Treasury bills are one of the most appealing opportunities to earn extra yield in the market today, Customers of Merrill Edge and Merrill Lynch can easily buy secondary Treasury bills using the online platform. New issue Treasury bills can be purchased on the phone with a Merrill representative. In this article, we’ll walk through how to buy Treasury bills online from Merrill’s secondary market.

How to Buy Treasury Bills on Merrill Edge: A Step-by-Step Guide

With Merrill Edge’s online platform, you can only buy secondary Treasuries. New-issue Treasuries must be purchased on the phone with a Merrill Edge representative. This guide will cover how to purchase Treasury bills on Merrill Edge’s online platform.

1. Log into your Merrill Edge account.

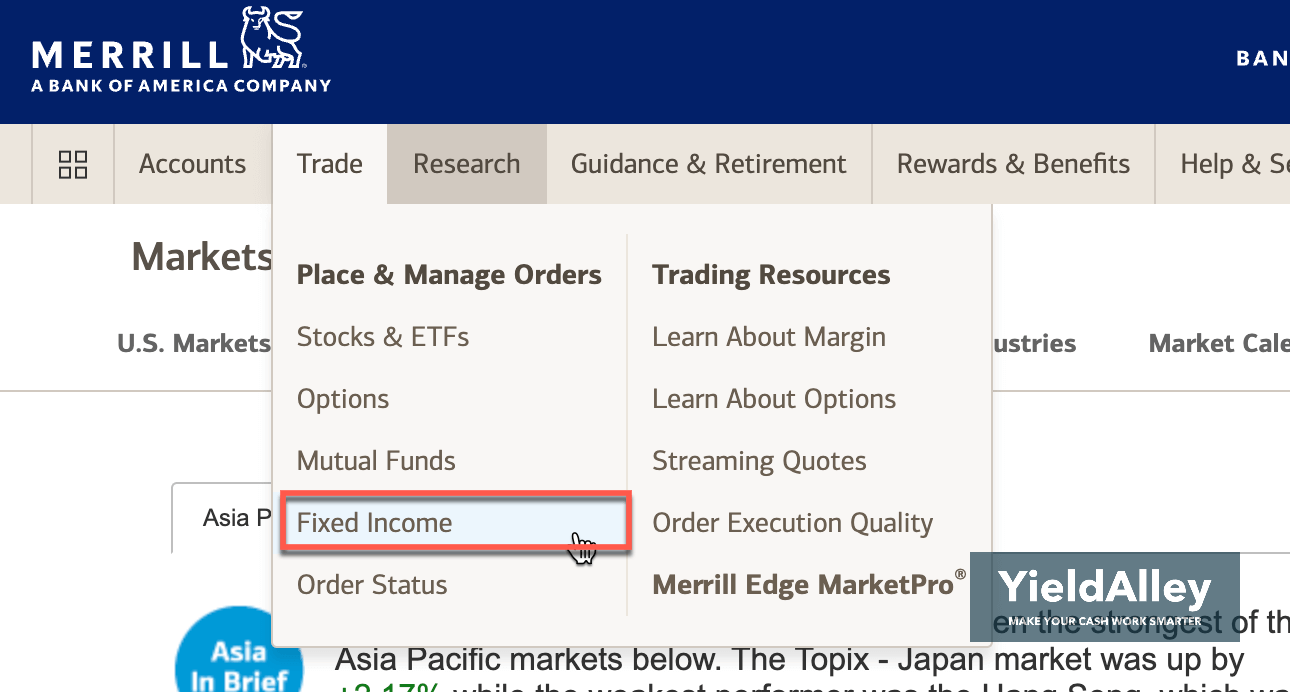

