Brokered CDs present a distinctive approach to incorporating a relatively secure and potentially higher-yielding element into an investment portfolio. They capture attention as they can be traded in secondary markets, usually offering better rates compared to standard bank CDs. Through our detailed pictorial guide, we’re demystifying the steps on how to buy CDs on TD Ameritrade, an online brokerage platform.

TD Ameritrade currently offers a range of brokered CDs, essentially bank CDs acquired through a brokerage like TD Ameritrade. They come in various terms including 3-month, 6-month, 9-month, 1-year, 2-year, 3-year, 5-year, 6-year, and 10-year options, catering to diverse investment timelines and risk levels.

How to Buy CDs on TD Ameritrade: A Step-by-Step Guide

1. Log into your TD Ameritrade account.

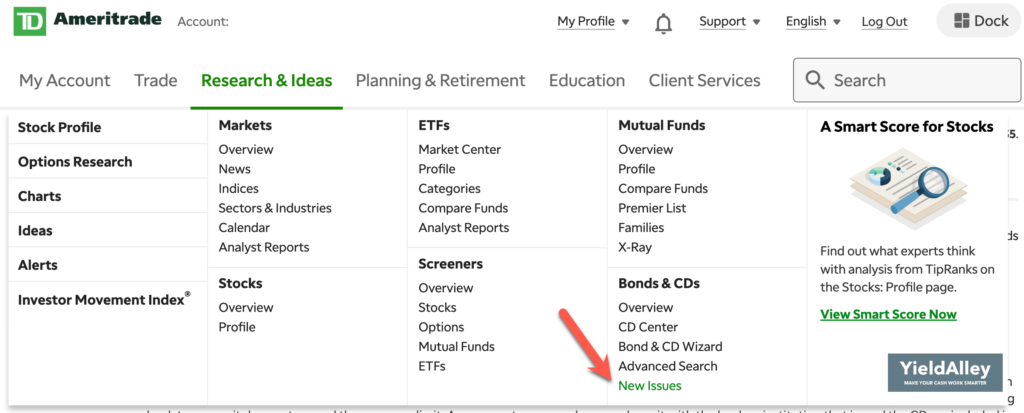

2. To view new issue CDs, navigate to “New Issues” under the “Bonds & CD” section in the “Research & Ideas” tab.

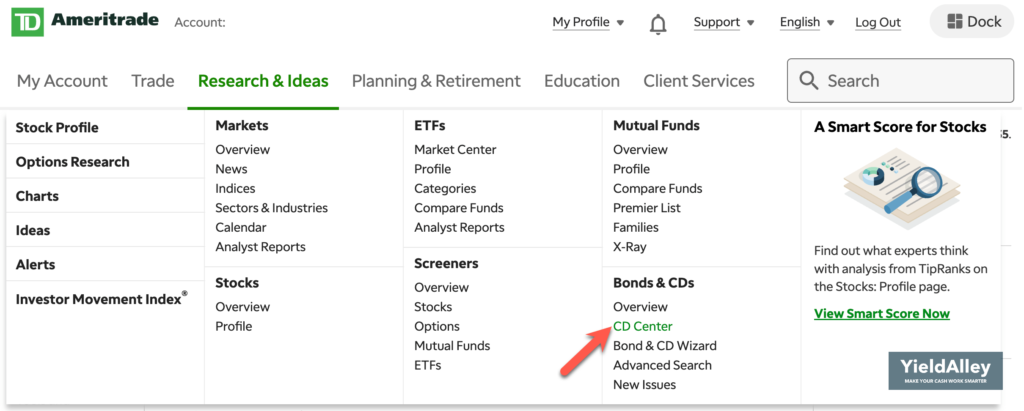

You can also view a list of all TD Ameritrade brokered CDs by navigating to “CD Center” instead. This will include secondary CDs that you can buy.

