Brokered CDs offer a unique way of adding a relatively safe and potentially higher-yielding component to an investment portfolio. They are particularly intriguing since they can be bought and sold in secondary markets, often providing better rates than traditional bank CDs. With our step-by-step picture guide, we’re unlocking the process of how to buy CDs through Vanguard, an online brokerage.

Vanguard currently offers multiple types of brokered CDs, which are essentially bank CDs purchased via a brokerage like Vanguard. With a variety of terms including 3-month, 6-month, 9-month, 1-year, 2-year, 3-year, 5-year, and 10-year options, Vanguard’s CD rates and terms cater to different investment horizons and risk appetites.

How to Buy CDs Through Vanguard: A Step-By-Step Guide

1. Open or log into a Vanguard account.

To buy CDs through Vanguard, start by opening an account with Vanguard if you don’t already have one.

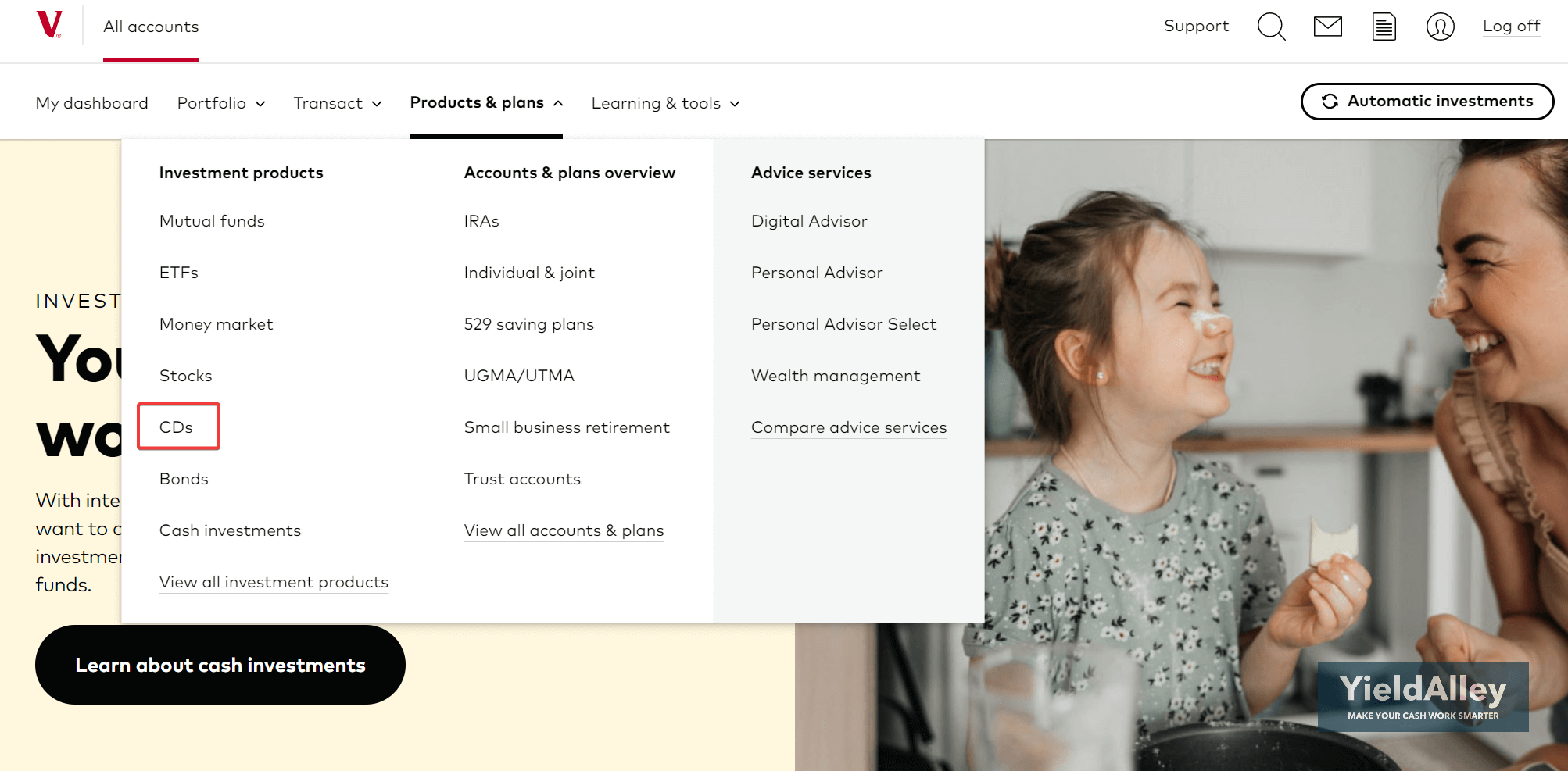

2. Navigate to “Products & Plans” and click CDs.

Once you have an account, navigate to the “Investment Products” section and choose the option for CDs.

