Bank of America (BofA) has 57 million users in the United States, approximately 18% of the national population. Unfortunately, most of these customers earn Bank of America’s infamously low annual percentage yield (APY) of 0.01%. If all 57 million customers had an average bank account size of $8,000, the median savings account balance in the U.S., they’d collectively lose out on $23 billion in interest income by not employing the strategies in this article.

In this article, we will walk you through how to hack together and create your own personal high-yield savings account with Bank of America to earn an APY of up to 5.50% on your cash and have liquidity whenever you want. The key? Utilizing Merrill Edge, the self-directed brokerage platform that Bank of America owns.

Bank of America Interest Rates Are Infamously Low

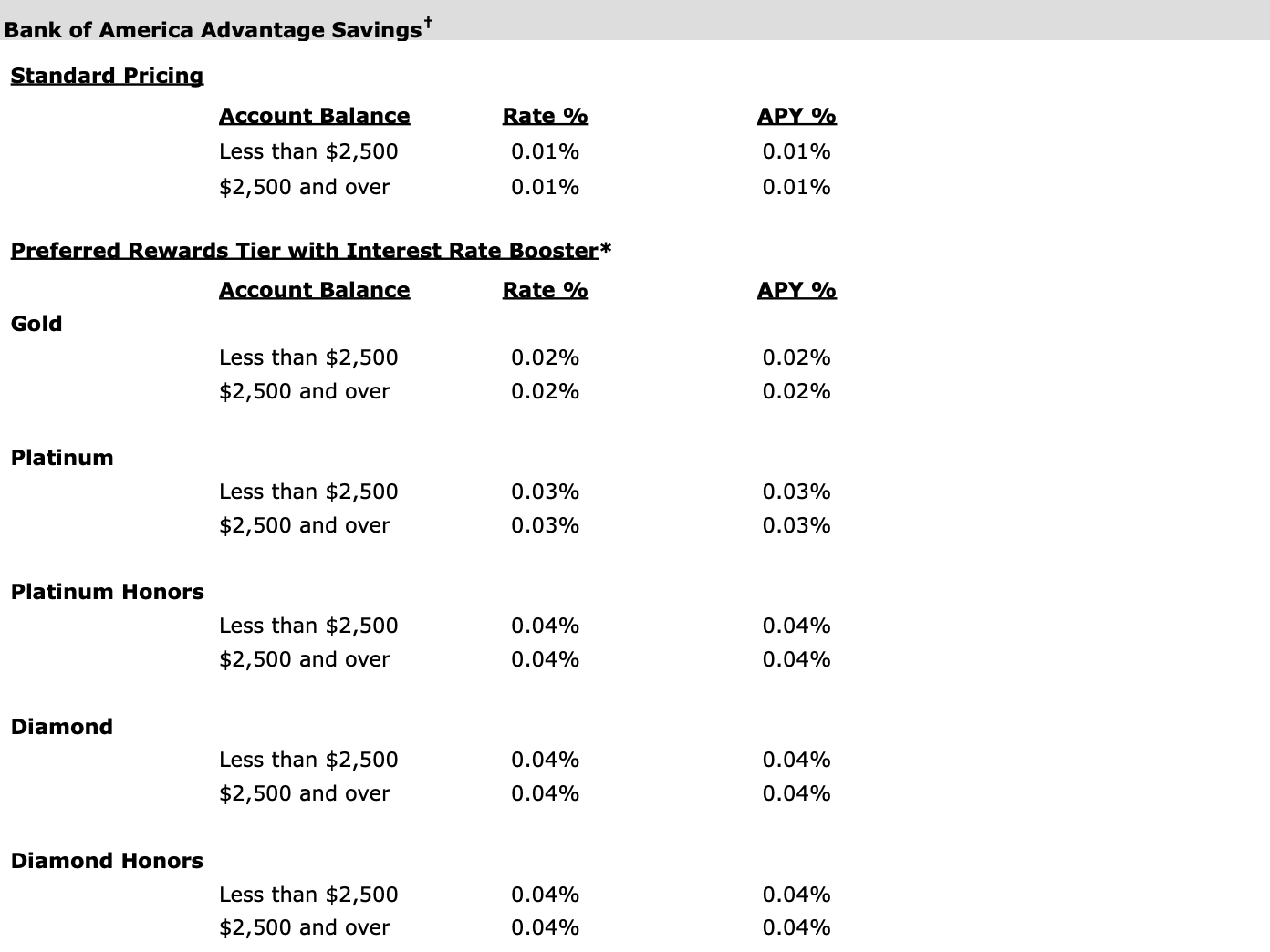

There’s no skimping around it. Bank of America pays an APY of 0.01%, well below the national savings rate of 0.58% (still very low).