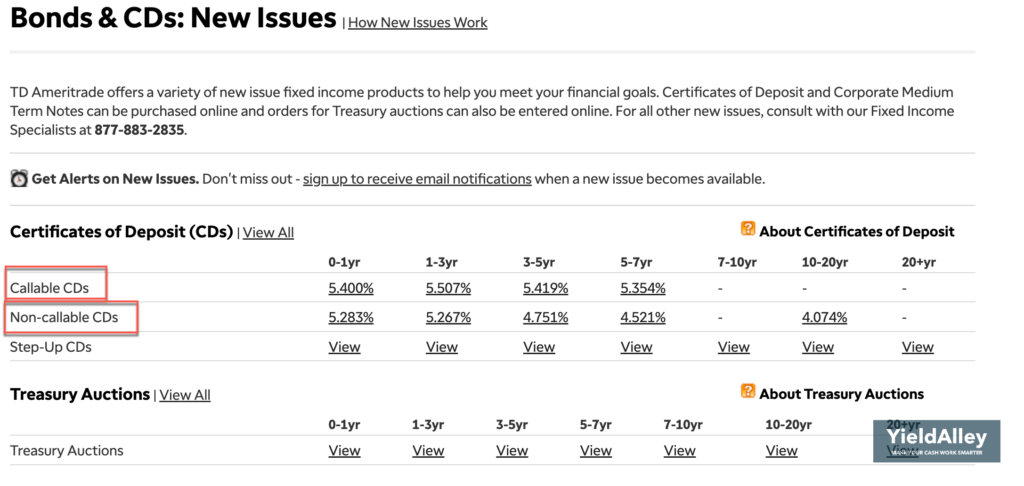

3. Choose the CD type and term you are interested in.

Remember, callable CDs can be called by the issuing bank, which can happen in a declining interest rate environment. Since we are interested in a higher yield, we’ll select a callable CD since we are comfortable with that risk.

