Robinhood offers 5% on your cash with a Robinhood Gold account. But is this 5% annual percentage yield (APY) the best option for your cash, and is Robinhood Gold worth it for the interest rate? In this article, we’ll compare Robinhood Gold to other cash options including money market funds, ultra short-term cash ETFs, CDs, and Treasury Bills. Our conclusion: there are better cash options on Robinhood that pay more than Robinhood Gold’s 5% sweep rate, but Robinhood Gold can be worth it if you find value in its other features.

Robinhood’s Brokerage Cash Sweep Program

As of February 2024, uninvested cash goes through Robinhood’s brokerage cash sweep program. Uninvested cash in an ordinary Robinhood brokerage account will earn a 1.5% APY. With a Robinhood Gold subscription, you’ll earn a 5.00% APY on your cash. Robinhood Gold costs $5 a month.

Uninvested Robinhood cash is swept across several of Robinhood’s partner banks so you get FDIC insurance of up to $2.25 million on your cash. Robinhood partner banks include Goldman Sachs Bank, HSBC Bank, Wells Fargo, Citibank, Bank of Baroda, U.S. Bank, Bank of India, Truist Bank, M&T Bank, First Horizon Bank, EagleBank, and CIBC Bank.

Robinhood Money Market Fund Options

Robinhood does not support trading with mutual funds. Since money market funds are a type of mutual fund, you cannot purchase any money market funds on Robinhood.

Can You Buy Treasury Bills, CDs, and Bonds on Robinhood?

You cannot buy Treasury bills, brokered CDs, or corporate bonds on Robinhood. Robinhood does not support trading in individual bonds, and there are no Robinhood brokered CD rates to evaluate.

However, you can buy bond ETFs on Robinhood that hold Treasuries and other bonds. These are known as ultra short-term Treasury ETFs and are an effective alternative to directly buying Treasury bills

Buying Bond ETFs Like SGOV, BIL, USFR, and TFLO on Robinhood

Robinhood allows the purchase of ultra short-term bond ETFs such as SGOV, BIL, USFR, and TFLO. These ETFs exclusively hold short-duration Treasury bills and have become a very popular alternative to T-Bills, Treasury money market funds, CDs, and high-yield savings accounts.

There are two main types of ultra short-term bond ETFs:

- Treasury ETF

- Floating rate Treasury ETF

Treasury ETFs hold a ladder of 13-week T-Bills that constantly cycle every week, like Treasury money market funds. The most popular options are SGOV (iShares 0-3 Month Treasury Bond ETF) and BIL (SPDR Bloomberg 1-3 Month T-Bill ETF).

Floating rate Treasury ETFs, on the other hand, hold Treasury floating rate notes that always reflect the latest 13-week T-bill rate, which resets every week. In simple terms, you are always getting the most recent 13-week T-Bill rate by holding these ETFs. The most popular floating rate Treasury ETFs are USFR (WisdomTree Floating Rate Treasury Fund) and TFLO (iShares Treasury Floating Rate Bond ETF).

