Treasury bills are one of the most attractive yield opportunities in the market today, offering over 5% yield. Treasuries offer investors the opportunity to obtain risk-free yield with guaranteed repayment by the U.S. government. Many Schwab customers and investors may not know that it only takes a few button clicks to take advantage of this free money. In this step-by-step guide, we’ll show you how to buy Treasury bills on Charles Schwab easily.

How to Buy Treasury Bills on Charles Schwab: A Step-by-Step Guide

First, log into your Schwab account to follow these step-by-step instructions on how to buy Treasury bills on Schwab.

1. Log into your Schwab account.

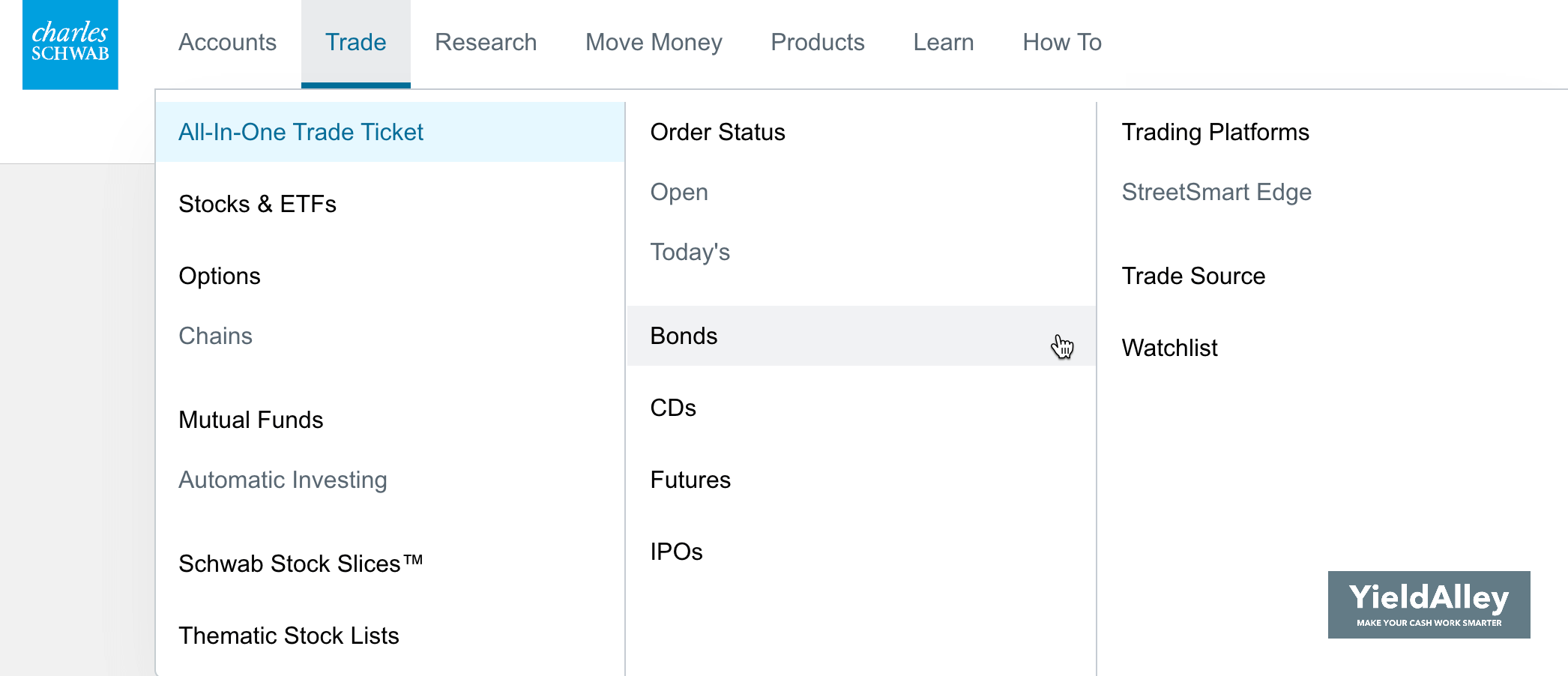

2. Under the “Trade” tab, select “Bonds”.

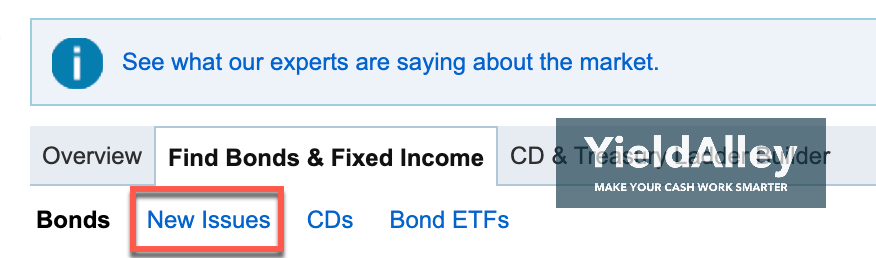

3. Click “Find Bonds & Fixed Income” and then “New Issues”.

Click “New Issues” under the “Find Bonds & Fixed Income” tab.