Bank of America has no incentive to pay more interest than they need on your checking or savings account. It may be painful to hear, but the main reason is because they don’t have to. As long as loyal customers continue to bank with Bank of America regardless of the low APY, the bank will be content to keep interest rates low.

Why Doesn’t Bank of America Have a High-Yield Savings Account?

Most major banks offer “free” products and features that allow customers to use their online platforms, ATMs, and credit cards for free. Their business model is to earn revenue from the cash we deposit.

Banks take your deposits to buy extremely cash investments, such as U.S. Treasury Bills, which currently pay up to 5.40%. Whatever the difference between the yield that they pay you gets pocketed by Bank of America.

In recent years, many online banks have popped up to compete with Bank of America by offering a high-yield savings account that pays an APY of around 4.50%. Online banks can do this because they (1) have lower overhead than Bank of America’s physical brick-and-mortar branches and (2) want to acquire customers from Bank of America.

Why Stick with Bank of America When the Rates Are So Low?

There are multiple reasons why so many people stick with Bank of America instead of switching banks to get a better APY. You may fall into one of the following buckets:

- You didn’t know you could earn higher interest elsewhere.

- You don’t want to go through the hassle and friction of opening a new bank account and transferring cash.

- You don’t believe you have enough money to merit earning a higher APY.

- You want to take advantage of Bank of America’s extremely favorable credit cashback since you’re a higher Preferred Rewards tier customer.

Here is our response to each reason:

- Using your Bank of America account, we will teach you how to earn higher interest. There is no need to open a new account.

- See response 1 above.

- With our strategies, there should be no reason to take advantage of passive income with higher APYs.

- This generally requires a minimum of $100k. If this is you, we have a trick to earn significantly more yield on the $100k in your Bank of America account.

Increase Your Savings Rates With a Merrill Edge Account

Bank of America acquired Merrill Lynch in January 2009 after the financial crisis of 2007-2008 and became the new owner of Merrill Lynch’s wealth management business.

In 2010, Bank of America launched Merrill Edge, which provides a self-directed brokerage for individuals. Merrill Edge was launched to compete with Charles Schwab and Fidelity and offers investment products from stocks, bonds, ETFs, mutual funds, and more for zero commissions.

Cash transfers between Bank of America and Merrill Edge are instant and free.

Because of the merger between Bank of America and Merrill Lynch, cash transfers between a Bank of America bank account and a Merrill Edge brokerage account are instant and free. This means any Bank of America customer can effectively treat a Merrill Edge account as a bank replacement and earn a much higher savings rate than Bank of America’s standard 0.01% APY.

The strategy to create your own high-yield savings account with Bank of America is as follows:

Move any uninvested cash or emergency funds from your Bank of America account into a Merrill Edge self-directed brokerage to buy high-yielding, high-liquidity, and extremely low-risk cash investments on Merrill Edge. This should be cash that you don’t expect to use in the short to mid-term but would like to be on standby for any emergency expenses. If you need this cash for whatever reasons, the investments can be liquidated in 1-2 business days and can be immediately transferred back to Bank of America for free.

More advanced users can replace your Bank of America checking account with this strategy. You would move money from your checking account to Merrill Edge and buy the same low-risk cash investments. When it comes time to pay any monthly bills or expenses, liquidate your cash investments at least three days before the payment date. You can either pay your bills directly from your Merrill Edge account or instantly transfer your cash from your Merrill Edge back to your Bank of America checking account. While this may seem tedious, it’s the difference between earning over 5% APY and 0.01%, a 500x difference in income.

There are a few methods to earn a higher rate by using Merrill Edge. We’ll walk through each one in detail.