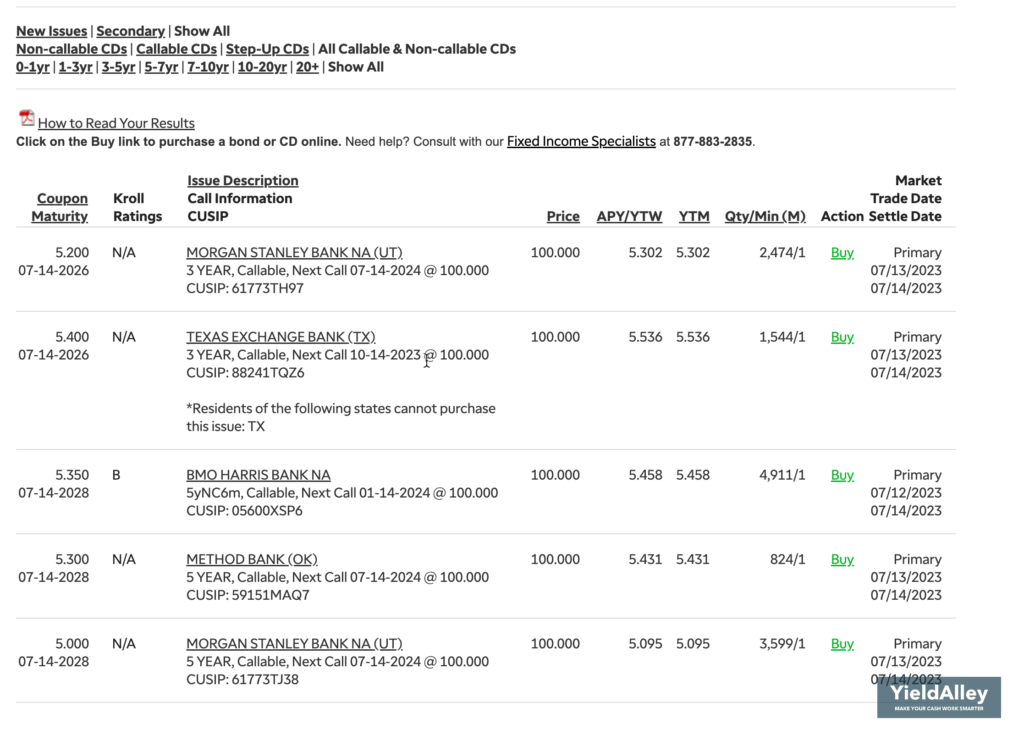

4. Review the list of CDs and choose the one you want.

You will want to pay attention to a few things.

First, confirm whether the CD is callable. Because we chose a callable CD option in step 3, our entire list will show callable CDs. But if you are looking at a list of all the CDs offered, you should confirm whether the CD is callable or non-callable.

Second, check the maturity date. By default, TD Ameritrade displays CDs based on their maturity terms in grouped intervals. For instance, when viewing the CD options, you can choose to see a list of CDs with maturity terms ranging from 5-7 years or 7-10 years. To see only a specific maturity length, you can filter this in the “Refine Search” option. Double check the maturity length of the CD to ensure it aligns with your desired duration. You can sort the maturities by clicking the “Maturity” label in the leftmost column.

Finally, check the coupon rate and ensure it aligns with your desired preference. Again, this can be sorted by clicking the “Coupon” label in the leftmost column.