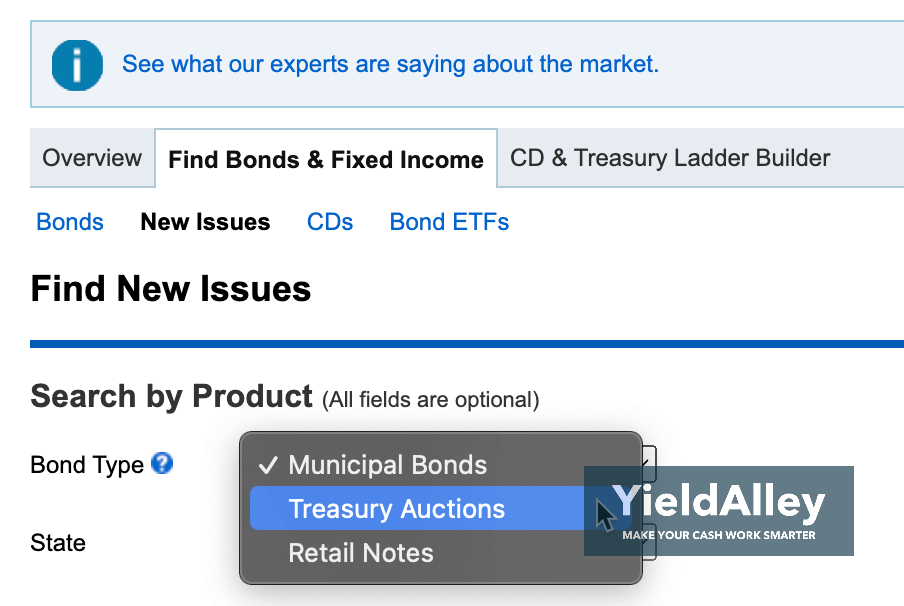

4. In the “Bond Type” dropdown menu, select “Treasury Auctions”.

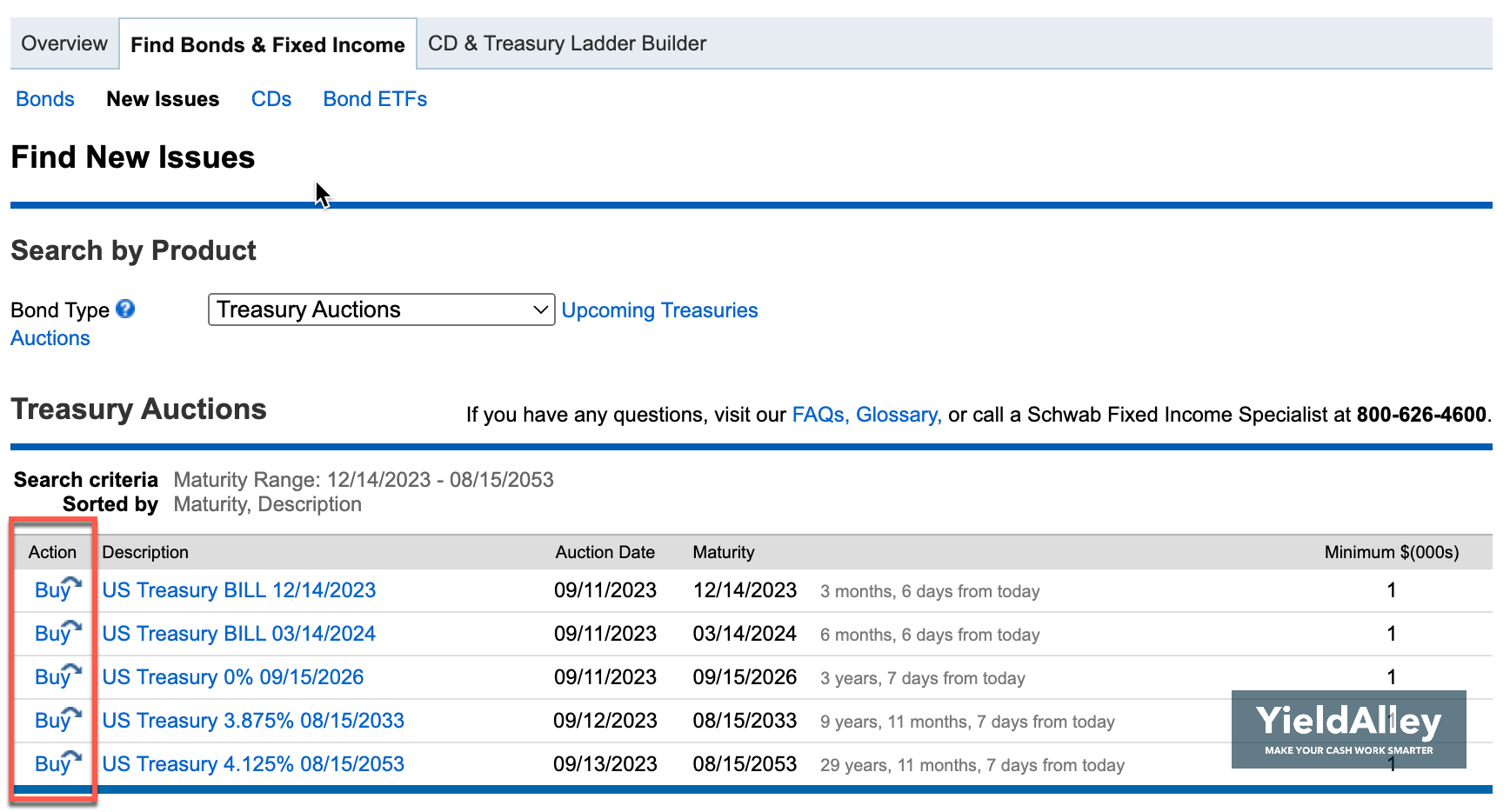

5. Select which Treasury bond you’d like to buy.

If you don’t see any Treasury bills in the list (or Treasury notes and Treasury bonds if those are what you’re looking for), check the U.S. Treasury auction schedule to see when the next auction is. Chances are, it will be within a few weeks.

You’ll see three dates: the announcement date, the auction date, and the settlement date.

The announcement date is when the new-issue Treasury bonds will appear for purchase. The auction date is when the order you placed will be filled. The settlement date is when the orders will settle in your account.

