Treasury bills are one of the most attractive yield opportunities with annual yields over 5%. TD Ameritrade, which was bought by Charles Schwab in 2020, offers investors the ability to purchase Treasury bills on its online platforms. Treasuries are especially appealing to many investors given the extremely safe nature of the investment. In this guide, we’ll show you how to buy Treasury bills on TD Ameritrade.

How to Buy Treasury Bills on TD Ameritrade: A Step-by-Step Guide

Log in to your TD Ameritrade account and follow these step-by-step instructions on how to buy Treasury bills on TD Ameritrade.

1. Log into your TD Ameritrade account.

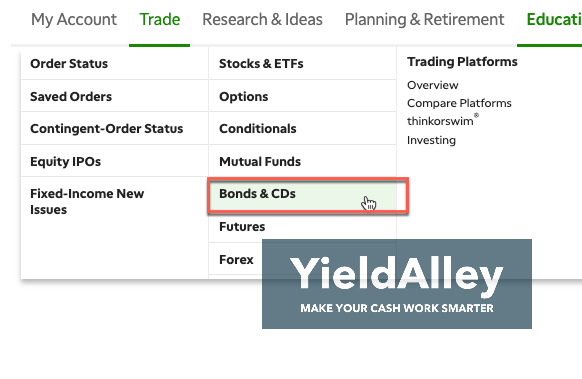

2. Click “Bonds & CDs” under the “Trade” tab.

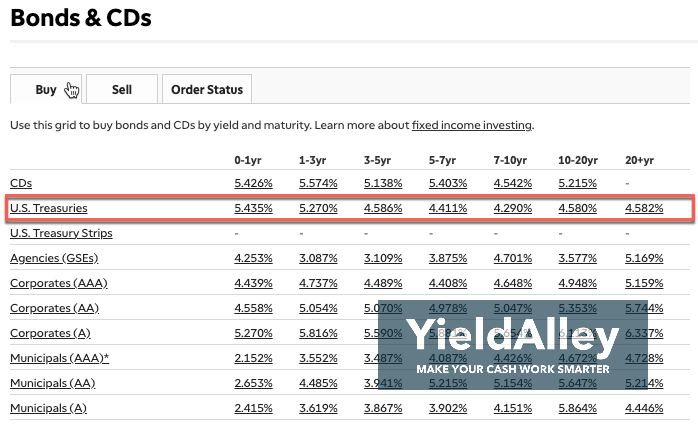

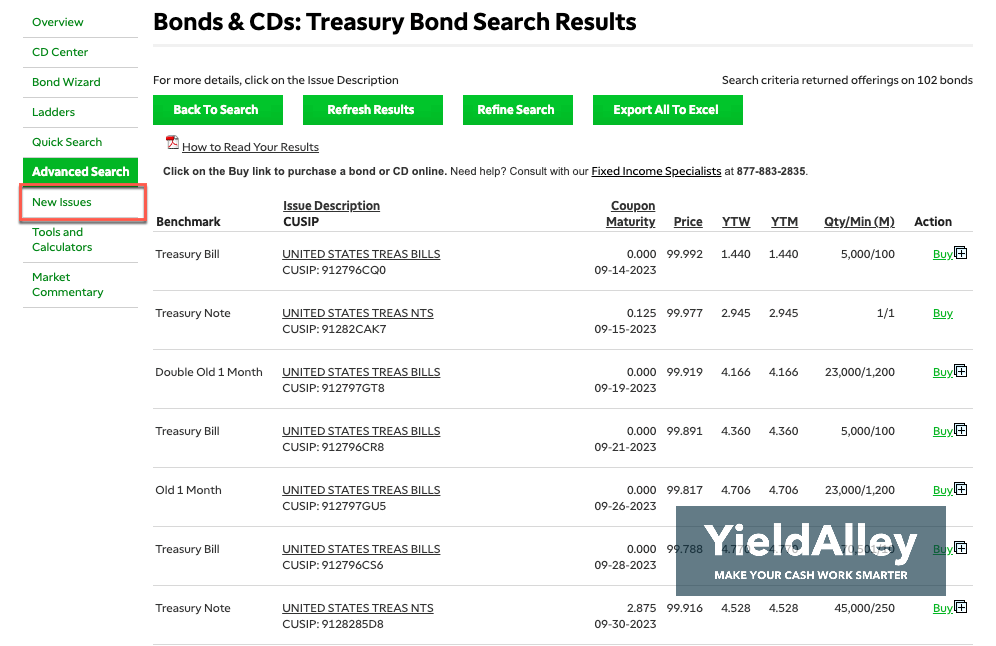

3. Click on any of the percentages in the U.S. Treasuries row.

4. Click “New Issues” in the left-hand column.

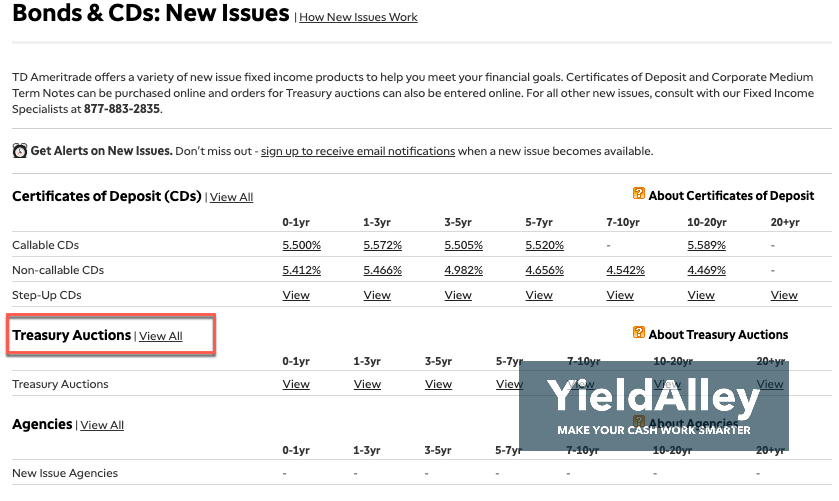

5. Next to “Treasury Auctions”, click “View All”

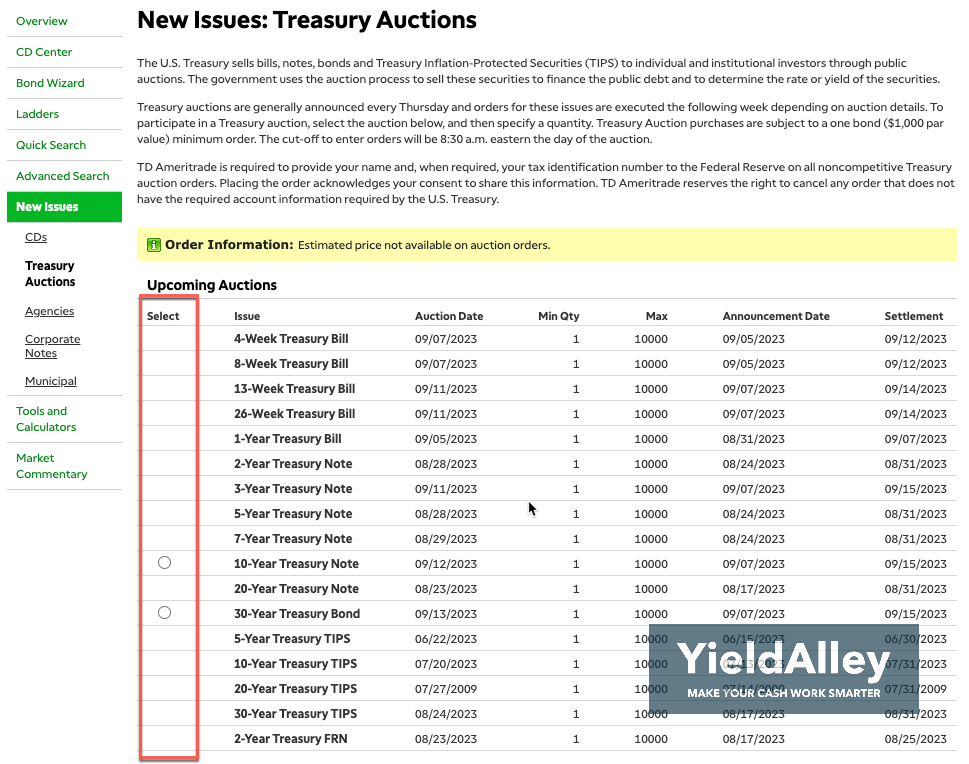

6. Select the Treasury bond you wish to buy.

If you don’t see any Treasury bills in the list available, check the U.S. Treasury auction schedule to see when the next auction is. TD Ameritrade does a helpful job of listing the auction dates for each Treasury.

