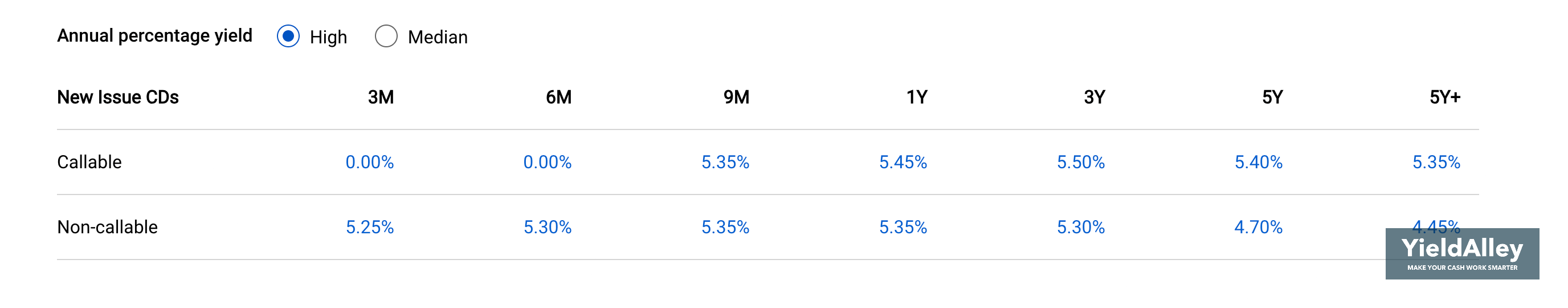

3. Scroll down until you see the “New Issues” table.

By default, Merrill Edge will show you the best rates and the highest APY (annual percentage yield) for each maturity term. You can change this to the median yield if you’d like.

Note: Merrill Edge does not show information about its brokered CDs during non-market hours. This means you cannot view CD information on Merrill Edge outside the standard market hours of 9:30 a.m. Eastern time and 4:00 p.m. Eastern time.