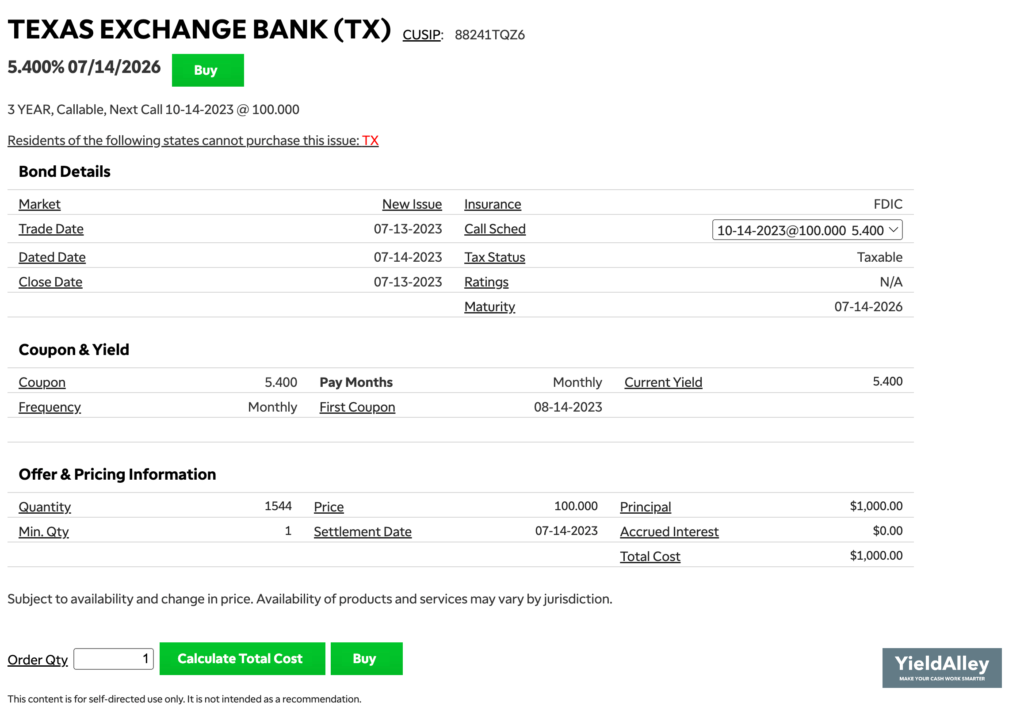

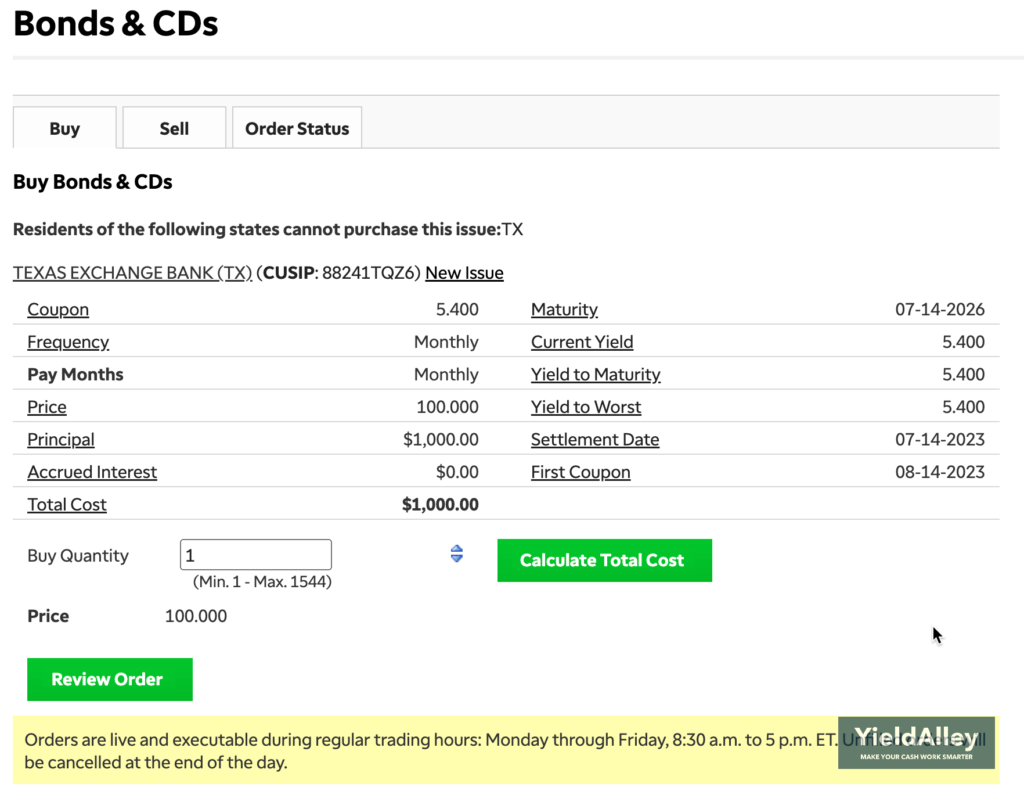

5. Review the terms of the CD you wish to buy. Enter the quantity you want to buy.

On this screen, you will find more useful information such as the Call Schedule (if the CD is callable), the frequency of interest payments, and any Blue Sky restrictions.

TD Ameritrade has a minimum investment of $1,000 to buy a CD. An order quantity of 1 represents one CD with a principal of $1,000.