You’ll see three dates: the announcement date, the auction date, and the settlement date.

The announcement date is when the new-issue Treasury bonds will appear for purchase. The auction date is when the order you placed will be filled. The settlement date is when the orders will settle in your account.

Be sure to place an order before the auction date, as the new-issue bonds will stop being offered on the auction date (when the orders are filled).

In the quantity field at the bottom of this page, enter how many Treasury bills you want to purchase. Remember that each bond has a face value of $1,000 and that you buy T-bills at a discount. A quantity of 1 means you will purchase a T-bill at a discount to the $1,000.

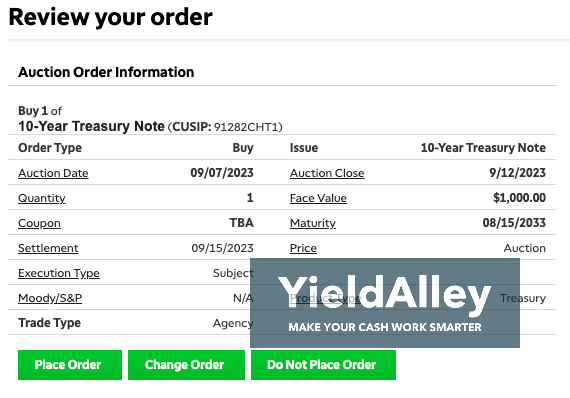

7. Review your order before purchasing.

TD Ameritrade does not offer an Auto Roll option, which is an option to automatically buy another Treasury of the same term and the same amount when this Treasury matures. An Auto Roll option is most often used with short-term Treasury Bills. This feature is unavailable in TD Ameritrade but can be found on Fidelity and Charles Schwab.

Congrats! You know now how to buy Treasury bills on TD Ameritrade!

The Opportunity of Treasury Bill Yields

Treasuries currently offer higher yields and better liquidity than traditional bank CDs and savings accounts. Many banks and credit unions were slow to react to increase the rates they were paying on savings accounts and bank CDs. Banks offer promotional rates that expire to take advantage of people not actively moving their money to higher-yielding instruments like Treasury bills.

With TD Ameritrade, you can easily purchase T-Bills and investments with competitive cash rates. We also recommend exploring the cash options on Schwab, which also offers Treasury bills.

How Much Money Do I Need to Buy a T-Bill?

The typical minimum order for a new-issue Treasury is $1,000 in face value when you buy it on TD Ameritrade.

When you buy a T-Bill, you buy the T-Bill at a discount to face value, meaning you’ll be paying less than $1,000 for each $1,000 bill. The interest you earn is the difference between what you pay for the T-bill versus the $1,000 you automatically receive at maturity.

What Happens When My T-Bills Mature on TD Ameritrade?

You don’t need to do anything when your T-Bills mature on TD Ameritrade. When a T-Bill matures on TD Ameritrade, you receive the total face value of the bill, which is $1,000 per bill. Since you buy T-Bills at a discount, the difference between what you paid and the face value of the T-Bill is the interest you’ve earned.

TD Ameritrade will automatically credit your account with the principal amount.

What Kind of Taxes Do I Pay on TD Ameritrade?

The interest you earn from Treasury bills is subject to federal income taxes. The interest income is exempt from state and local tax. Interest earned from Treasuries are not taxed as capital gains. The only time you’ll pay capital gains taxes is if you sell your Treasury bill before the maturity date for more than what you paid for it. If you sell it for less than what you paid, you have a capital loss.

Your brokerage typically sends you the necessary tax forms after the year ends.

Does TD Ameritrade Charge a Fee to Buy Treasury Bills?

TD Ameritrade does not charge a fee for purchasing new-issue T-Bills. If you need the help of a TD Ameritrade representative, there is a flat rate of $25 per transaction. Avoid this expensive fee by following our guide on how to buy Treasury bills on TD Ameritrade online!

What are TD Ameritrade’s Treasury Bill Rates?

TD Ameritrade’s Treasury bill rates can be found on the Treasury auction page in step 3 of our guide above, or in the full list of new-issue Treasuries shown in step 6.

These pages show the 3-month, 6-month, 9-month, 1-year Treasury bill rates, and more.

Are Treasury Bills Cash Equivalents?