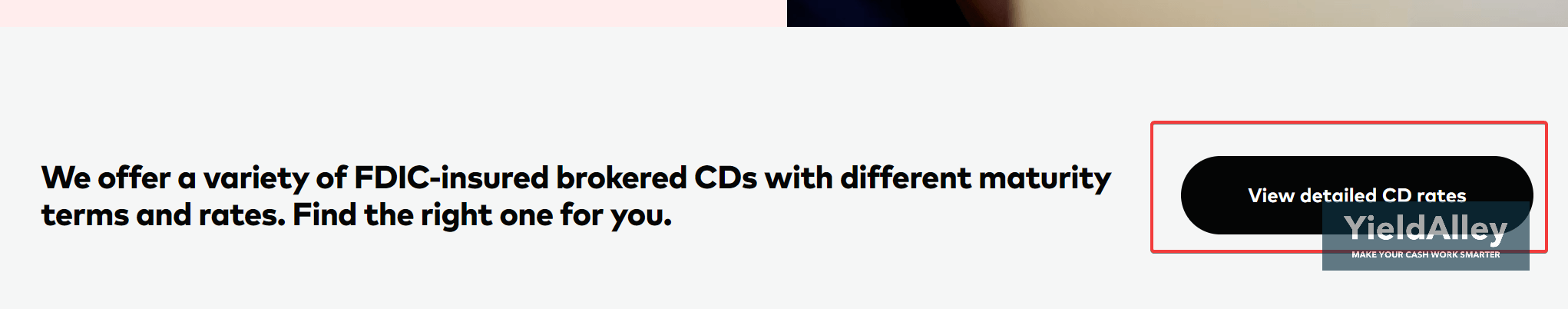

3. Click “View Detailed CD Rates”

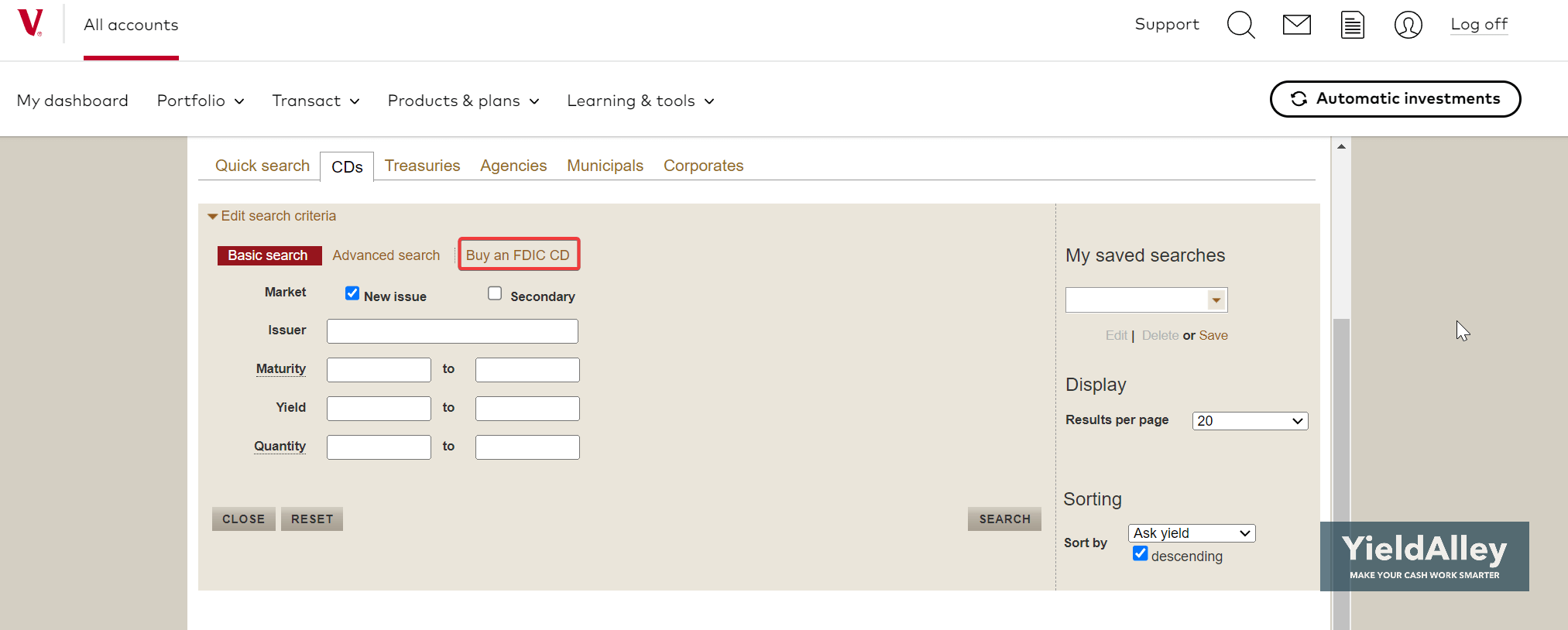

4. Next, click “Buy an FDIC CD” to view Vanguard’s FDIC-Insured CDs.