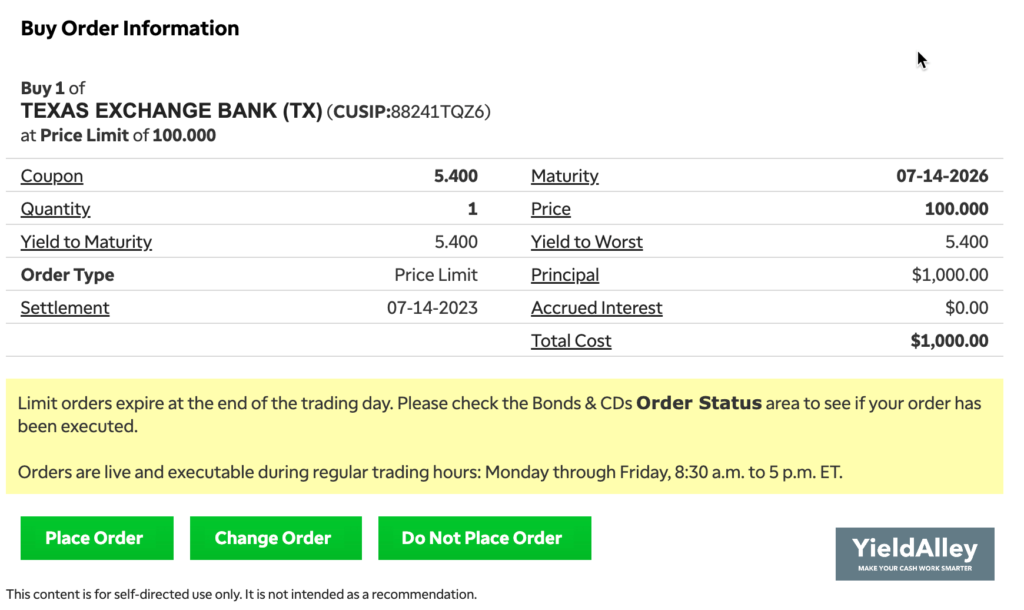

6. Review your order before you purchase.

7. Place your order.

Congrats, you have learned how to buy a CD on TD Ameritrade now!

If you wish to buy a brokered CD on the secondary market on TD Ameritrade, you can follow the same steps by going to “CD Center” in the “Research & Ideas” tab instead of just “New Issues.”

Does TD Ameritrade Have CDs?

Yes, TD Ameritrade offers Certificates of Deposits (CDs) that can be bought online. TD Ameritrade is an online brokerage platform where investors can trade many things like stocks, bonds, options, mutual funds, ETFs, and CDs.

TD Ameritrade Brokered CDs vs. Bank CDs

TD Ameritrade sells brokered CDs, which are like CDs you can buy directly from a bank (bank CDs) but sold through a brokerage. Brokered CDs usually offer higher rates than bank CDs since they are more competitive and can be sold to others easily. Brokered CDs from TD Ameritrade also have FDIC insurance, just like bank CDs.

Are CDs Safe in TD Ameritrade?

Yes, the CDs in TD Ameritrade are considered safe. All the CDs sold by TD Ameritrade are brokered CDs, and they have FDIC insurance that covers up to $250,000 for each person, at each bank. If you have a TD Ameritrade account, you can buy two CDs from different banks and get insurance coverage up to $500,000.