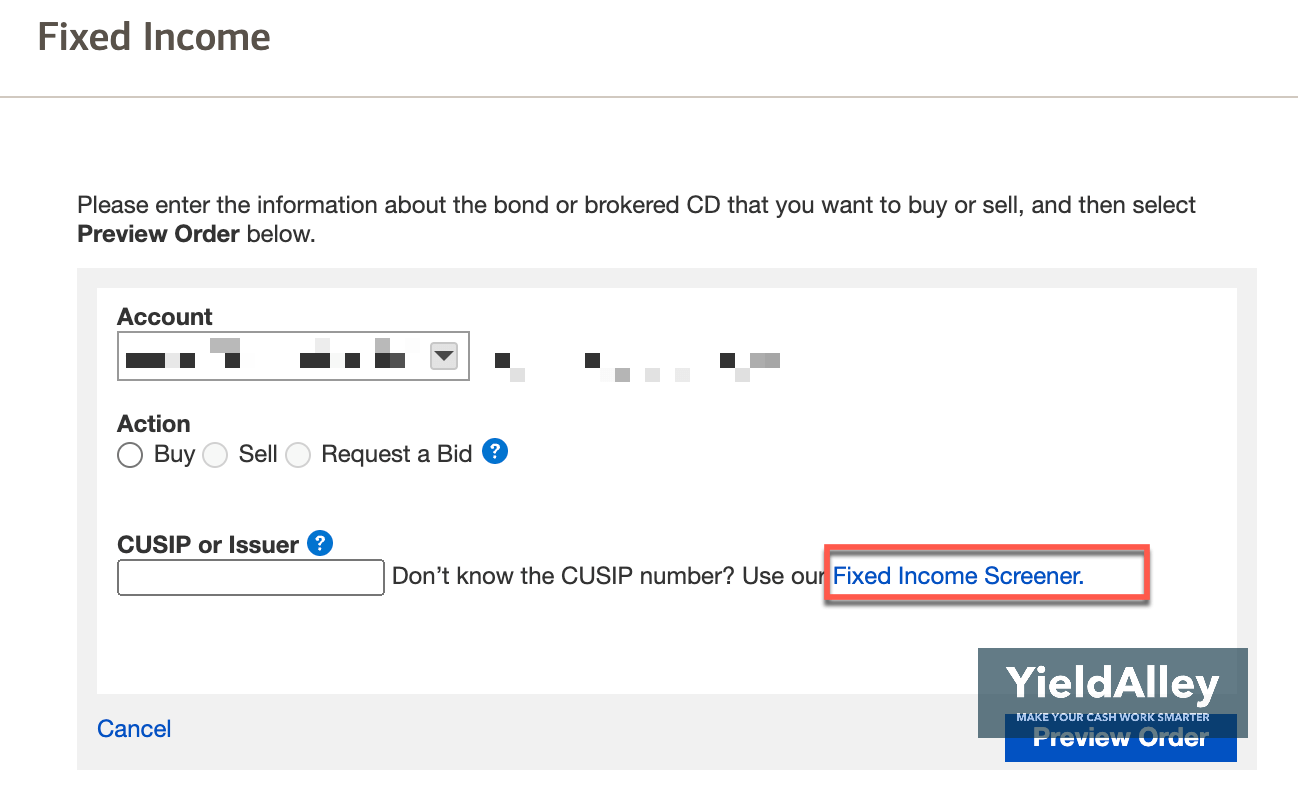

2. Click “Fixed Income” under the “Trade” tab and navigate to the “Fixed Income Screener”.

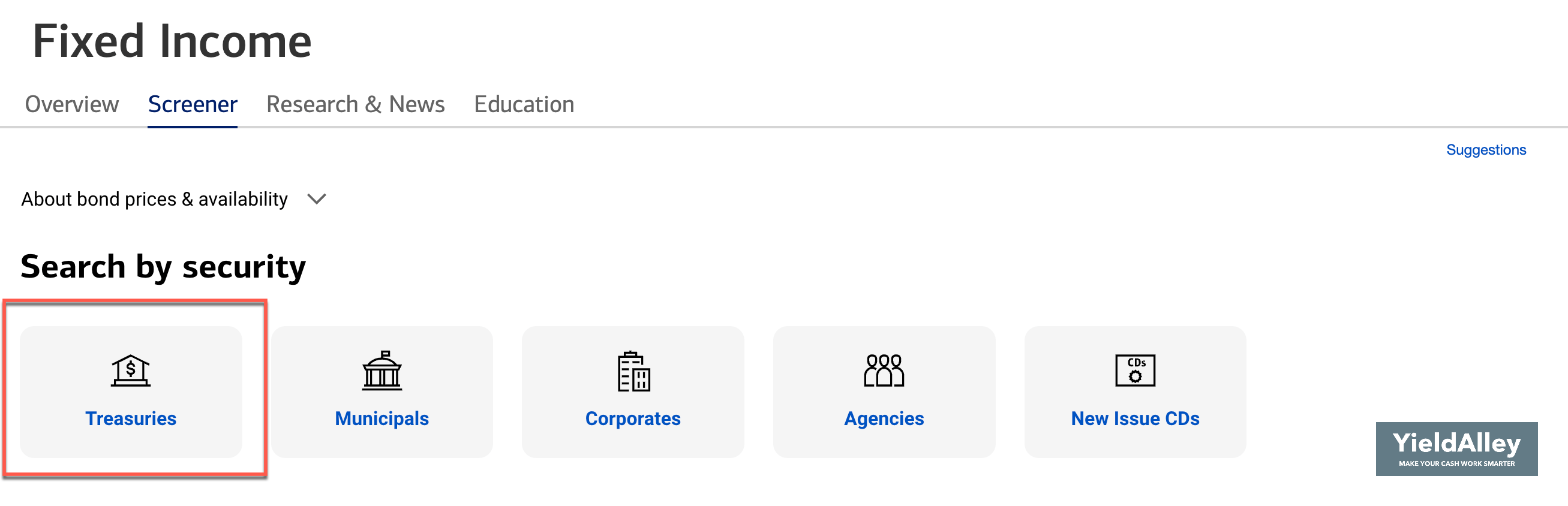

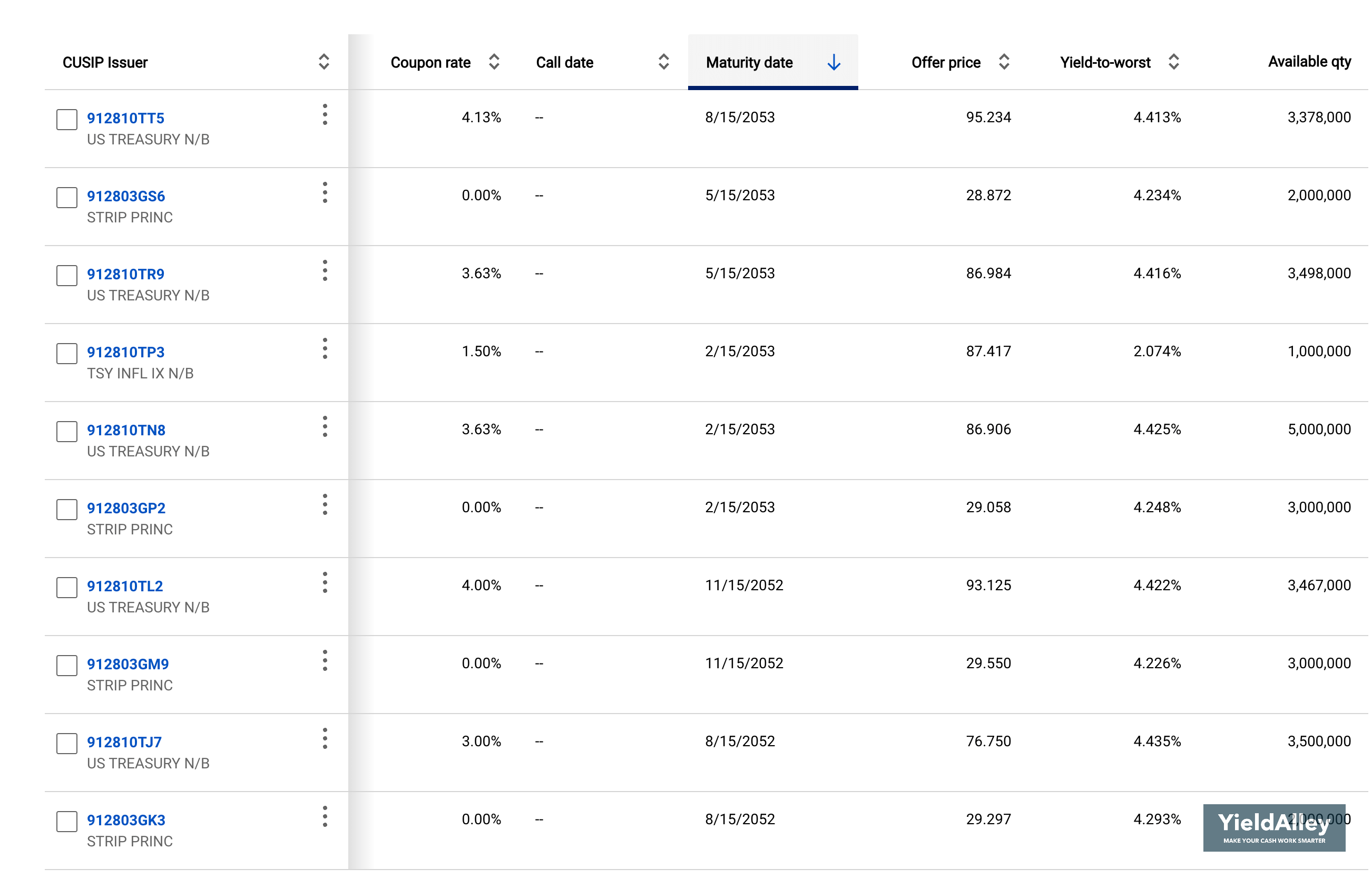

3. Click “Treasuries” to navigate to Merrill’s list of Treasuries. Filter for your preference appropriately.

Clicking Treasuries will direct you to the full list of Treasuries on Merrill’s platform.