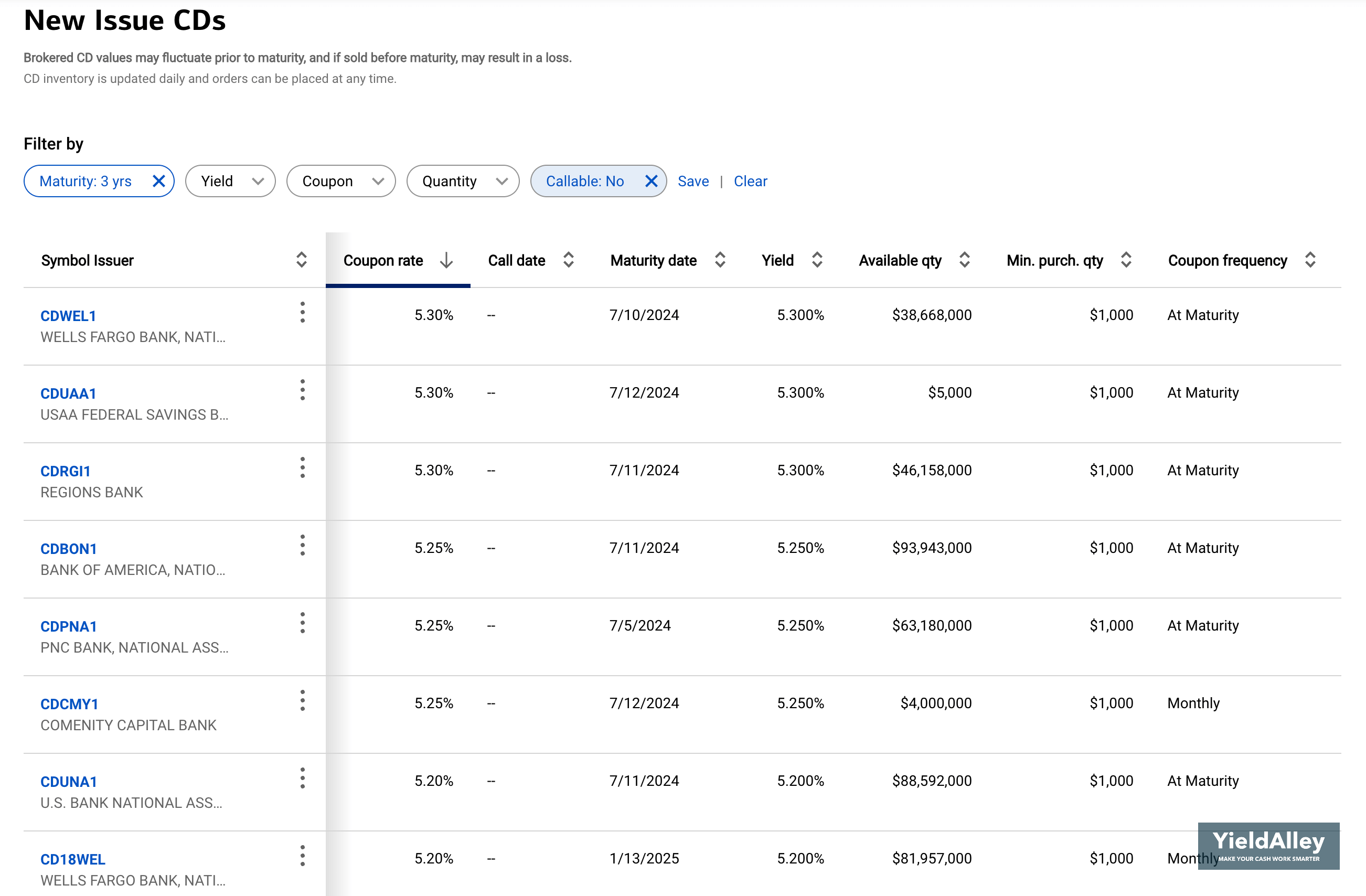

5. Sort and filter for your preferred CD.

You can filter the list of CDs by maturity, yield, coupon frequency and coupon, the quantity you want to buy, and whether the CD is callable or not.

Here, we have filtered for CDs with a maturity range between 1 to 3 years, and is a non-callable CD. Then, we sorted for the highest to lowest coupon rate.