TD Ameritrade CD Rates

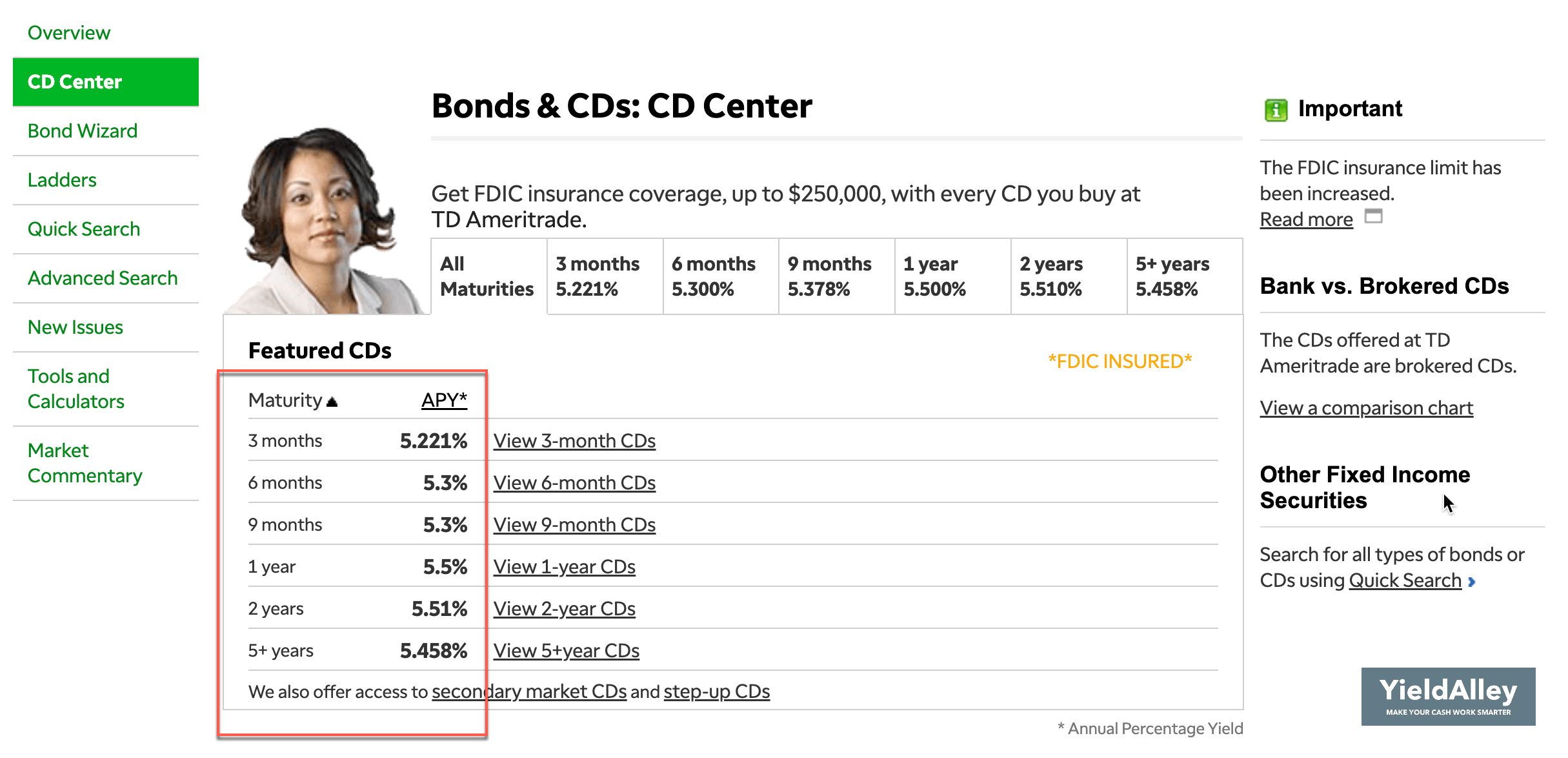

TD Ameritrade offers CDs with different time lengths like 3-month, 6-month, 9-month, 1-year, 2-year, 3-year, 5-year, 6-year, and 10-year. The “CD Center” in TD Ameritrade shows the highest yield for each maturity, as shown below. For the latest CD rates, it’s a good idea to check TD Ameritrade’s website.

You can also check the latest TD Ameritrade CD rates here. For other brokerages, you can also check the latest CD rates for Fidelity, E*Trade, Vanguard, Merrill Edge, and Charles Schwab.

Should I Buy CDs on TD Ameritrade?

TD Ameritrade brokered CDs stand as a solid choice for those desiring a guaranteed return backed by the U.S. government. The brokered CDs at TD Ameritrade offer competitive rates and a wider range of maturity terms compared to traditional CDs.

Understanding how to buy CDs on TD Ameritrade serves as a beneficial precursor to establishing a brokered CD ladder on TD Ameritrade. It’s also advisable to explore Treasury bills, which come with tax benefits and other advantages over CDs. We have also produced a guide on how to buy Treasury bills on TD Ameritrade.

It’s important to note that TD Ameritrade has been bought by Charles Schwab, and these two major online brokerages are combining in 2024. and the process of buying CDs and Treasury bills on Schwab is also relatively straightforward.