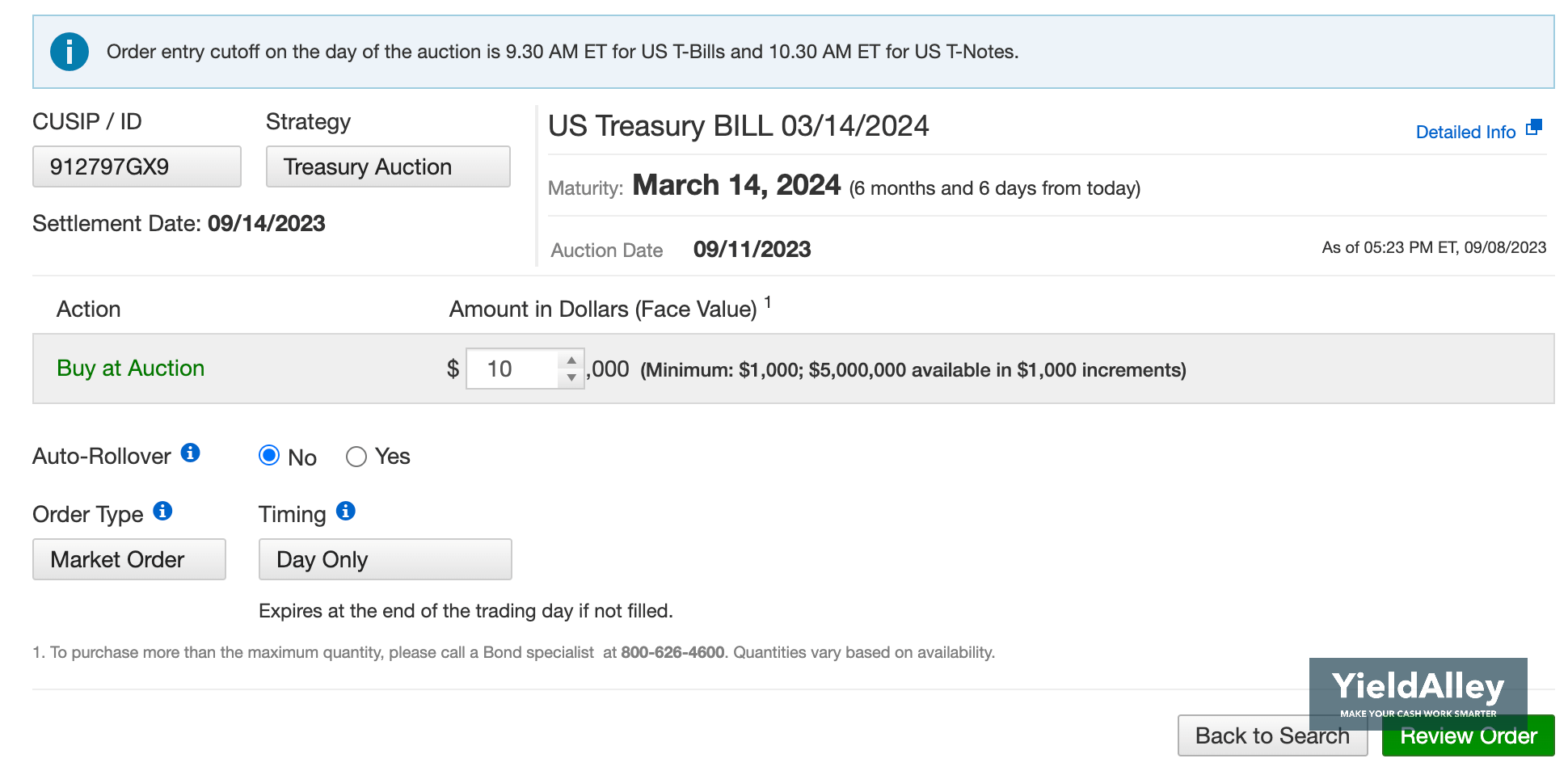

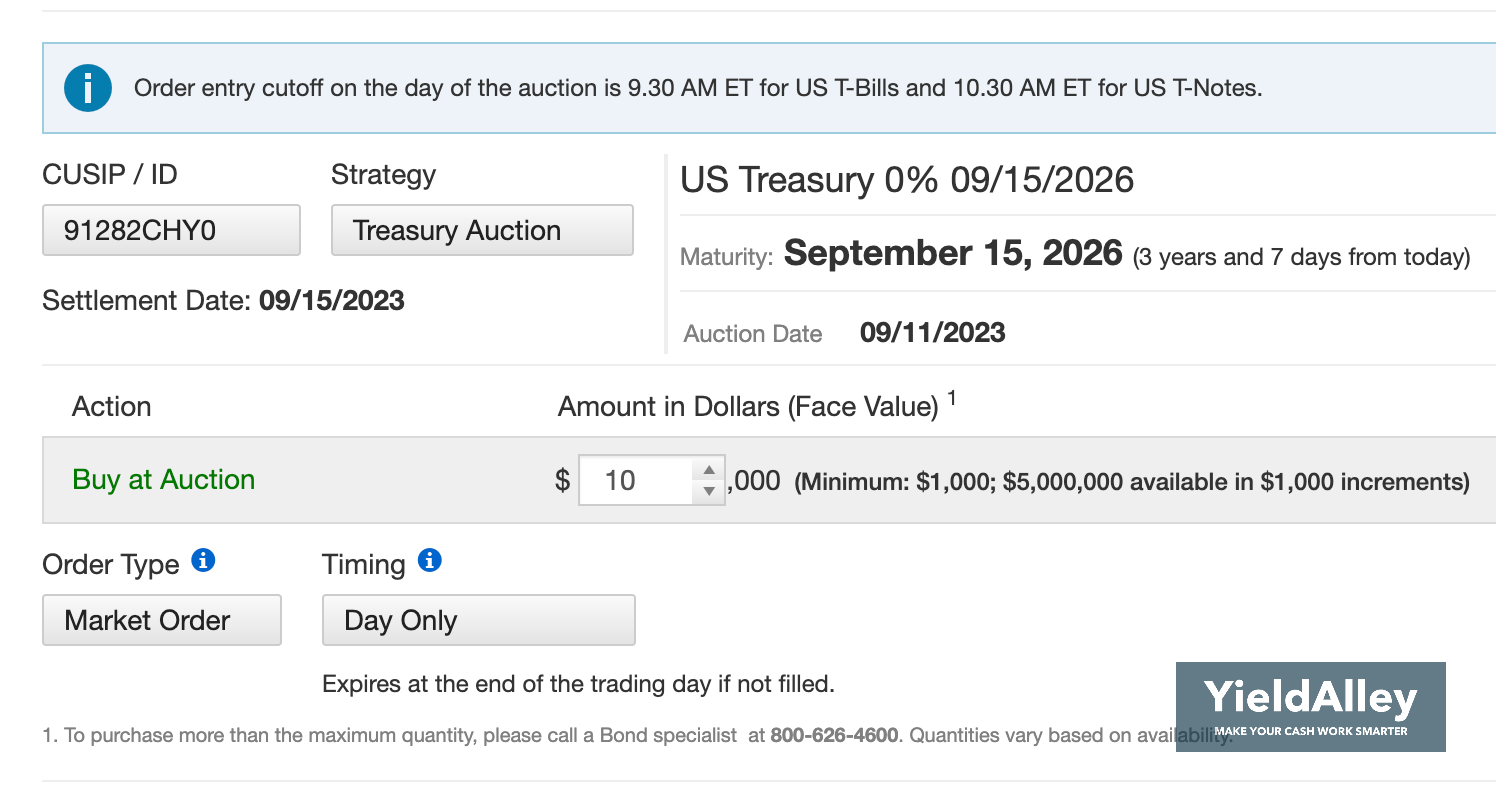

6. Preview your order and purchase your T-bill.

Be sure to place an order before the auction date, as the new-issue bonds will stop being offered on the auction date (when the orders are filled).

In the quantity field, enter how many Treasury bills you want to purchase. Remember that each bond has a face value of $1,000 and that you buy T-bills at a discount. A quantity of 1 means you will purchase a T-bill at a discount to the $1,000.

Schwab has an Auto Roll option for Treasury bills with less than 6-month maturities, so you can automatically buy another Treasury of the same term and the same amount when this Treasury matures.

As you can see below, this Treasury note with a maturity of 3 years does not offer an auto roll feature.

Congrats! You know now how to buy Treasury bills on Charles Schwab Schwab! With just a few button clicks, you now own Treasury bills directly backed by the U.S. government.

The Opportunity of Treasury Bill Yields

Treasury bills pay higher yields higher yields than most bank and savings accounts. When the Federal Reserve raised interest rates, most banks and credit unions weren’t incentivized to increase the rates they were paying on savings accounts and bank CDs. This lack of incentive is the same reason why we prefer brokered CDs over bank CDs, due to brokerages negotiating higher interest rates.

Due to Treasury bills being backed by the U.S. government, investors benefit from both extreme safety and higher yields. Treasury bills are one of the most popular options on Schwab to earn a yield on your cash.

How Much Money Do I Need to Buy a T-Bill?