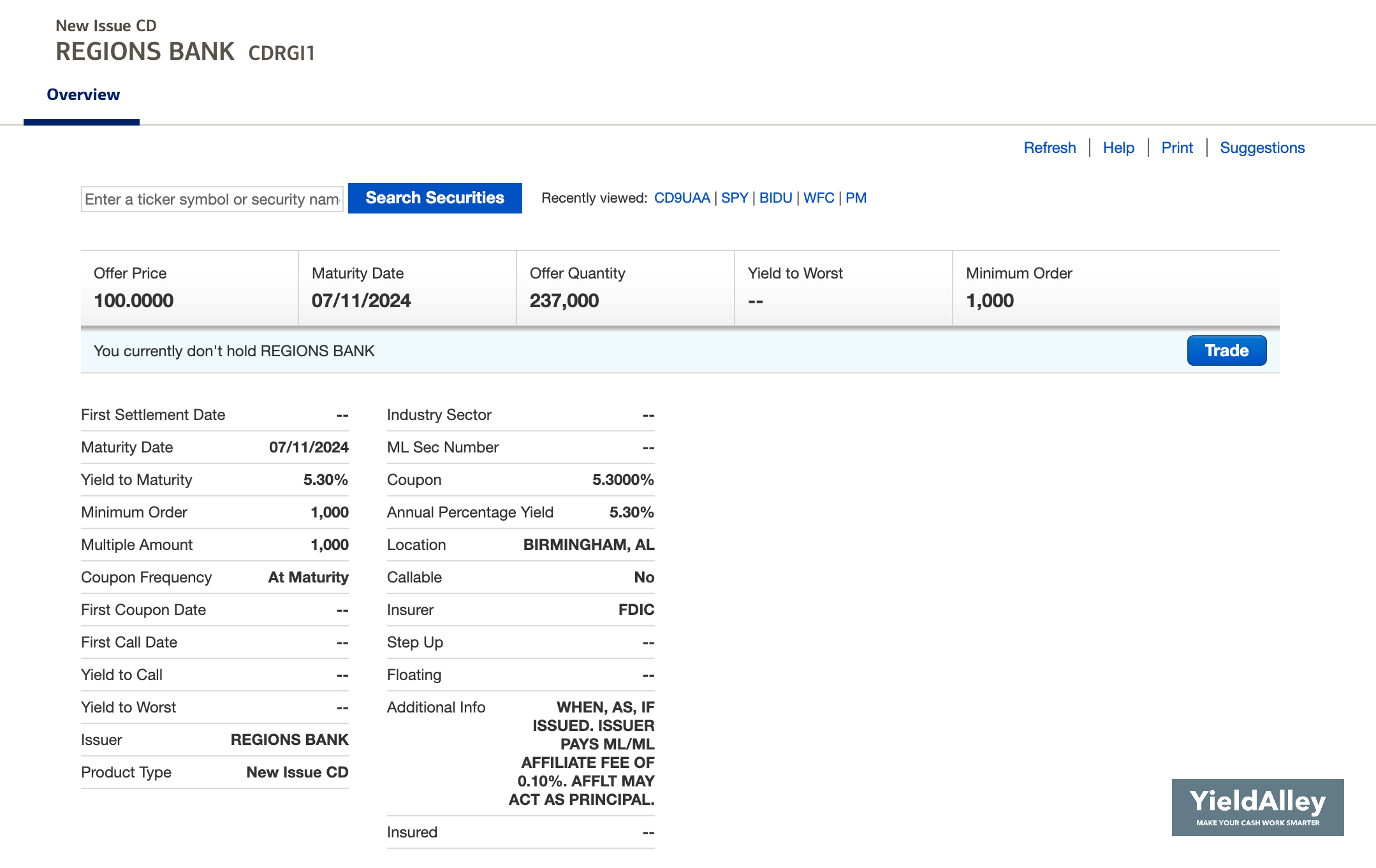

6. Click into the CD to learn more details.

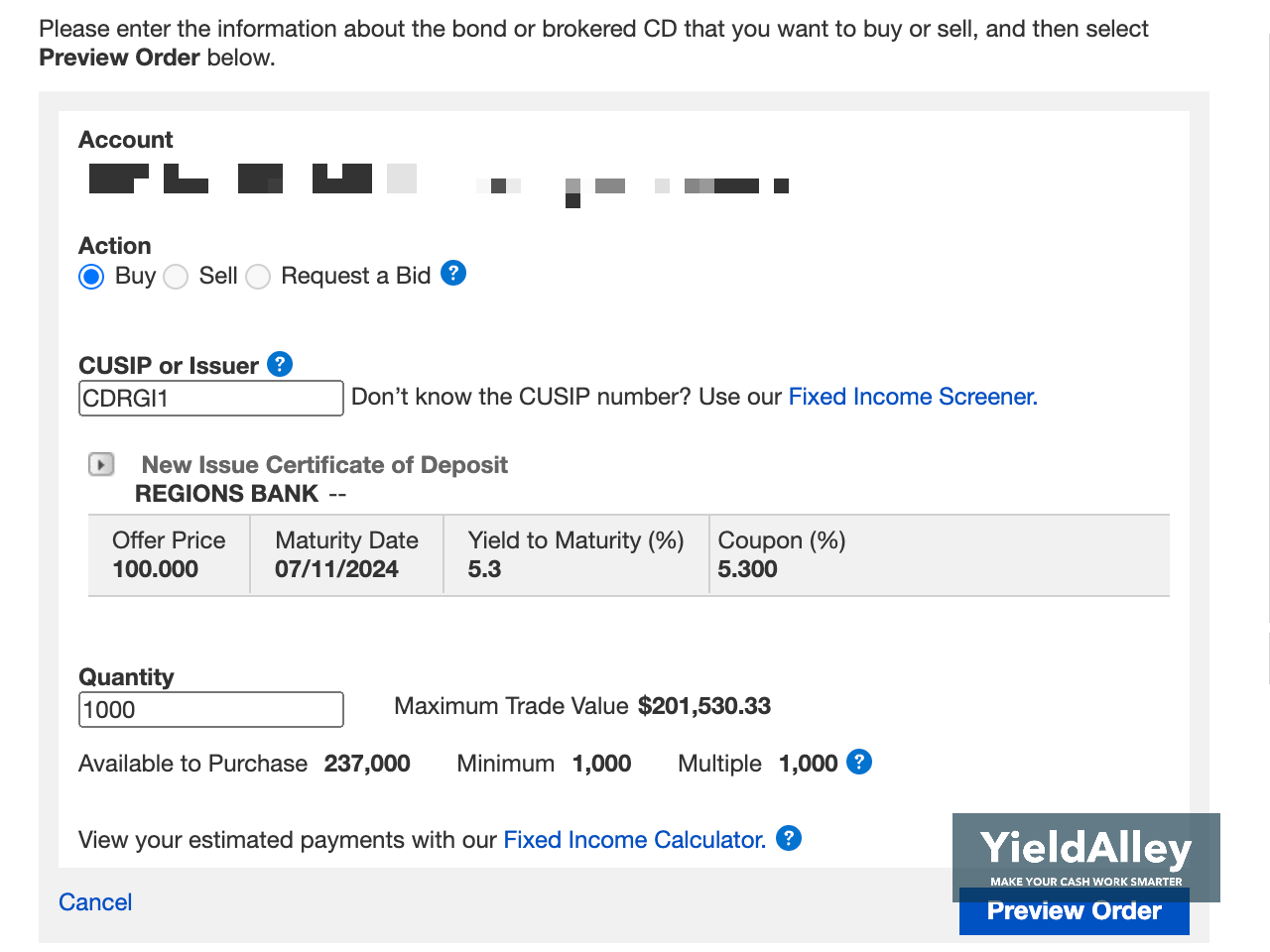

7. Enter the details of your purchase and preview your order.