You can also click “Search” if you wish to see all the CDs that Vanguard offers.

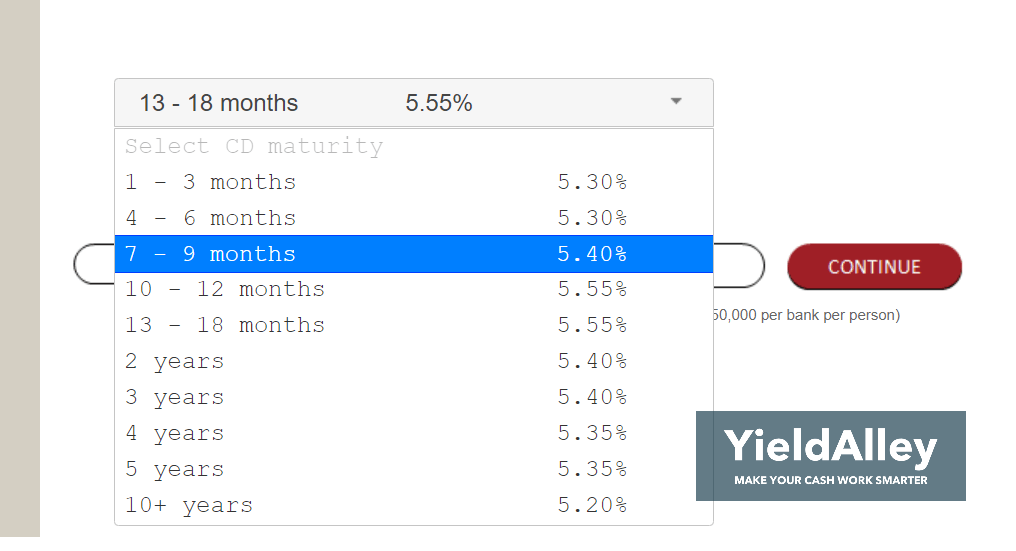

5. Select a maturity term and click continue.

You will see the stated annual APY yield next to the CD maturity term.

