Treasury bills currently offer an attractive yield opportunity of over 5%. Investors benefit from these Treasuries by obtaining risk-free yield and guaranteed repayment by the U.S. government. In this step-by-step guide, we’ll show you how to buy Treasury bills on E*Trade.

How to Buy Treasury Bills on E*Trade: A Step-by-Step Guide

Now that you understand some of the details of Treasury bills, log in to your E*Trade account and follow these step-by-step instructions on how to buy Treasury bills on E*Trade.

1. Log into your E*Trade account.

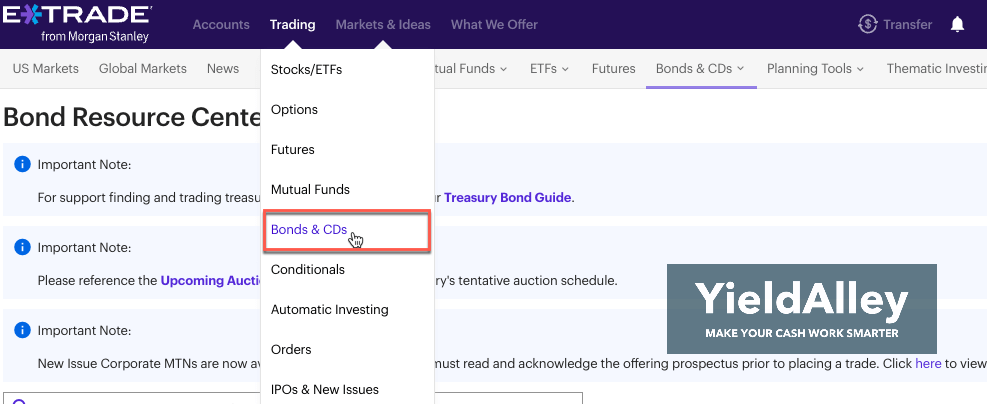

2. Click “Bonds & CDs” under the “Trading” tab.

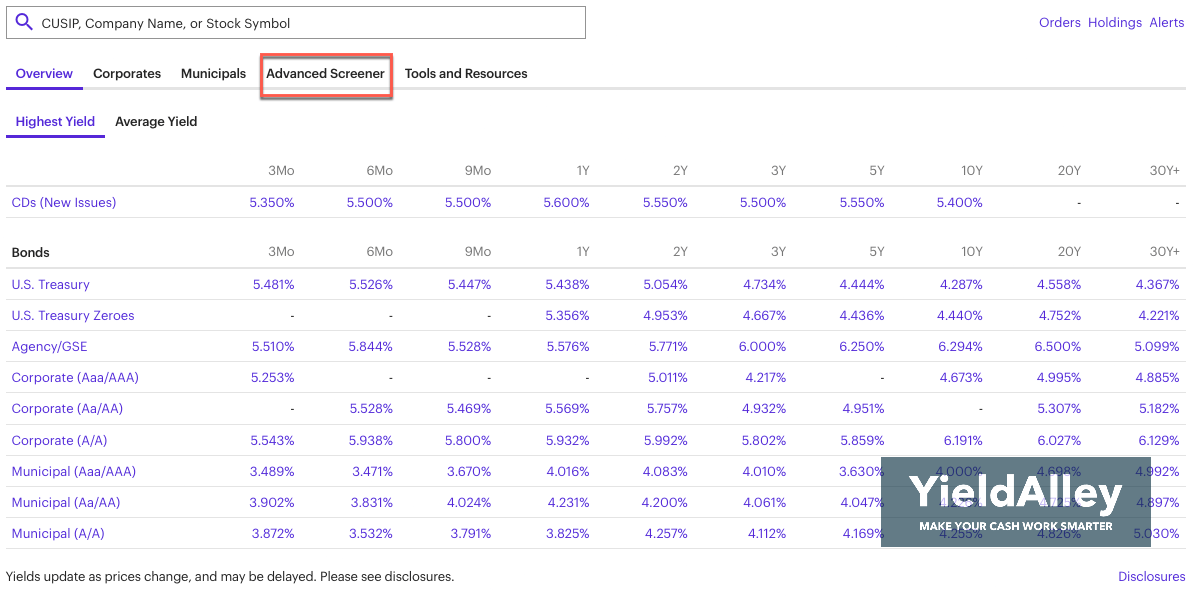

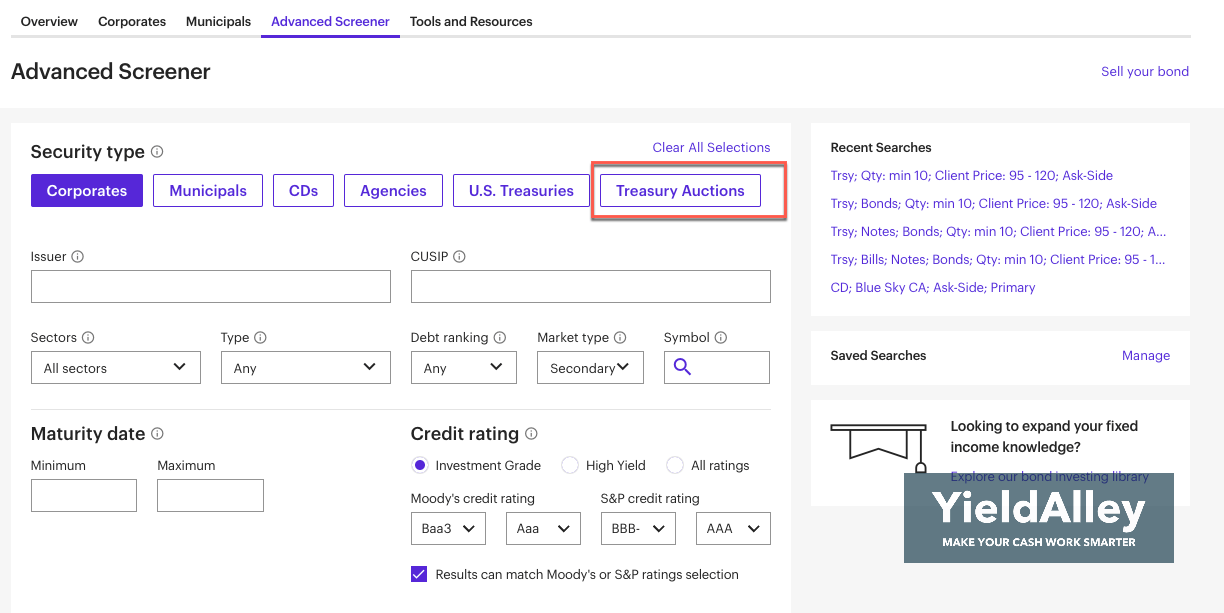

3. On the “Bonds & CDs” page, click “Advanced Screener” and then “Treasury Auctions”.

Ignore the percentages and links you see in the U.S. Treasury row, which will bring you to the secondary market page for U.S. Treasuries on E*Trade.

Since we want to buy new issue U.S. Treasuries for no fees and not pay a bid-ask spread, let’s access E*Trade’s Treasury Auctions page.