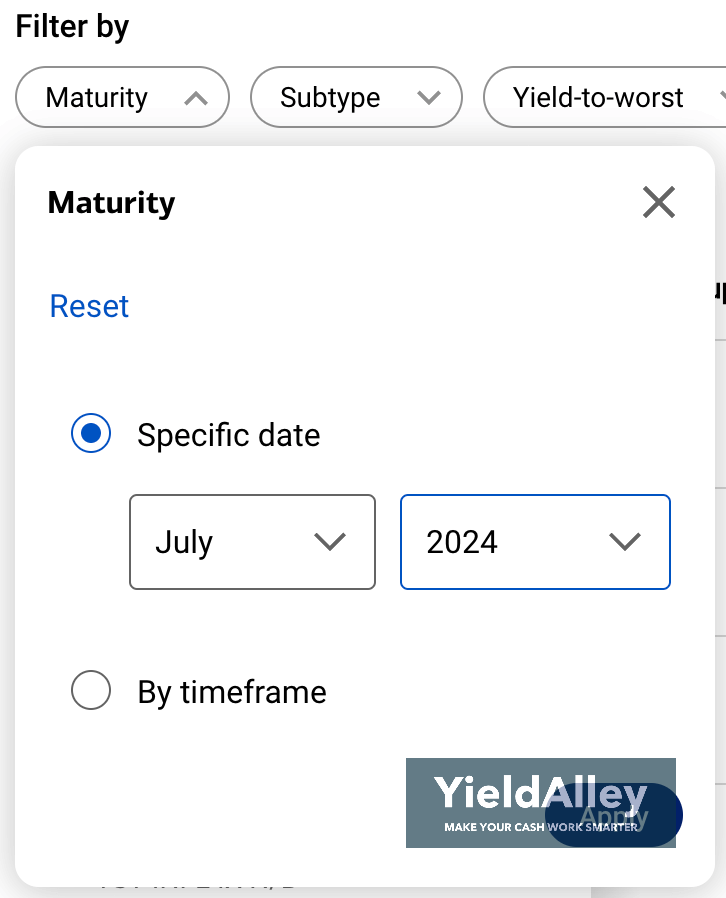

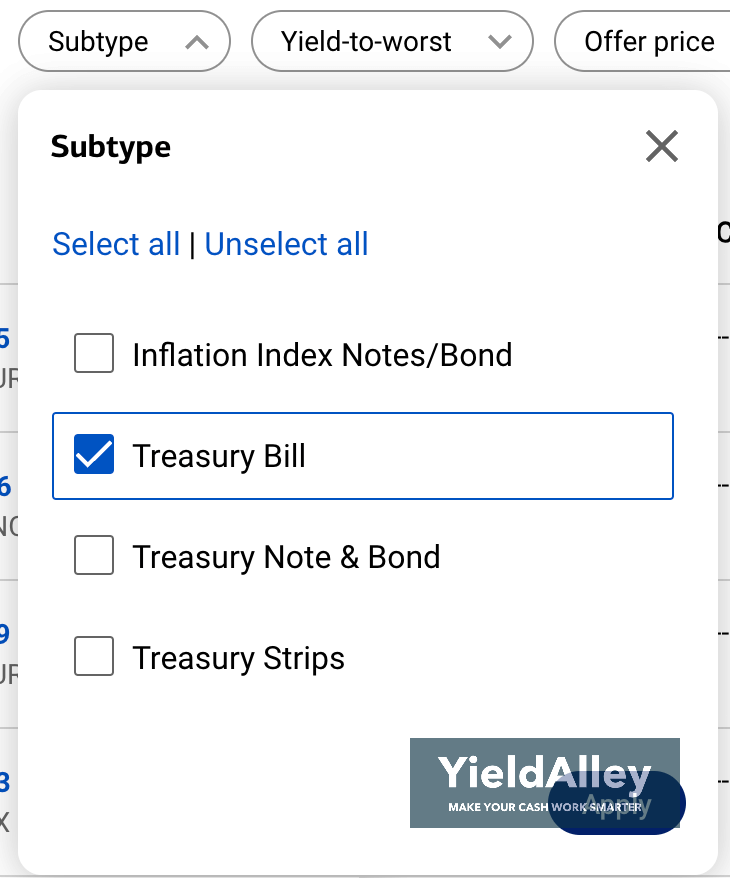

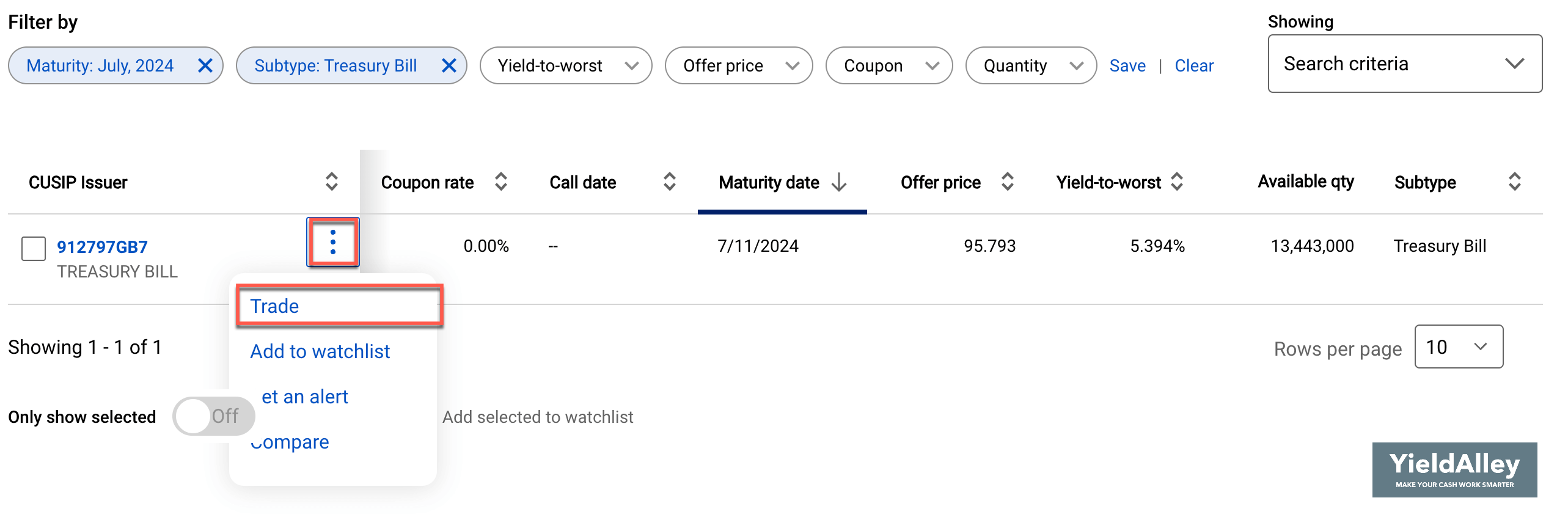

If you’d like to filter for a Treasury with a specific maturity, say a T-Bill that expires in July 2024, you can do so with the Maturity and Subtype filters in the top drop-down menus.