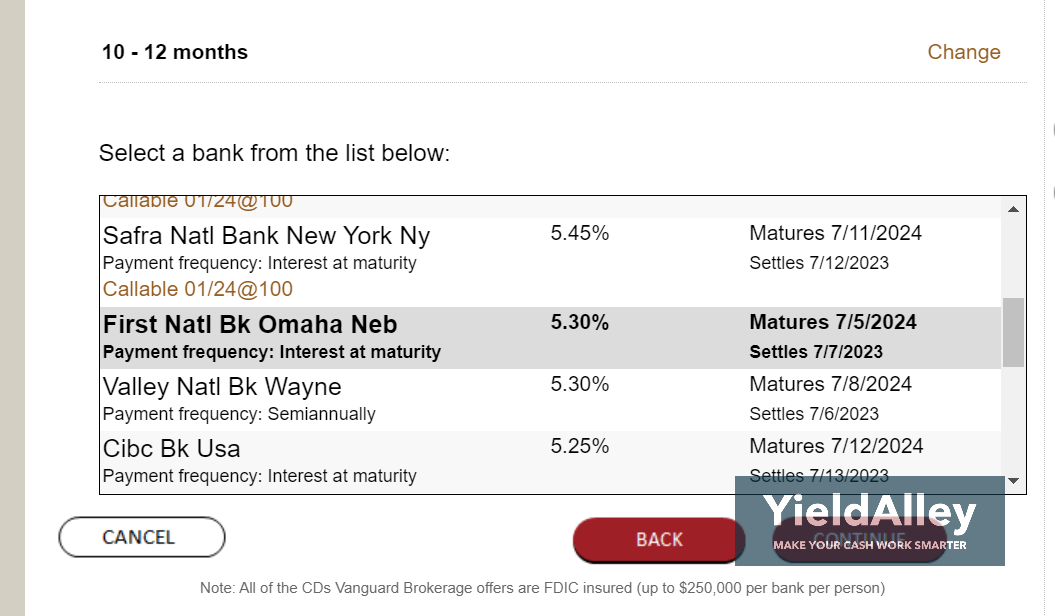

6. Review the details, such as the interest rate and maturity date of the CDs listed.

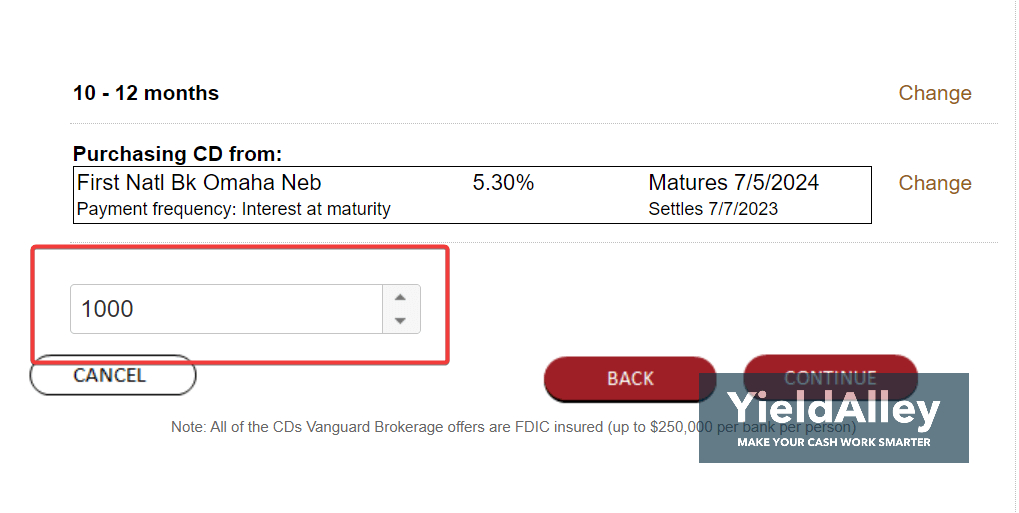

7. Enter your desired purchase amount and click Continue.

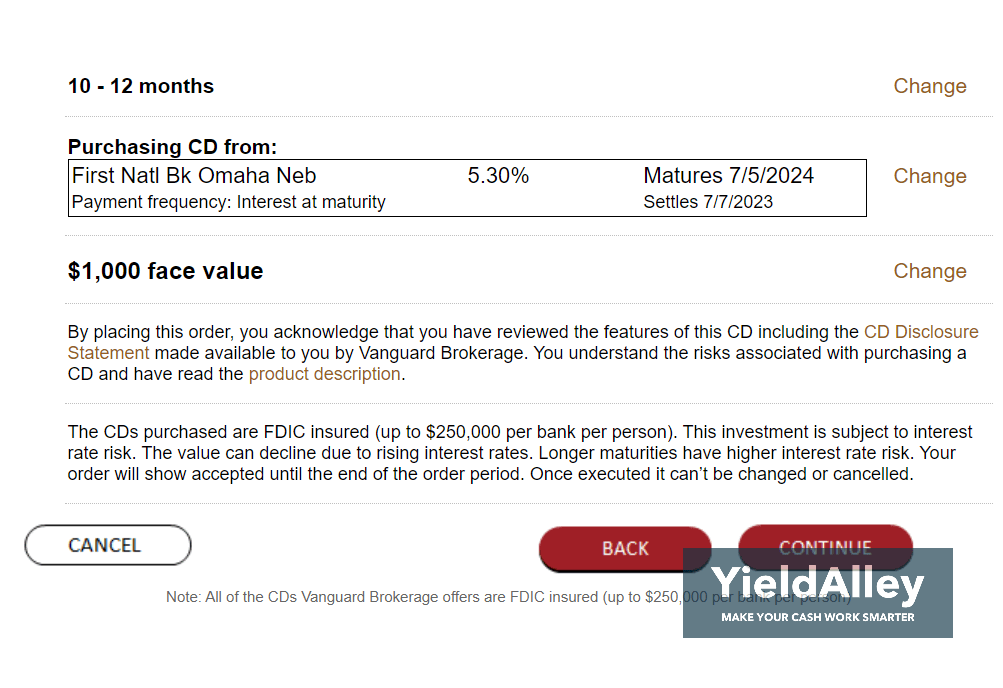

8. Review your CD purchase details. When you’re ready, you can continue to purchase the CD.

Congrats, you have learned how to purchase CDs through Vanguard now!

Alternatively, you can call a Vanguard representative at 877-662-7447 and say “Buy CD” when prompted. If you will be placing a secondary trade over the phone, Vanguard Brokerage will charge you an additional $25.

Does Vanguard Offer CDs?

Vanguard, a big player in the finance world, offers a range of Certificates of Deposit (CDs) to its customers. They have a mix of FDIC-insured CDs with different rates and term lengths.

Investing in Vanguard’s CDs is seen as a safe and low-risk choice. These brokered CDs have a set rate of return, which means the rate stays the same regardless of market changes.

Is It Safe To Buy CDs Through Vanguard?

Buying CDs from Vanguard is generally seen as safe due to the firm’s long-standing presence and good reputation in the finance sector. Vanguard has backing from the Securities Investor Protection Corporation (SIPC) to safeguard investors if things go south with the firm. Like with any investment, CDs involve certain risks like fluctuating interest rates. But for those seeking a dependable platform to buy CDs, Vanguard is considered a safe bet for investors.

Are Vanguard CDs FDIC Insured?

Yes, the CDs from Vanguard are insured by the FDIC. The FDIC insurance is there to cover deposits at banks and savings outfits if they fail.