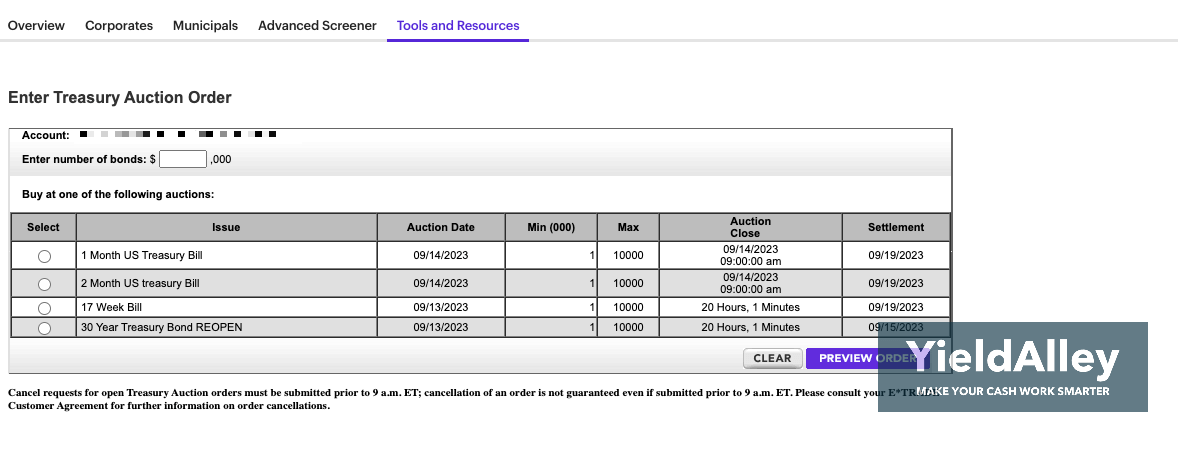

4. See the list of new-issue Treasury products, and preview your order.

This is E*Trade’s full list of new-issue Treasuries that you can purchase.

Check the U.S. Treasury auction schedule to see when the next auction is for the Treasury bond you wish to buy.

In the quantity field, enter how many Treasury bills you want to purchase. Remember that each bond has a face value of $1,000 and that you buy T-bills at a discount. A quantity of 1 means you will purchase a T-bill at a discount to the $1,000.

Congrats! You know now how to buy Treasury bills on E*Trade!

Why Should I Learn How to Buy Treasury Bills On E*Trade?

People invest in T-Bills to earn a safe and reliable yield on their cash. Treasury bills are considered one of the safest investments available, backed by the full faith and credit of the U.S. government. Not only do they offer higher yields compared to bank CDs and savings accounts, but they also provide a level of security for risk-averse investors.