- Merrill Edge Preferred Deposit

- Merrill Edge brokered CDs

- Merrill Edge money market funds

- Merrill Edge cash investments such as ETFs and Treasury bills

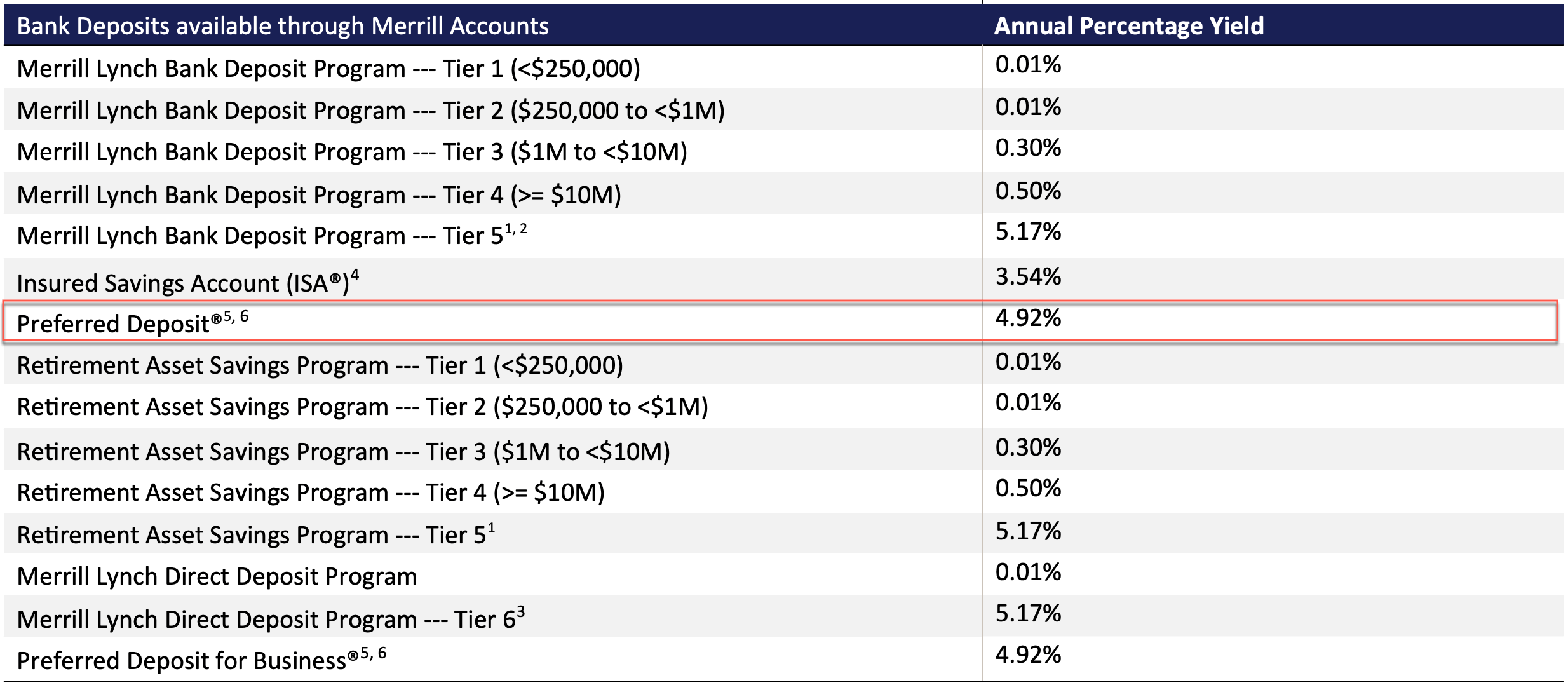

Merrill Edge Preferred Deposit

The Merrill Edge Preferred Deposit is an account that pays an annual percentage yield of 4.92%. There is a $100,000 minimum opening deposit, although you can go below a $100,000 balance at any time and still earn the Preferred Deposit APY.

Afterward, deposits can be made in whole dollar amounts of $1,000 or more and withdrawals in any whole dollar amount by calling a Merrill Lynch financial advisor.

While the APY is higher than most high-yield savings account rates, we don’t suggest this route given the large minimum deposit and complexity of deposit and withdrawals.

Merrill Edge Brokered CDs

Brokered CDs on Merrill Edge offer some of the highest savings rates right now. If you’re familiar with Bank of America CDs, brokered CDs are simply bank CDs sold on a brokerage like Merrill Edge.

The benefits of buying a brokered CD on Merrill Edge instead of using a Bank of America CD are many:

- You will get higher rates. The highest-yielding brokered CD on Merrill Edge currently pays a 5.30% APY. The highest APY that a Bank of America CD offers is 4.75%.

- You have more options. With a Merrill Edge brokered CD, you can buy CDs from various banks, instead of being limited to just a Bank of America bank CD.

- You have more liquidity. Brokered CDs are traded in the market. If you need access to cash and wish to sell your brokered CD before maturity, you can do this on Merrill Edge’s platform. On the other hand, ordinary Bank of America CDs typically come with early withdrawal penalties. Bank of America Flexible CDs, which offers one free withdrawal per month, only pays a 3.51% APY.

- You get the same FDIC insurance. Almost all brokered CDs offered by Merrill Edge are FDIC-insured. If you buy two brokered CDs from two different banks, you get insurance up to $500,000 ($250,000 per bank per depositor).

Merrill Edge brokered CDs are a solid option for those who want to lock in a guaranteed return over a fixed time. If you are confident you won’t need the cash during the length of the CD, consider a Merrill Edge brokered CD over a Bank of America CD. You get more yield, with more liquidity and the same insurance.