4. To buy a T-Bill, click on the three dots next to the name of the Treasury and click “Trade”.

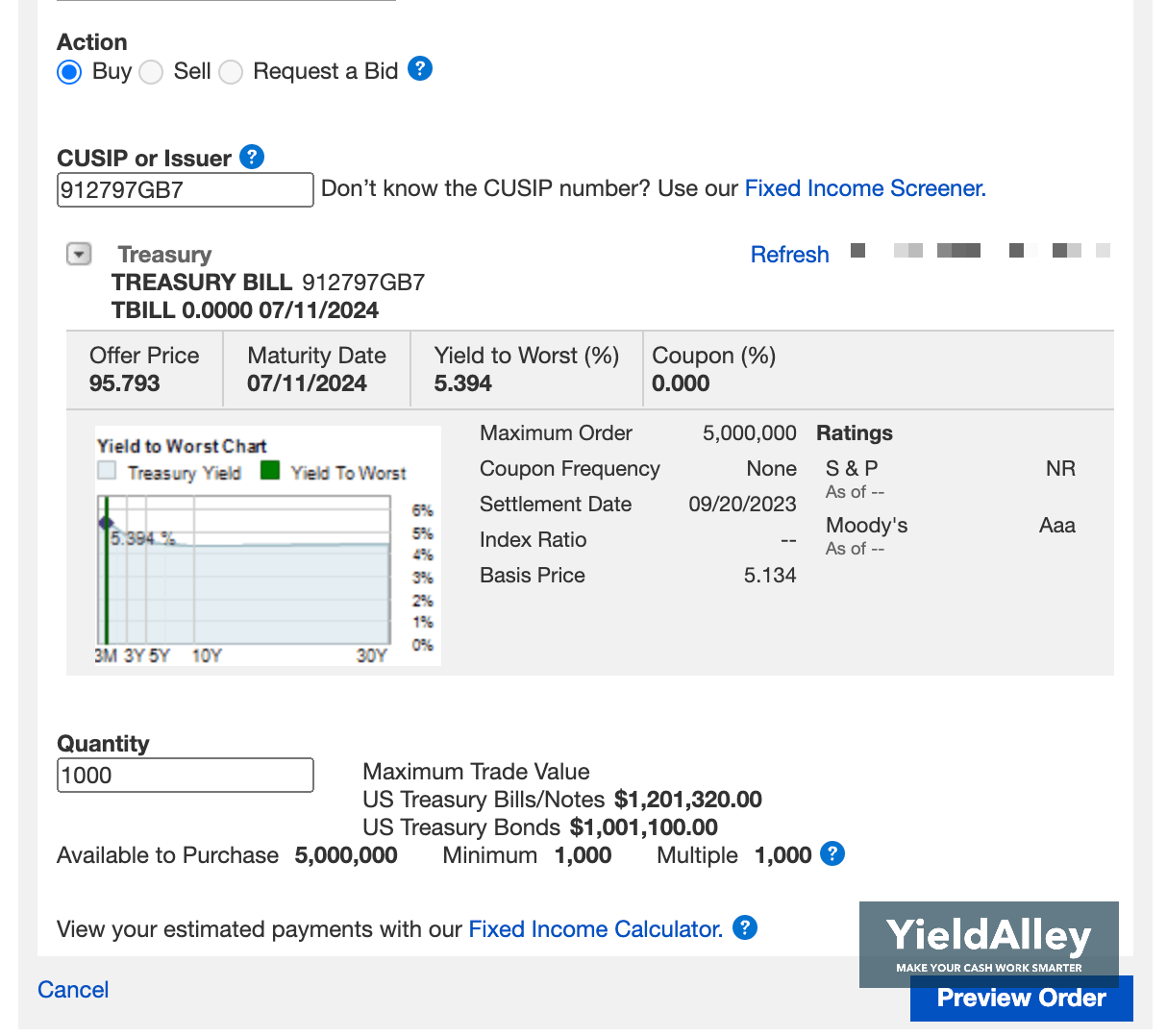

5. Enter the amount you wish to buy, then preview your T-Bill order before purchasing!

In the quantity field, enter the dollar ($) amount of T-Bills you wish to buy. For Treasury bills, there is a minimum purchase amount of $1,000, and in multiples of $1,000.