The typical minimum order for a new-issue Treasury is $1,000 in face value when you buy it on Schwab.

You buy T-Bills at a discount to face value, meaning you’ll be paying less than $1,000 for each $1,000 bill. The interest you earn is the difference between what you pay for the T-bill versus the $1,000 you automatically receive at maturity.

What Happens When My T-Bills Mature on Schwab?

You don’t need to do anything when your T-Bills mature on Schwab. When a T-Bill matures on Schwab, you receive the total face value of the bill, which is $1,000 per bill. You bought it at a discount before, so the difference between what you paid and the face value of the T-Bill is the interest you’ve earned.

Schwab will automatically credit your account with the principal amount.

What Kind of Taxes Do I Pay on Schwab?

The interest you earn from Treasury bills is subject to federal income taxes. The interest income is exempt from state and local tax. Interest earned from Treasuries are not taxed as capital gains. You’ll only pay capital gains taxes if you sell your Treasury bill before the maturity date for more than what you paid for it. You have a capital loss if you sell it for less than what you paid.

Your brokerage typically sends you the necessary tax forms after the year ends.

Does Schwab Charge a Fee to Buy Treasury Bills?

Schwab does not charge a fee for purchasing new-issue T-Bills. If you need the help of a Schwab representative, there is a flat rate of $25 per transaction. Because of that fee, we recommend you follow our step-by-step guide on how to buy Treasuries online to avoid this significant fee.