Merrill Edge Money Market Funds

Merrill Edge also offers a variety of money market funds. Money market funds are mutual funds that hold extremely low-risk investments such as Treasury bills and other extremely high-quality short-term debt. The U.S. government has strict guidelines for money market funds and what investments they can hold, and these investments are considered extremely safe and low-risk.

While Fidelity and Vanguard are known for their money market funds, Merrill Edge offers money market funds from multiple fund managers, primarily BlackRock, Federated Hermes, and Fidelity.

Merrill Edge money market funds have a few unique characteristics to consider:

- Merrill Edge offers many institutional money market funds with no minimum investment. Some of these funds would ordinarily require a $3,000,000 minimum deposit, but on Merrill Edge, anyone can buy them for no minimum investment.

- Merrill Edge money market funds are much more liquid than brokered CDs and settle in one business day when sold. While it’s possible to sell your brokered CD on the secondary market, the CD market isn’t as liquid as the money market fund one.

- Some government money market funds benefit from state tax exemption. If you live in a high-tax state such as California or New York, up to 100% of your money market fund income could be exempt from state taxes. Income from savings accounts and CDs don’t enjoy this benefit.

We have compiled a full list of money market fund rates on Merrill Edge for you to compare. While the yields can be lower than brokered CDs, they make up for it in more liquidity. With money market funds, you are earning a rate that surpasses Bank of America’s savings account rate of 0.01% and Merrill Lynch Preferred Deposit’s APY of 4.92%.

Ultra Short-Term Bond ETFs on Merrill Edge Might Be Your Best Bet

Now we get to our favorite investment that can replace your Bank of America savings account: the ultra short-term bond ETF.

These short-term ETFs are similar to money market funds, but pay a much higher yield due to more efficient fund management. Our favorite type of ultra short-term bond ETF is the floating rate note ETF, and the two ETFs to consider here are:

- USFR (WisdomTree Floating Rate Treasury Fund)

- TFLO (iShares Treasury Floating Rate Bond ETF).

We enjoy these ETFs for the following reasons:

- They pay the highest yields we’ve seen. As of the time of this writing, USFR pays a 30-day SEC yield of 5.37% and TFLO pays 5.40%. This is higher than any Bank of America product, any Merrill Lynch account savings rate, and any Merrill Edge brokered CD or money market fund.

- These ETFs benefit from a state tax exemption similar to Merrill Edge government money market funds. Both had state tax exemptions of 99.9% in 2023.

- They are also extremely liquid. ETFs currently have a settlement period of 2 business days after being sold. In May 2024, all securities including ETFs will have a settlement of one day. This makes the settlement time for ETFs no different than that of money market funds.

In a nutshell, these ETFs pay the highest low-risk rate, benefit from a state tax exemption, and are also extremely liquid. When bought on Merrill Edge, they trump any other product offered across the Bank of America, Merrill Lynch, and Merrill Edge universe. No other cash investment comes close to USFR or TFLO in terms of yield, flexibility, and liquidity.

Tying it All Together to Earn Higher Yields on Bank of America

Now you have all the pieces of the puzzle to get the highest interest rates from Bank of America. You should earn well over 5% APY on your cash instead of the measly 0.01% that Bank of America offers. Let’s recap and walk through a hypothetical example.

Imagine you have $50,000 in a Bank of America savings account and would like to keep this cash on standby for a large purchase 6 months from now.

You could do the following:

- Open a Merrill Edge self-directed brokerage account.

- Transfer $50,000 from your Bank of America savings account to your Merrill Edge account.

- You buy $50,000 worth of USFR or TFLO (there is no difference between the two) and begin earning state tax-exempt dividend income every month. Every month, you’re earning over $200 in passive income instead of 40 cents, the difference between a 5.40% APY instead of 0.01%.

- On month 6, you decide to purchase a $20,000 car. With a down payment of 20%, you fork out over $4,000. But you’ve made enough passive income from USFR or TFLO in 6 months, over $1,300, to cover 30% of the car’s down payment!

This is the power of earning the highest returns on your cash investments. Without using the strategies we outlined, most Bank of America customers earn a whopping $5 annually on a $50,000 balance, instead of over $2,500! Imagine paying off a new iPhone or computer with just passive income on your cash balance.

While Bank of America doesn’t offer high savings rates or even a high-yield savings account, we can hack together our own workaround to earn high yields by utilizing Merrill Edge and the instant cash transfers between our Merrill and Bank of America accounts.

Everything in our strategy is free and uses the tools provided to us by Bank of America and Merrill Edge. Many people are unaware of the strategy we’ve outlined here or are unwilling to go through it. But remember, you could be earning 500x more on your cash by following the steps above! That’s a huge difference.