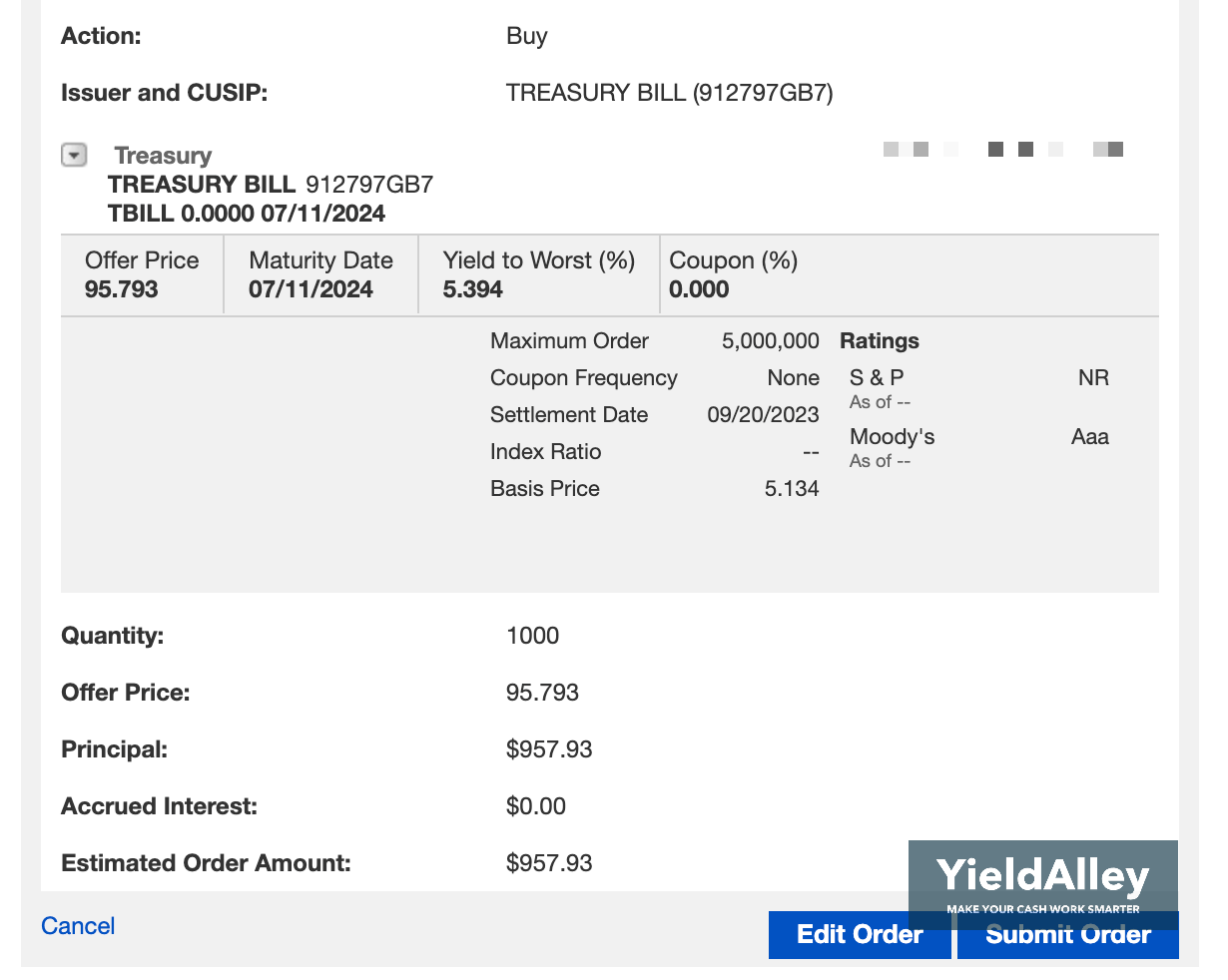

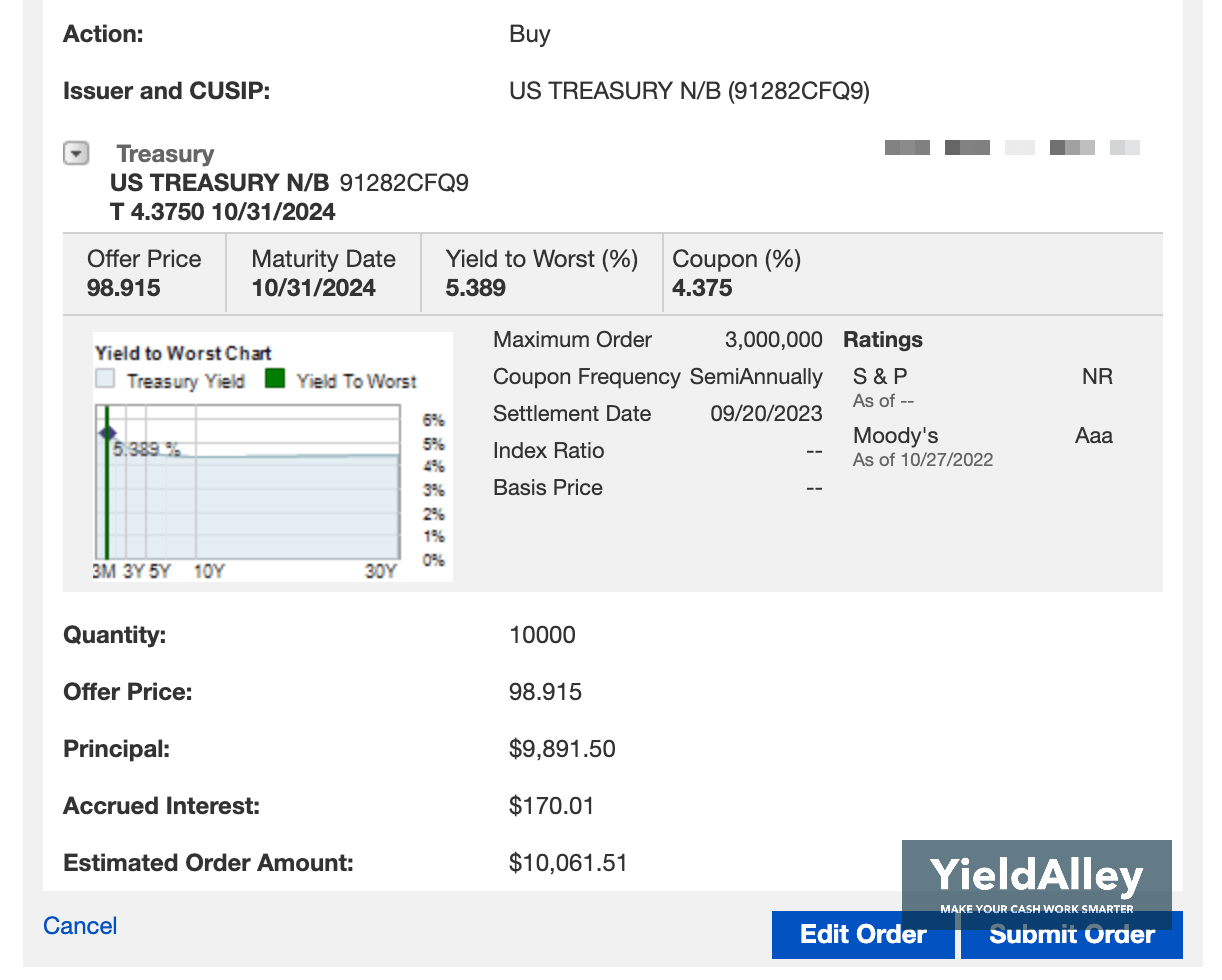

When you’re ready, preview your order and review the final details before purchasing.

A side note: because you can only buy secondary Treasuries on Merrill’s online platform, there is accrued interest associated with purchases of Treasury notes and Treasury bonds. This is essentially the interest you’re paying to the previous owner of the note or bond.

Congrats! You know now how to buy Treasury bills on Merrill Edge!