Merrill Edge has a $1,000 minimum investment for brokered CDs.

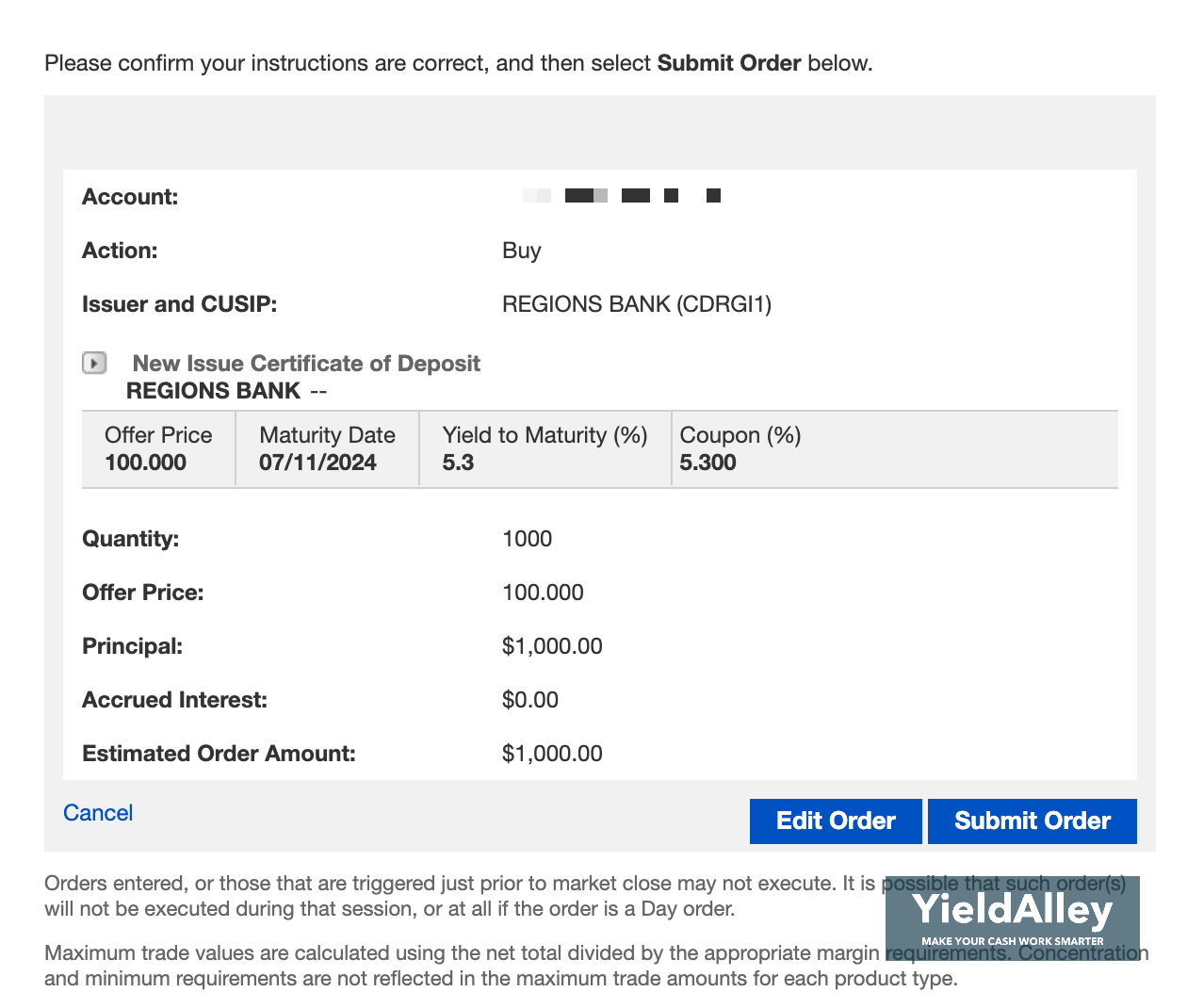

8. Review your order, and click “Submit Order” when ready.

Congrats, you have now learned how to buy CDs on Merrill Edge!