Robinhood Gold vs. SGOV, BIL, USFR and TFLO

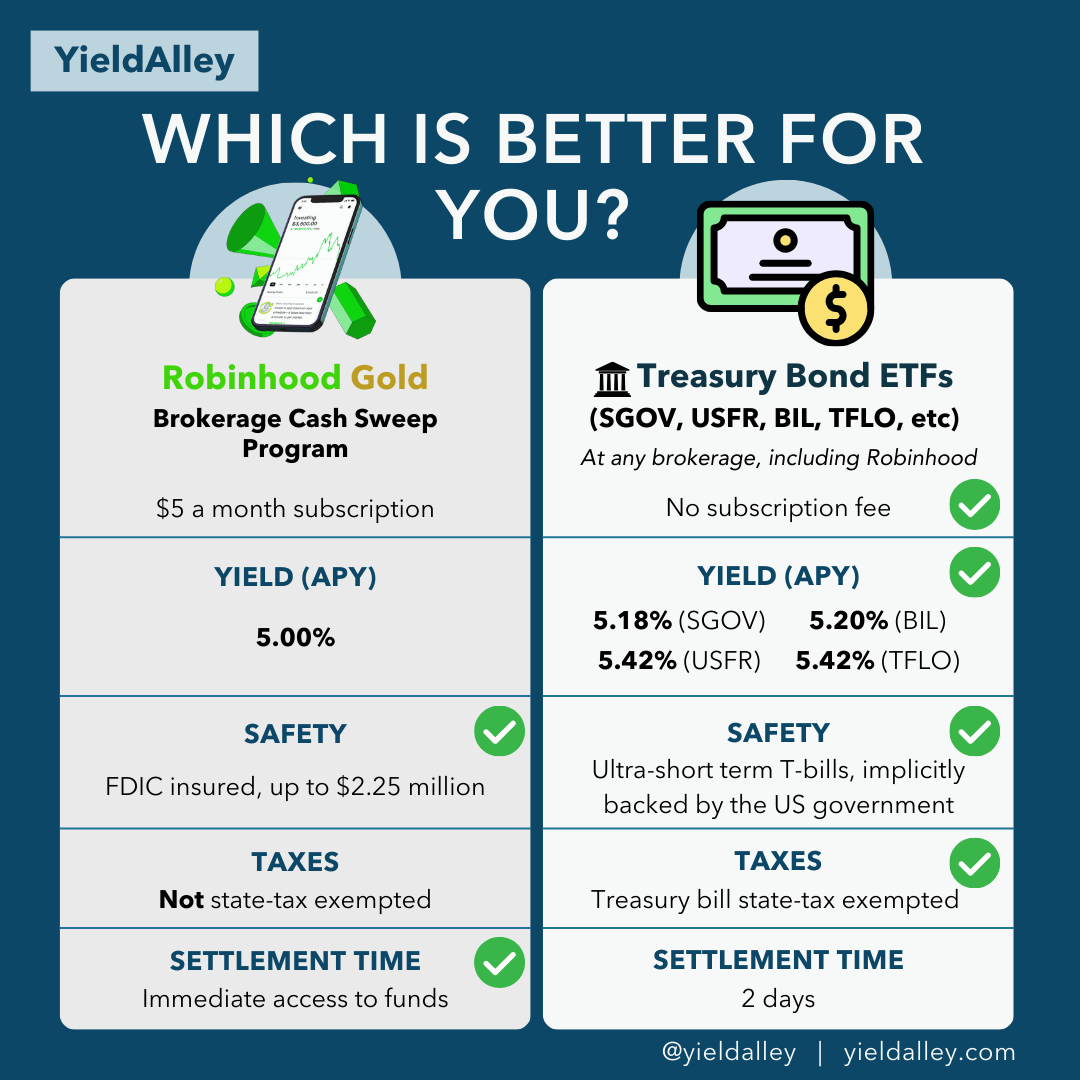

How does Robinhood Gold’s brokerage cash sweep program compare with these Treasury ETFs? In our research, we learned that compared to Robinhood Gold, Treasury ETFs are cheaper, pay a higher yield, and also benefit from a tax exemption that Robinhood Gold cash doesn’t get.

Let’s compare the cost, yields, and safety of Robinhood Gold vs. Treasury ETFs.

Cost of Robinhood Gold vs. Treasury ETFs

To earn a 5.00% Annual Percentage Yield (APY) on uninvested cash within your Robinhood account, you need to subscribe to Robinhood Gold, which has a monthly fee of $5. If you do not subscribe to Robinhood Gold, your cash earns a lower APY of 1.5%.

On the other hand, there is no cost or commission for buying Treasury ETFs on Robinhood. However, the fund managers of the ETFs charge an expense ratio, a type of annual fee that’s deducted from the ETF’s yield — essentially, the profit you earn from the investment. The return you receive on your ETF investment is net of these costs. Instead of analyzing ETF expense ratios, we recommend comparing the yields, as these yields reflect your profit after the cost of the expense ratios.

To effectively benefit from Robinhood Gold’s 5% APY, the cash balance in your account must be sufficient to cover the annual cost of $60 (12 months x $5 per month) for the service. You begin to earn net gains only after the interest income on your uninvested cash exceeds this fee. Comparatively, Treasury ETF returns start accruing immediately, without a similar subscription cost to overcome.