The process of buying Treasuries has become increasingly convenient and accessible. With the rise of online brokerage accounts like E*Trade, investors can now easily purchase Treasury bills and other government securities with just a few clicks.

How Much Money Do I Need to Buy a T-Bill?

The minimum investment for a new-issue Treasury is $1,000 in face value when you buy it on E*Trade.

When you buy a T-Bill, you buy the T-Bill at a discount to face value, meaning you’ll be paying less than $1,000 for each $1,000 bill. The interest you earn is the difference between what you pay for the T-bill versus the $1,000 you automatically receive at maturity.

What Happens When My T-Bills Mature on E*Trade?

No action is required on your part when your T-Bills mature on E*Trade. When a T-Bill matures on E*Trade, you receive the total face value of the bill, which is $1,000 per bill. The difference between what you paid for the discounted T-Bill and the face value of the T-Bill is the interest you’ve earned.

E*Trade will automatically credit your account with the principal amount.

What Kind of Taxes Do I Pay on E*Trade?

T-Bills have tax implications that you should be aware of. Here’s a walk-through of the tax implications of T-Bills:

- Interest Income: T-Bills earn interest income, which is subject to federal income tax. However, they are exempt from state and local income taxes. The interest income is taxable in the year it is received or when the T-Bill matures, whichever comes first.

- Taxable Interest: The interest earned on T-Bills is considered taxable interest, and it is reported on your federal income tax return. You will receive a Form 1099-INT from E*Trade will detail the amount of interest income earned.

- Tax Rates: The interest income from T-Bills is taxed at ordinary income tax rates, which means the tax rate depends on your income level. The more you earn, the higher your tax rate will be.

- State and Local Taxes: As mentioned earlier, T-Bill interest income is exempt from state and local income taxes. This can be advantageous for individuals residing in high-tax states, as they can avoid paying state income tax on this investment income.

- Capital Gains: When you sell or redeem T-Bills, any difference between the purchase price and the sale price is considered a capital gain or loss. However, T-Bills are typically sold at a discount to their face value, so the difference is treated as taxable interest rather than a capital gain. The tax treatment is the same as if you held the T-Bill until maturity.

E*Trade typically sends you the necessary tax forms after the year ends.

Does E*Trade Charge a Fee to Buy Treasury Bills?

E*Trade does not charge a fee for purchasing new-issue T-Bills. If you need the help of an E*Trade representative, they charge a flat rate of $25 per transaction. To avoid this expensive fee, we recommend you follow our guide on how to buy Treasury bills on E*Trade’s website online.

What are E*Trade’s Treasury Bill Rates?

E*Trade’s Treasury bill rates can be found on the Treasury auction page in step 3 of our guide above.

Are Treasury Bills Cash Equivalents?

Treasury bills are considered cash equivalents, which are highly liquid investments that can be converted to cash quickly. Treasury bills are low-risk investments backed by the U.S. government, making them a safe choice for investors. They also offer higher yields compared to most savings accounts, providing the potential for higher returns on your investment.

Compare this to brokered CDs, which are more illiquid and require you to hold them for a fixed duration. The tradeoff is that sometimes CDs will pay attractive interest rates. They’re also easily bought on E*Trade, but will not be as easy to sell as T-Bills.

Does E*Trade Offer T-Bill Funds?

E*Trade doesn’t have its own money market funds but offers funds such as VUSXX (Vanguard) Treasury Money Market Fund (VUSXX) from Vanguard and SPAXX (Fidelity Government Money Market Fund) by Fidelity.

VUSXX is comprised of 95% U.S. Treasury bills, and 5% other U.S. government obligations and repurchase agreements. Because VUSXX is a government money market fund, it’s required to have at least 99.5% of its total assets in cash, U.S. government securities, and/or repurchase agreements that are collateralized solely by U.S. government securities or cash. It’s one of the most conservative money market funds you can buy on E*Trade.

Is It Easy to Create a T-Bill Ladder on E*Trade?

Creating a T-Bill ladder on E*Trade is straightforward and can provide you with a flexible investment strategy. A T-Bill ladder strategy involves buying a series of Treasury Bills with staggered maturities. By doing this, you can maximize T-Bill returns while maintaining liquidity.

On E*Trade, to easily build a bond ladder, go to E*Trade’s Bond Ladder Builder. You can get to this page by clicking “Tools and Resources” in Step 3 of our guide instead of clicking “Advanced Screener”. There, you should see a link to the bond ladder builder.

A T-Bill ladder is a much more flexible ladder strategy utilizing Treasuries instead of a ladder comprised of investments like CDs or other long-term bonds. T-Bills have shorter maturities than brokered CDs, allowing you to reinvest or access funds more frequently. Additionally, T-Bills are one of the most liquid investments in the world.

Should I Buy T-Bills on E*Trade?

Treasury bills offer a compelling investment option for those looking for a stable and reliable investment and can be easily bought on E*Trade. Additionally, E*Trade has access to the secondary market to buy and sell Treasury bills before they mature. E*Trade also provides other cash investments to earn a yield on its platform.