PNC Bank is one of the most popular and largest banks in the United States. With a presence in over 27 states, PNC customers use the bank for many services, from standard savings and checking accounts to high-yield savings accounts.

While PNC Bank’s high-yield savings account offers an interest rate of 4.65% APY today for select customers, its typical savings account pays a measly 0.01%. In this article, we’ll show you how to increase your PNC Bank savings rate to over 5% APY by buying extremely low-risk high-yielding cash investments with PNC Investments, PNC’s self-directed brokerage account.

The State of PNC Savings Accounts Today

PNC Bank’s ordinary savings rates are among the industry’s lowest. Rates will depend on where you live, so our research analyzed rates for the Pennsylvania market where most PNC Bank customers live. PNC Bank pays up to a 1.25% APY, but generally, PNC Bank’s savings rates range from 0.01% to 0.03%. Yes, it’s low!

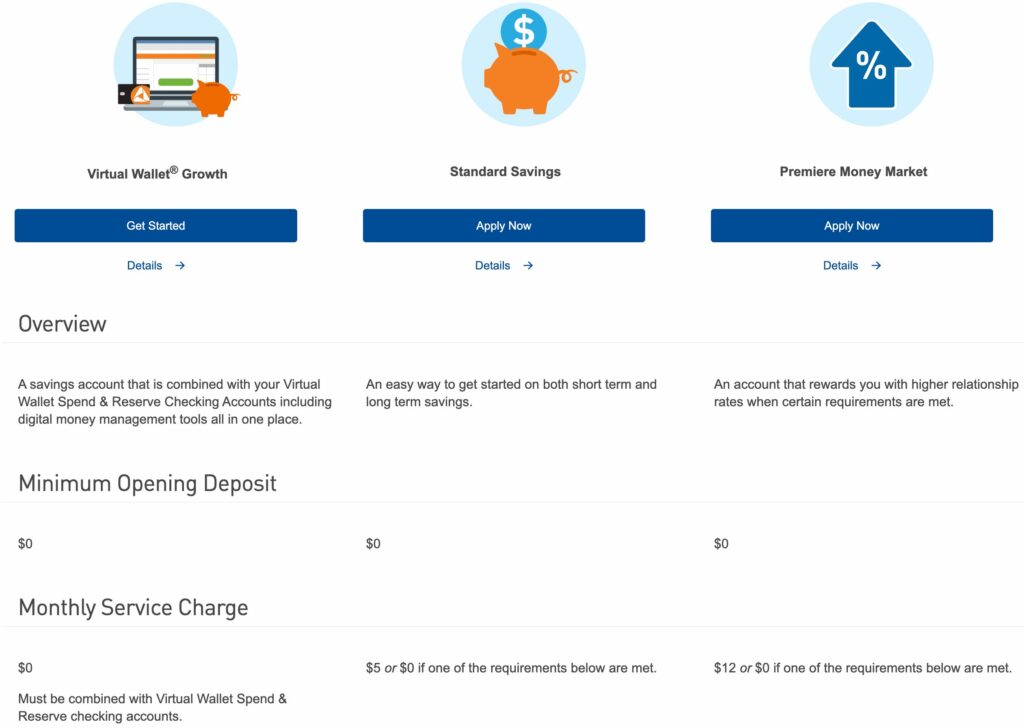

PNC Bank offers three main saving products:

- Virtual Wallet

- Standard Savings

- Premiere Money Market

It can be confusing comparing all of PNC Bank account options. We’ll compare the different account types below.

PNC Bank’s Virtual Wallet

The Virtual Wallet is PNC Bank’s primary bank account product and is meant to help you manage both your checking and savings accounts. However, the savings rate for the PNC Bank Virtual Wallet is only 0.01% APY. For every $10,000 in your PNC bank account, you’ll earn $1 every year.

PNC Bank has three versions of its Virtual Wallet: Virtual Wallet Standard, Virtual Wallet with Performance Spend, and Virtual Wallet with Performance Select. The difference between the three types comes down to the different features offered and the monthly service charge.

For example, the Virtual Wallet with Performance Select offers ATM fee reimbursements and higher interest on your savings, but requires a $25 monthly service charge or a higher balance threshold to waive that fee. Despite being PNC Bank’s most premium account tier, the Performance Select tier only pays up to a 1.25% APY for balances of $1,000,000 or greater.