Treasury bills are considered cash equivalents in your investment portfolio. They have some advantages when compared to savings accounts. Treasury bills are low-risk investments backed by the U.S. government, making them a safe choice for investors. They also offer higher yields than most savings accounts, providing the potential for higher returns on your investment.

Does TD Ameritrade Offer T-Bill Funds?

TD Ameritrade is now owned by Charles Schwab. As a result, TD Ameritrade’s money market funds are those offered by Charles Schwab.

Schwab offers SNSXX (Schwab U.S. Treasury Money Fund – Investor Shares), a fund that only holds Treasuries. The fund’s entire portfolio comprises various Treasury bills, notes, and bonds. Since this fund only holds Treasuries, there are no state and local taxes on the interest.

Other government and treasury money market funds offered by Schwab include:

- Schwab Government Money Fund – Investor Shares (SNVXX)

- Schwab Treasury Obligations Money Fund – Investor Shares (SNOXX)

SNVXX holds more mortgage debt, while SNOXX holds more short-term Treasuries. In addition, both hold repurchase agreements backed by Treasury bonds and agency bonds. These are not directly backed by the full faith of the U.S. Government, and the interest income is also not exempt from state and local taxes.

Is It Easy to Create a T-Bill Ladder on TD Ameritrade?

Creating a T-Bill ladder on TD Ameritrade is straightforward and can provide you with a flexible investment strategy. A T-Bill ladder strategy involves buying a series of Treasury Bills with staggered maturities. By doing this, you can maximize T-Bill returns while maintaining liquidity.

A T-Bill ladder is a more flexible strategy than ladders with securities such as long-term bonds or CDs. T-Bills have shorter maturities, allowing you to reinvest or access funds more frequently. Additionally, T-Bills are highly liquid. While you can use brokered CDs on TD Ameritrade to build a ladder, they’re less liquid than T-Bills.

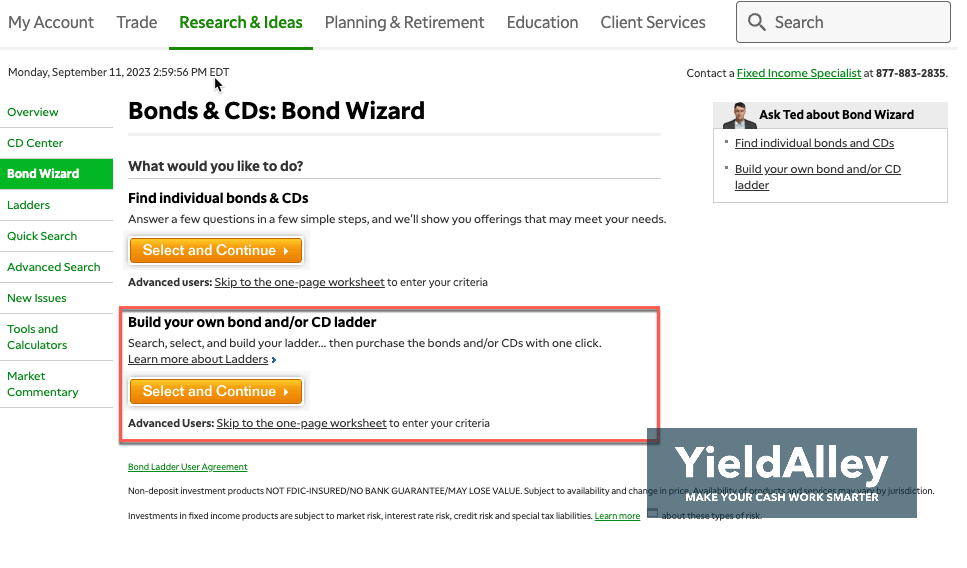

To create a T-Bill ladder on TD Ameritrade, you can start by logging into your account and selecting the “Bond & CD Wizard” option under the “Research & Ideas” tab. You can choose the ‘Fixed Income’ section and search for available Treasury Bills. By carefully selecting T-Bills with different maturity dates, you can optimize your returns while maintaining liquidity.

Should I Buy T-Bills on TD Ameritrade?

Treasury bills offer a compelling investment option for those looking for a stable and reliable investment. Buying on TD Ameritrade, a highly reputable broker owned by Charles Schwab, is a straightforward process that can be done online and the brokerage ensures you get the best yield during the Treasury auction. Using a brokerage like TD Ameritrade to buy T-Bills is a convenient and efficient way to buy and manage your Treasury bills alongside your other investments.