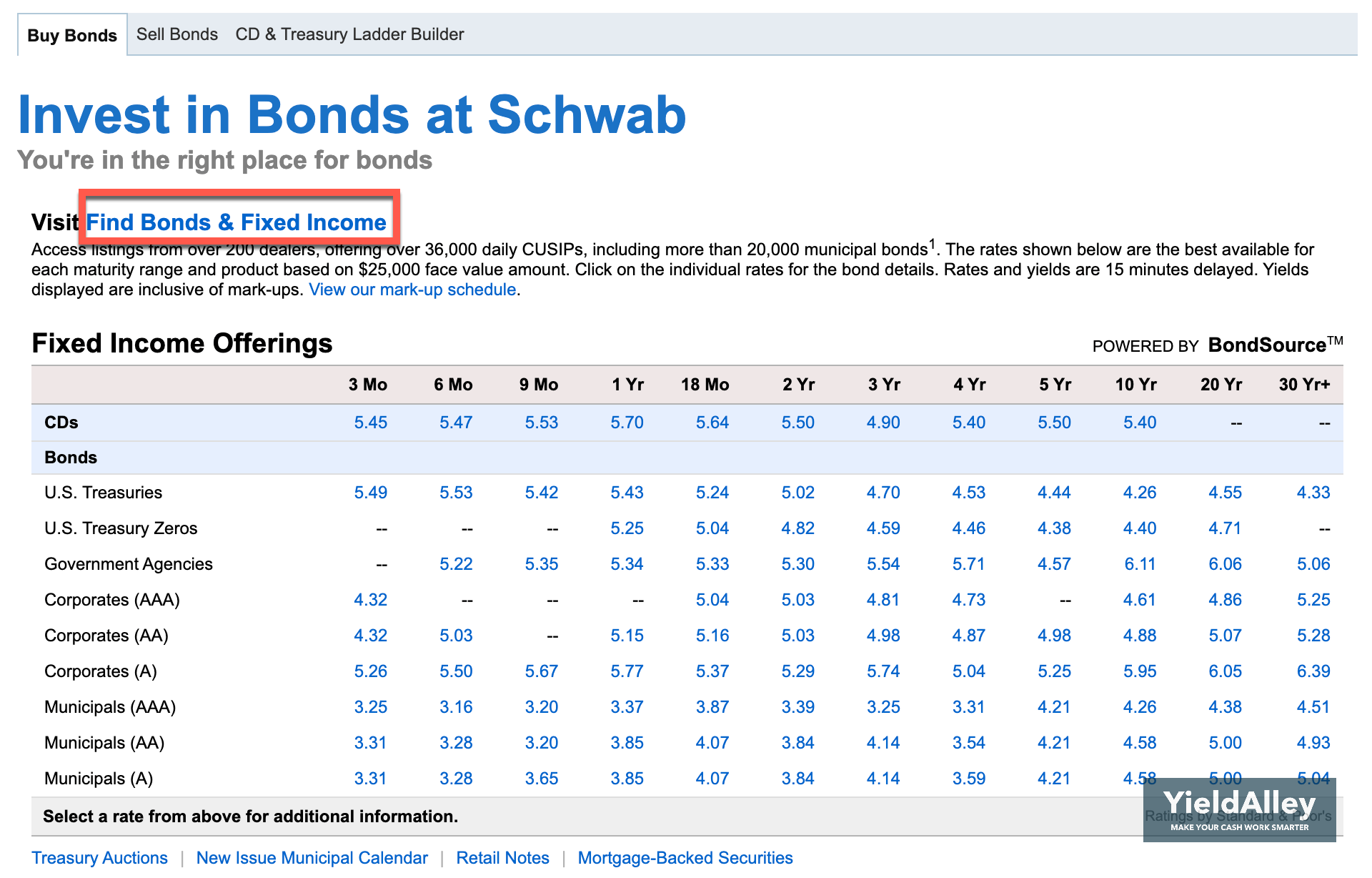

What are Schwab’s Treasury Bill Rates?

Charles Schwab Treasury bill rates are on their Bonds, CDs, and Fixed Income Investments.

This page shows the 3-month, 6-month, 9-month, and 1-year Schwab Treasury bill rates, as well as the rates for Treasury notes and Treasury bonds.

Are Treasury Bills Cash Equivalents?

Treasury bills are considered cash equivalents in your investment portfolio. They have some advantages when compared to savings accounts. Treasury bills are low-risk investments backed by the U.S. government, making them a safe choice for investors. They also offer higher yields compared to most savings accounts, providing the potential for higher returns on your investment.

Does Charles Schwab Offer T-Bill Funds?

Charles Schwab offers various money market funds that hold short-term, liquid investments. These include Treasury bills, notes, and bonds as a diversified portfolio of low-risk assets.

Schwab offers SNSXX (Schwab U.S. Treasury Money Fund – Investor Shares), which is a fund that only holds Treasuries. The fund’s portfolio comprises exclusively Treasury bills, notes, and bonds. Since this fund only holds Treasuries, there are no state and local taxes on the interest.

Other government and treasury money market funds offered by Schwab include:

- Schwab Government Money Fund – Investor Shares (SNVXX)

- Schwab Treasury Obligations Money Fund – Investor Shares (SNOXX)

SNVXX holds more mortgage debt, while SNOXX holds more short-term Treasuries. In addition, both hold repurchase agreements backed by Treasury bonds and agency bonds. These are not directly backed by the full faith of the U.S. government, and the interest income is also not exempt from state and local taxes.