Within each Virtual Wallet, you have three accounts:

- "Spend" is your primary checking account.

- "Reserve" is your secondary checking account for short-term budget planning needs.

- "Growth" is your long-term savings account and is supposed to pay the higher interest rates on your balance.

Did we mention that PNC Bank likes to keep things complicated?

PNC Bank's Standard Savings and Premier Money Market Accounts

PNC Bank also offers "Standard Savings" and "Premiere Money Market" accounts. These accounts are meant to pay a higher interest rate, but when we compared the rates with the PNC Virtual Wallet's, the rates were pretty much the same. Our research showed that PNC Bank pays up to 0.03% APY in these two account types for Pennsylvania residents.

In addition, you must maintain minimum activity requirements to waive monthly service fees.

PNC Bank does have a high-yield savings account that pays 4.65%, but this isn't available for most PNC Bank customers, as we'll explain in the next section.

PNC Bank's High-Yield Savings Account Isn't Available For Everyone

PNC Bank's high-yield savings account pays a 4.65% APY, but when we read the fine print, we discovered that this account isn't available to most PNC Bank customers.

The high-yield savings account is available online only to Arizona, California, Colorado, New Mexico, Tennessee, Texas, and West Virginia residents.

Pennsylvania residents make up most of PNC Bank's customers, but they're not eligible for the high-yield savings account.

The reason? We believe that when PNC Bank expands to different states, it will offer its HYSA product as a promotional tactic to gain new customers. PNC has been content to pay as little interest in regions with an established customer base such as Pennsylvania.

How to Increase Your PNC Bank Savings Rate

The trick to getting a higher PNC Bank savings rate is to open a PNC Investments "Brokerage Plus" account to purchase extremely low-risk and short-term Treasury bill ETFs.

You must open a PNC Brokerage Plus account instead of a Classic Investment Account. The Brokerage Plus account is PNC's self-directed brokerage option. The Classic Investment Account requires you to work with a PNC Investments financial advisor, who will charge you fees for advice we'll provide you here for free.

With a Brokerage Plus account, you can instantly transfer money between your PNC Bank and your PNC brokerage account.

Once you have a PNC Brokerage Plus account set up and have transferred cash from your PNC Bank Virtual Wallet or other savings accounts, you can research and purchase any of the following ETFs:

- USFR (WisdomTree Floating Rate Treasury Fund)

- TFLO (iShares Treasury Floating Rate Bond ETF)

- SGOV (iShares 0-3 Month Treasury Bond ETF)

These ETFs are known as ultra short-term bond ETFs and they are extremely low-risk investments that pay up to 5.40% APY. USFR and TFLO are floating rate note ETFs that hold floating rate notes, a type of bond issued directly by the U.S. government. SGOV is a Treasury bill ETF that holds U.S. Treasury bills.

There are no minimum investments or deposit amounts to buy and hold these ETFs. They're also traded on the market daily and easily sold and liquidated whenever you need cash. There are also no monthly service charges to earn this income, unlike the ones PNC Bank requires you to pay.

But These ETFs Aren't FDIC Insured!

Both ETF types hold assets directly backed and guaranteed by the U.S. government, some people consider them even safer than FDIC-insured savings accounts. They believe that the U.S. government would honor these floating rate notes and Treasury bills even before paying the cash that is insured by the FDIC.

While you can debate whether an FDIC-insured account is safer than a Treasury bill issued directly by the government, it's a largely academic conversation. In our opinion, we view both options as equally safe.

In that case, we would opt for the higher yielding investment, which is of course the ETFs.

Wrapping It All Up

Our strong belief is that these short-term ETFs are the best alternative to leaving cash in a PNC Bank savings account or PNC's high-yield savings account. Even in other brokerages that offer money market funds and Treasury bills, these ETFs are our preferred option to generate the highest return on our cash due to a unique balance of yield, stability, and liquidity.

To take advantage of these ETFs as a PNC Bank customer, you can either transfer your cash to one of the major brokerages (and replace PNC altogether by using it as a bank) or open a PNC Investment Brokerage Plus account.

You will have to manually transfer your cash from your PNC Bank Virtual Wallet or savings account to your Brokerage Plus account, and many of you won't do it. However, those who do will be the beneficiary of cash earning over 5% APY in your account. For those holding $10,000, that's a difference of $500 passive income every year vs. $1 in the PNC account.