The FDIC gives a standard insurance cover of up to $250,000 for each depositor, for each kind of account, at every insured bank or savings association. So if you have several CDs at Vanguard, each one gets insured up to $250,000. It’s important to remember that other investment items from Vanguard like money market funds, mutual funds, and ETFs aren’t covered by FDIC insurance.

Vanguard CDs Review

Vanguard stands as one of the globe’s biggest and most trusted brokerage firms. By opening a brokerage account with Vanguard, you can pick from a variety of CDs that match your preferences. To start a CD with Vanguard, you’ll need at least $1,000. If you’re eyeing CDs that require a lesser initial investment, you may want to consider Fidelity’s fractional CDs.

For those who prefer not buying new issues straight from banks, there’s an option to buy brokered CDs on the secondary market. This means buying from others who are selling off their brokered CDs. There’s a fee of $1 for every $1,000 CD you buy on this secondary market.

Vanguard CD Rates

Vanguard CD rates and terms include 3-month, 6-month, 9-month, 1-year, 2-year, 3-year, 5-year, and 10-year terms. The rates will often change. Please check Vanguard’s website for the latest CD rates.

YieldAlley collects the latest Vanguard CD rates here.

Investors should compare CD rates from multiple banks as well as different brokerages to find the best CD rates. You can check brokerages such as E*Trade, Charles Schwab, TD Ameritrade, Fidelity, and Merrill Edge and see what CD rates and terms they are offering.

Should I Buy a CD Through Vanguard?

Now that you know how to buy CDs through Vanguard, you’ll have access to the brokerage’s wide variety of FDIC-insured CDs with different rates and maturity terms. Vanguard-brokered CDs offer competitive rates and are a solid option for investors looking for a safe, low-risk investment that generates return beyond what your bank account offers.