Is It Easy to Create a T-Bill Ladder on Schwab?

Creating a T-Bill ladder on Schwab is straightforward and can provide you with a flexible investment strategy. A T-Bill ladder strategy involves buying a series of Treasury Bills with staggered maturities. By doing this, you can maximize T-Bill returns while maintaining liquidity.

A T-Bill ladder is more flexible than a ladder with CDs or other bonds. T-Bills have shorter maturities, allowing you to reinvest or access funds more frequently. Additionally, T-Bills are highly liquid and can be easily sold through any broker.

To create a T-Bill ladder on Schwab, you can start by logging into your account and selecting the “Bonds” selection in the ‘Trade’ menu. Search for “CD & Treasury Ladder Builder” which will direct you to Schwab’s convenient tool to build a ladder easily. By carefully selecting T-Bills with different maturity dates, you can optimize your returns while maintaining liquidity.

Should I Buy T-Bills on Charles Schwab?

Buying Treasury bills on Charles Schwab is a straightforward process that can be done online. Charles Schwab is a safe and highly reputable broker, and Schwab will ensure you get the best yield during the Treasury auction. Schwab also provides the benefit of accessing the secondary market, and the Treasury bill market is one of the most liquid in the world.

With a low minimum investment, tax exemption, and guaranteed liquidity, Treasury bills offer Schwab investors a compelling option for those looking to park their cash in an interest-bearing investment.