Does Merrill Edge offer CDs?

Merrill Edge offers Certificates of Deposits (CDs) that can be purchased online. You will need a Merrill brokerage account to buy brokered CDs on Merrill Edge. These CDs offer a guaranteed rate of return over a specific period of time, as long as the CDs are held to maturity. Merrill Edge is a full-service brokerage that allows investors to trade stocks, bonds, options, mutual funds, ETFs, and CDs.

Don’t See CDs in Merrill Edge or Merrill Lynch?

If you are unable to see or can’t find CDs on Merrill Edge, you may be accessing Merrill outside of market hours. Merrill Edge and Merrill Lynch only show CD rates when the market is open. The stock market is open from 9:30 a.m. Eastern time and 4:00 p.m. Eastern time every day of the week, and closed on the weekends. The market is also closed during specific holidays if it lands on a weekday.

If you want to check CD rates or buy CDs on Merrill Edge or Merrill Lynch, you must do so when the stock market is open on the weekdays.

Are Merrill Edge CDs FDIC insured?

Brokered CDs sold by Merrill Edge have FDIC insurance coverage up to $250,000 per depositor, per insured bank. For example, with one Merrill Edge brokerage account, you can purchase three CDs from separate banks while enjoying insurance coverage up to $750,000.

Merrill Edge CD Rates

Merrill Edge offers brokered CDs with 3-month, 6-month, 9-month, 1-year, 3-year, 5-year, 5-year+ terms. There are both callable and non-callable CDs, all of which are FDIC insured. The CDs offered on Merrill Edge can frequently change, so we suggest visiting Merrill Edge’s website for the latest data.

You can also check the latest Merrill Edge CD rates here. For other brokerages, you can also check the latest CD rates for Fidelity, TD Ameritrade, E*Trade, Vanguard, and Charles Schwab.

Who is the Parent Company of Merrill Edge?

Merrill Edge is a subsidiary of Bank of America, making Bank of America the parent company of Merrill Edge. Bank of America is one of the largest banks in the United States and offers various financial services. Merrill Edge was launched in 2010 after Bank of America acquired Merrill Launch in 2009.

Merrill Edge is an online brokerage platform providing investment tools and solutions for self-directed investors. Through Merrill Edge, customers can access various investment products, including stocks, bonds, mutual funds, and exchange-traded funds.

Merrill Edge vs. Merrill Lynch: What’s the Difference?

Merrill Edge and Merrill Lynch are not the same, but they are both investment platforms offered by Bank of America. Merrill Edge is an online brokerage service geared towards self-directed investors who prefer to make their own investment decisions. On the other hand, Merrill Lynch is a full-service brokerage firm that offers personalized advice and financial planning for high-net-worth clients.

What is Merrill Edge?

Merrill Edge is an online brokerage platform that offers a range of investment products and tools for individuals to manage their own investments. It provides access to a wide selection of stocks, bonds, ETFs, and mutual funds, along with research and educational resources to help investors make informed decisions.

What is Merrill Lynch?

Merrill Lynch is a financial advisory company based in the United States. It offers a range of services including wealth management, investment banking, and brokerage services. As one of the largest wealth management firms in the world, Merrill Lynch provides personalized solutions through a team of financial advisors who provide tailored investment strategies and take a more hands-on approach with their clients.

Overall, the main difference between Merrill Edge and Merrill Lynch is the level of assistance and guidance provided to investors.

Summary of How to Buy CDs on Merrill Edge

With Merrill, you can purchase a CD from various issuers with many maturity and coupon options. Buying more than one CD will give you expanded FDIC insurance coverage while gaining returns and liquidity. The principal and interest payments will be directly credited to your Merrill account. While it is not obligatory, Merrill provides a secondary market option for you to sell brokered CDs before their maturity. It is also possible to transfer the brokered CD into or out of your Merrill account.

Familiarize yourself with how to buy CDs on Merrill Edge before constructing a brokered CD ladder on the platform, which can be set up for your particular cash needs.

We also suggest exploring Treasury bills, as they offer tax benefits and other advantages compared to CDs.