Robinhood Gold Yields vs. SGOV, BIL, USFR and TFLO Yields

Robinhood Gold pays a 5.00% APY on uninvested cash. Here are the bond ETF yields as of February 2024, from lowest to highest:

- Robinhood Gold: 5.00% APY (costs $5 a month or $60 a year)

- SGOV (iShares 0-3 Month Treasury Bond ETF): 5.18% APY (net of expense ratios)

- BIL (SPDR Bloomberg 1-3 Month T-Bill ETF): 5.20% APY (net of expense ratios)

- USFR (WisdomTree Floating Rate Treasury Fund): 5.42% APY (net of expense ratios)

- TFLO (iShares Treasury Floating Rate Bond ETF): 5.42% APY (net of expense ratios)

Even accounting for their expense ratios, SGOV, BIL, USFR, and TFLO all pay higher yields than Robinhood Gold.

Treasury ETF Tax Benefit vs. Robinhood Gold Cash

Because Treasury ETFs exclusively hold Treasury bills, they benefit from the Treasury bill state-tax exemption. The interest earned on Robinhood Gold offers no such state-tax exemption, unfortunately.

Here are the state-tax exemptions for 2023 for each fund:

- SGOV: 96.45%

- BIL (SPDR Bloomberg 1-3 Month T-Bill ETF): 98.43%

- USFR (WisdomTree Floating Rate Treasury Fund): 99.7% for 2022 (2023 not out yet)

- TFLO: 97.76%

- Robinhood Gold: 0%

What this means is any income earned from USFR is 99.7% state tax exempt. That means saving close to 100% on your typical state income taxes, or boosting your returns by up to 10% if you live in a high-tax state such as California, New York, or Connecticut.

Are Treasury ETFs as Safe as Robinhood’s FDIC-Insured Cash Sweep?

ETFs are an investment product, not a deposit product, so they do not benefit from FDIC insurance. All Robinhood customers, Gold subscribers or not, get FDIC insurance up to $2.25 million with its cash sweep program.

Treasury ETFs only invest in ultra short-term Treasury bills. Because Treasury bills are explicitly backed by the U.S. government, these ETFs (like their Treasury money market fund counterparts) are implicitly backed by the government.

In addition, Robinhood is a SIPC (Securities Investor Protection Corporation) member. So, if you buy Treasury ETFs on Robinhood, you get SIPC protection against the loss of up to $500,000 in securities, which includes Treasury ETFs. SIPC protection kicks in when your brokerage fails.

In our opinion, Treasury ETFs are as safe as FDIC-insured cash, since there is no backer more secure than the U.S. government, which backs both the FDIC and the Treasury bills held by the Treasury ETFs.

What Are the Downsides of Treasury ETFs vs. Robinhood Gold Cash?

The main drawback of investing in Treasury ETFs, as opposed to using Robinhood’s sweep program, is the settlement time. When you sell Treasury ETFs, you’ll need to wait two business days for the transaction to settle, meaning you should plan your cash needs at least two days in advance. This requirement is similar to the process of selling stocks to convert them into cash.

On the other hand, Robinhood’s sweep program offers the advantage of instant liquidity. Funds held in this program can be accessed immediately, without the waiting period required for ETFs or stock sales.

Despite this convenience, the instant access provided by Robinhood’s sweep program probably doesn’t justify its lower yield compared to the potential returns from Treasury ETFs. If you are willing to wait two days for your cash like you do with your stock trades, then you might as well earn higher yields.

Is Robinhood Gold Worth It For the 5.00% Interest Rate?

Our opinion is that paying $5 every month solely to earn 5.00% APY on your uninvested cash with Robinhood Gold is not worth it. Investments in Treasury ETFs like SGOV, BIL, USFR, and TFLO through a free Robinhood account can yield returns higher than Robinhood Gold’s 5.00% APY without any cost.

However, Robinhood Gold offers additional benefits such as a 3% IRA match on contributions and access to exclusive services like real-time market data and professional research tools. If these additional features align with your investment strategy and needs, then Robinhood Gold might be a worthwhile investment for you.

Other Alternatives to Robinhood Gold

If you want to explore the full range of cash alternatives such as money market funds, brokered CDs, and T-Bills, you will have to use a different brokerage. Fidelity, Charles Schwab, Merrill Edge, Vanguard, E*Trade, and many other full-service brokerages have a wider variety of cash investments that may be suitable for you. Fidelity and Vanguard both have automatic cash sweeps into money market funds that pay around 5% APY, without the $5 monthly fee.