The Appeal of Treasury Bill Yields Today

Compared to traditional bank CDs and savings accounts, which offer investors little to no interest, Treasury bills offer yields of over 5%. Investors and savers looking for a safe and consistent way to grow their savings can take advantage of Treasury bills. Because the U.S. government guarantees repayment of Treasury bill investments, there is virtually zero risk in buying T-bills if you hold them to maturity.

With a brokerage account such as Merrill Edge or Merrill Lynch, it’s easy to buy these Treasury bills that earn a much higher return than your checkings of savings accounts.

How Much Money Do I Need to Buy a T-Bill?

Merrill Edge requires a minimum investment of $1,000 to buy a new-issue Treasury bill.

T-Bills are zero-coupon bonds that are sold at a discount. The interest you earn is the difference between what you paid for the T-Bill and the face value of $1,000 you receive upon maturity.

What Happens When My T-Bills Mature on Merrill Edge?

Merrill Edge will automatically credit your account with the face value of the T-Bill when it matures, which is $1,000 per bill. You won’t need to do anything to claim this amount — this amount will show up in your account automatically.

What Are the Tax Implications of T-Bills on Merrill Edge?

Interest earned from Treasury bills is subject to federal income taxes. Luckily, this interest income is exempt from state and local tax.

You will incur a capital gain if you sell your Treasury bill before maturity for more than what you paid for it. In such cases, you will be required to pay capital gain taxes. If you sell it for less than what you paid, you have a capital loss.

After the year ends, Merrill Edge will send you the necessary tax forms associated with your T-Bills and other investments on the brokerage.

Does Merrill Edge Charge a Fee to Buy Treasury Bills?

Merrill Edge does not provide the option to buy new-issue T-Bills online. Buying a new-issue T-Bill requires getting on the phone with a Merrill Edge representative.

Merrill Edge’s website quotes a $29.95 service charge for broker-assisted trades of Treasuries. However, we have independently verified that Merrill Edge will not charge you for broker-assisted phone trades of Treasuries.

We strongly encourage you to confirm with your Merrill Edge representative that there is no service charge for completing a purchase of new-issue T-Bills over the phone.

Merrill Edge also provides the option to buy T-Bills on the secondary market without a fee.

What are Merrill Edge’s Treasury Bill Rates?

Merrill Edge’s Treasury bill rates can be found on the Treasury auction page in steps 3 and 4 of our guide above. These are competitive with Merrill’s money market fund rates and the rates from Merrill’s CD selection.

Are Treasury Bills Cash Equivalents?

Yes, Treasury bills are considered cash equivalents. Treasury bills are highly liquid with a robust secondary market. This means that investors can easily sell Treasury bills on the secondary market to get access to cash. T-Bills are low-risk investments backed by the U.S. government, making them both a safe and flexible investment. Treasury bills currently offer much higher yields compared to most savings accounts, providing the potential for higher returns on your money.

Does Merrill Edge Offer T-Bill Funds?

Merrill Edge doesn’t have its own money market funds but offers funds from BlackRock, Federated Hermes, and Fidelity. These include:

- BlackRock Liquidity Funds: T-Fund (TSTXX)

- BlackRock Liquid Federal Trust Fund (TFFXX)

- BlackRock BLF Treasury Trust Fund (TTTXX)

- Federated Hermes Government Obligations Fund — Premier Class (GOFXXG)

- Fidelity Investments Money Market Treasury Only Portfolio (FSIXX)

Merrill offers these funds with no minimum investment, and they invest the vast majority (sometimes close to 99%) of the fund’s assets in U.S. Treasury bills and other Treasury securities.

How Easy Is It to Create a T-Bill Ladder on Merrill Edge?

Building a T-Bill ladder requires buying a series of T-Bills with different maturities. By doing this, you maximize T-Bill returns while maintaining liquidity. It’s straightforward to build a T-Bill ladder if you understand how to buy Treasury bills on Merrill Edge with various stagged maturities.

A T-Bill ladder with Treasuries offers some advantages versus ladders built with other securities such as long-term bonds or brokered CDs. T-Bills have shorter maturities, allowing you to reinvest or access funds more frequently. Additionally, T-Bills are highly liquid and can be easily sold on Merrill Edge’s secondary marketplace.

Should I Buy T-Bills on Merrill Edge?

Treasury bills are an attractive opportunity to earn low-risk yield while maintaining liquidity. Merrill Edge is a reputable online brokerage and provides multiple options to earn a yield on your cash beyond T-Bills. In fact, we highly recommend many Bank of America customers replace their bank with a Merrill Edge account, to earn more on their cash.

While buying new-issue Treasury bills on Merrill Edge requires getting on the phone with a representative, buying secondary Treasury bills online is a straightforward process if you follow our guide. Merrill does offer the ability to buy money market funds and brokered CDs using the online platform. If you’d like to buy new-issue Treasury bills online, you can accomplish this on other brokerages.